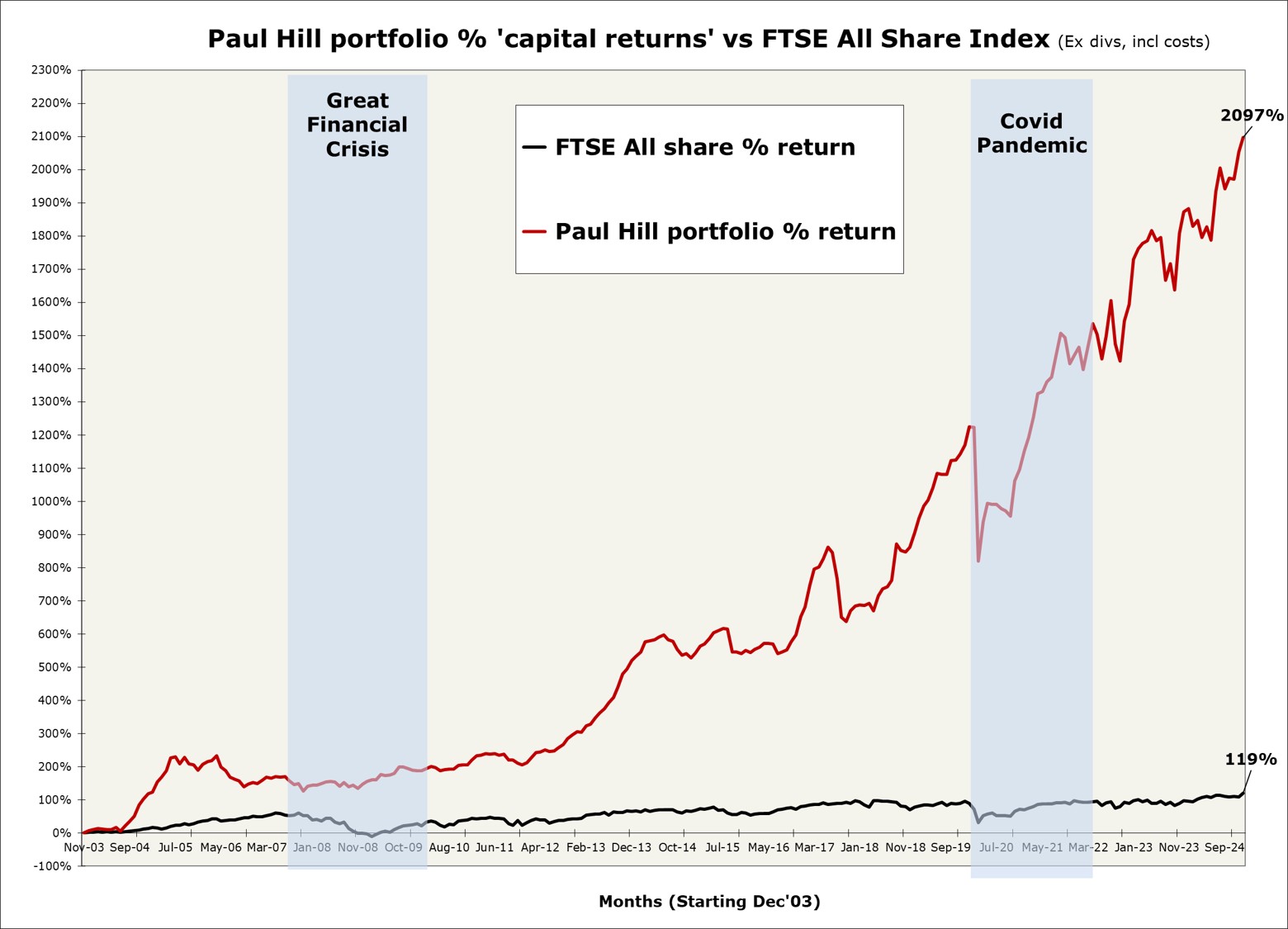

Two jumps forward and one step back is how I would best describe my investment career. That's because generally one in every three stocks goes pear-shaped with the rest generating positive returns. Fortunately though, the winners deliver on average 70% more profit than the losers.

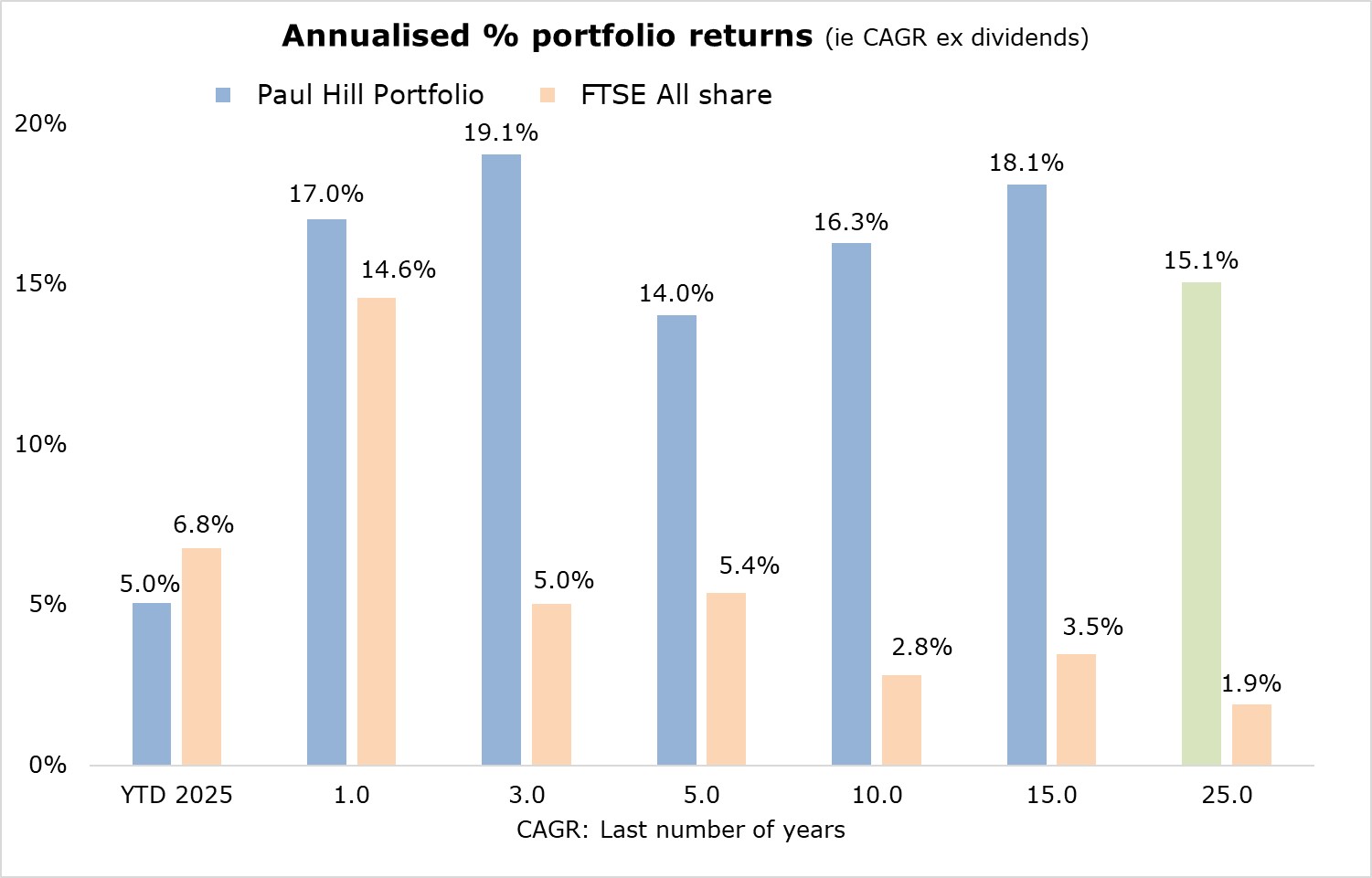

Rinse and repeat for 25 years (ie since Mar'00) and my concentrated portfolio (15-20 positions) has delivered annualised returns of 15% vs 2% for the FTSE All Share across three major market dislocations (ie 2000/03 Dotcom crash, 2008/9 GFC and the pandemic) without ever enjoying a 10x or 5x bagger from any of the 282 selections.

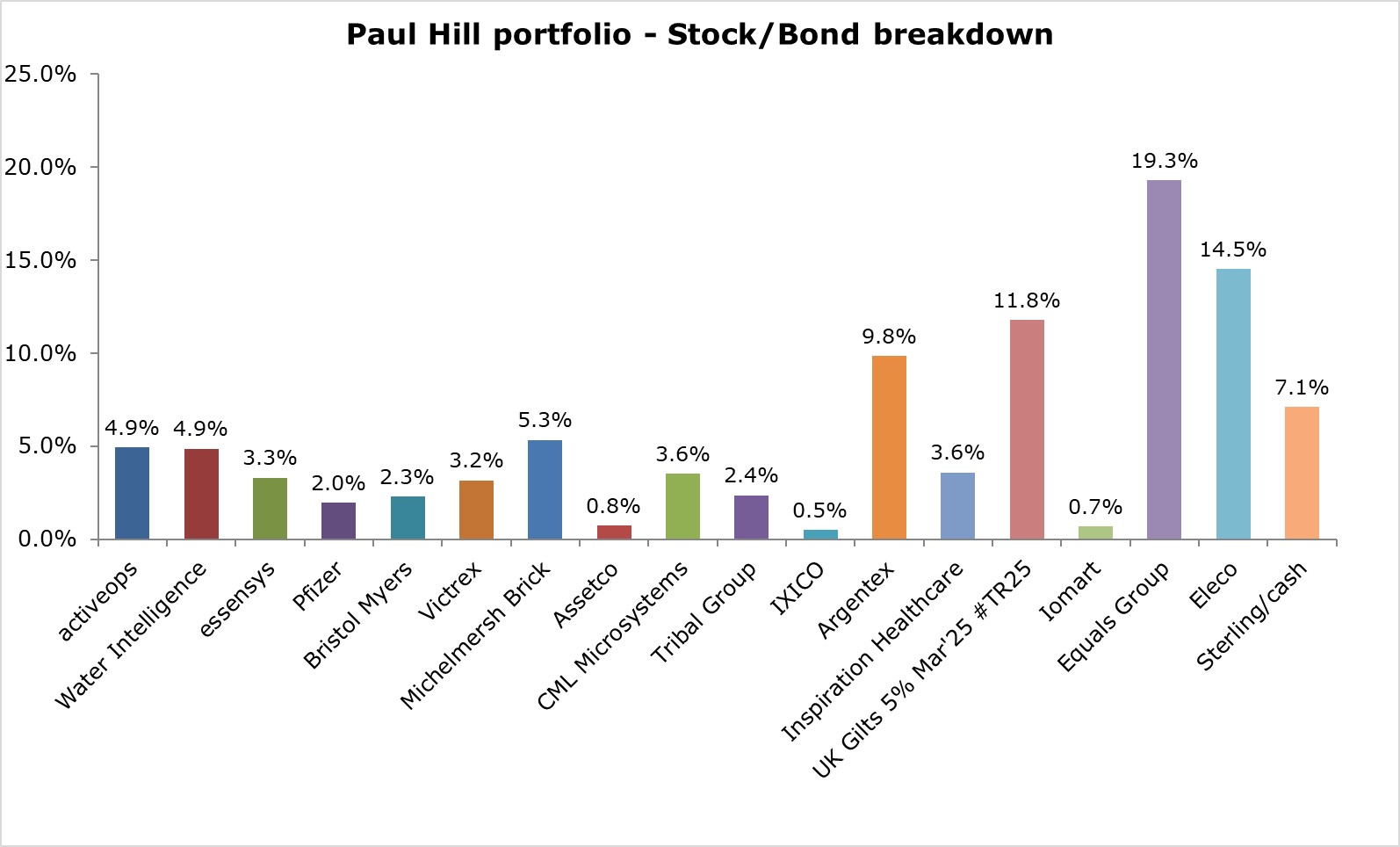

Granted, there's been a fair degree of luck. Yet the performance also reflects my higher-risk approach and GARP/value bias - tilting more towards UK smallcaps with a 3-5 year view.

Likewise, I've steered clear of ETFs/funds and stop losses, instead choosing to make my own mistakes and hopefully learn from the 'fun'. In fact, if I'd used tight stop losses, many of my most profitable shares would have been sold at the bottom - often down >50%.

So for me going forward, it's important is to stick to what works. Hence, I'm planning to stay true to the 'process', and importantly, not chase FOMO trades.

Indeed, this might mean I'm going to miss out on some 'juicy' opportunities. However, that's never been an issue before, and won't be again in the future.