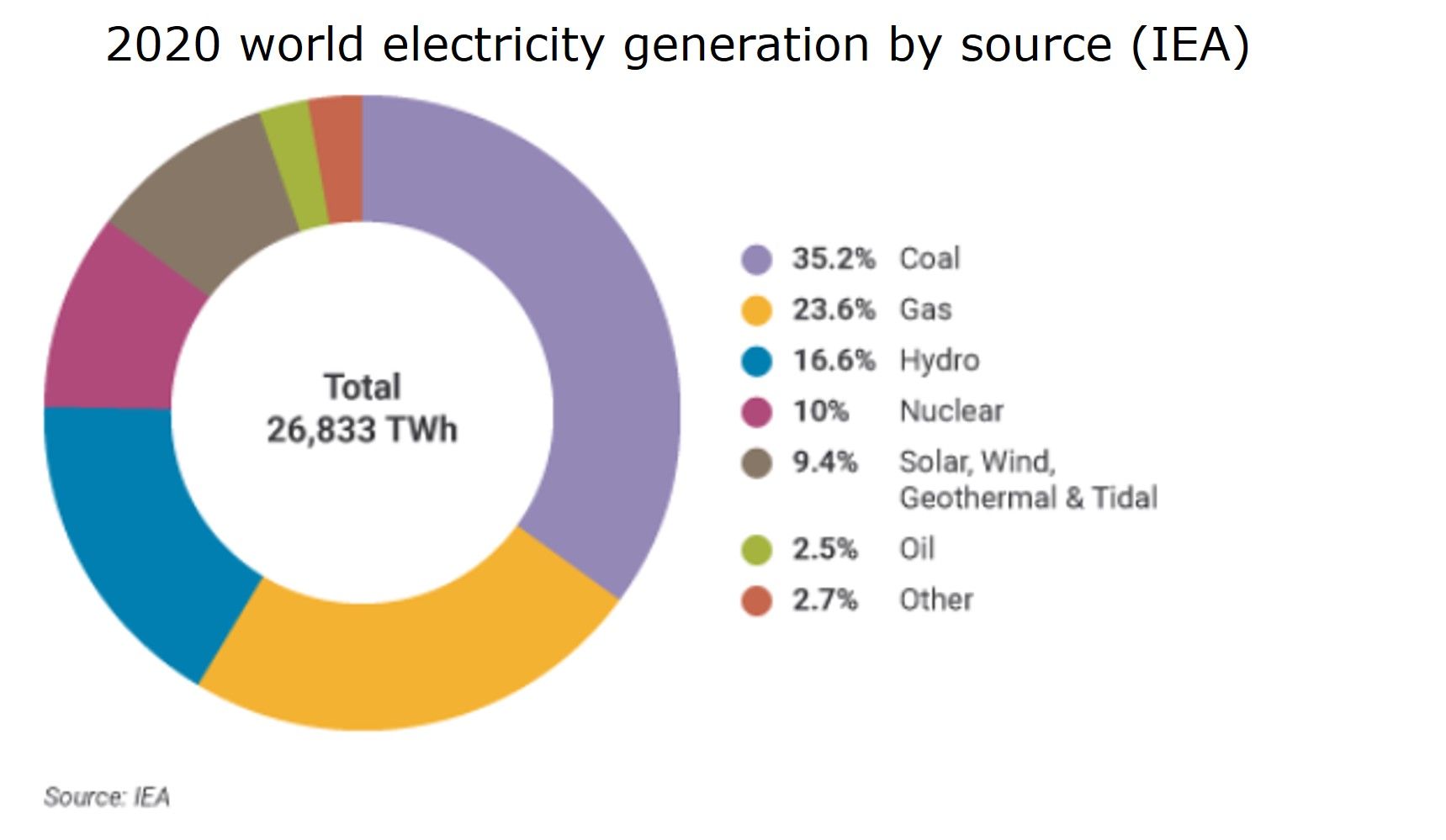

Clearly, the world has a major energy problem. Unfortunately, too much of the stuff comes from burning fossil fuels that cause global warming. Hence COP27 - UN Climate Change Conference is on a mission to switch as quickly as possible to cleaner solutions.

This is easier said than done though. Solar and wind are intermittent, renewables often require substantial subsidies and there is nowhere near enough electricity storage anyway.

So is there a 'zero carbon' alternative that provides ‘base load’ capacity which can be switched on and off as required?

Enter Bill Gates (aka Microsoft), who in 2008 co-founded TerraPower in order to create a new cheaper, more efficient and safer type of nuclear power station. Here its Natrium design uses liquid sodium instead of water as a coolant, and has storage capacity too that allows it to release even more electricity at moments of high demand.

Today, specialist engineer Avingtrans (est 30% of sales from nuclear) said that its US subsidiary Hayward Tyler had been awarded a $10m 3-4 year contract by TerraPower to design and develop sodium pumps to support the Natrium Reactor Demonstration Project in Wyoming. On top, TerraPower has a further option to later procure this state-of-the-art equipment from Hayward Tyler.

Upon successful completion in 2030, the facility will hopefully become a fully functioning commercial power plant.

Drew Van Norman, President of Hayward Tyler Inc commenting: “Execution of this contract will build upon years of strong working relationship between Hayward Tyler TerraPower in the field of high temperature, nuclear quality and critical-to-function reactor pumps. Hayward Tyler has long appreciated TerraPower’s approach to developing and commercialising advanced reactors in an effort to bring high volumes of carbon-free, nuclear energy to a variety of new and traditional consumers.’’

In terms of the numbers, this flagship order doesn’t change consensus forecasts, albeit it does derisk Singer Capital Markets’ FY24 projections (rev £137m, £10m EBITDA & 2.8p EPS) – who have a BUY rating and a 510p price target on the stock with Cavendish at 495p.

Moreover, AVG has excellent forward visibility supported by a backlog covering >90% of its targeted revenues for this year.

Follow News & Updates from Avingtrans: