Challenger Energy (CEG) , a Caribbean and Americas-focused oil and gas producer, said it has secured a £3.3m funding facility to support its technical work programmes in Uruguay, particularly the AREA OFF-1 block and newly awarded AREA OFF-3 block, as well as development opportunities in Trinidad. Challenger said it has drawn an initial £0.55m, with future drawdown available at the company's option.

Separately, Challenger announced a 3-month extension on the sale of its Cory Moruga asset in Trinidad and Tobago, currently awaiting regulatory approval, as well as the relinquishment of its Weg Naar Zee PSC in Suriname, all consistent with the the company's strategy to focus on its core assets.

The oil and gas producer also announced a 60 million shares purchase by its CEO Eytan Uliel to increase his aggregate shareholding to approx. 6% of the company.

View from Vox

Despite markets' negative reaction to the news, this is a positive development for Challenger as the company is still in the development stages for its valuable Uruguay licenses and will benefit from the flexibility of additional funding until those investments begin to generate sufficient cashflows. An initial £0.55m has been drawn with an additional £2.75m available if needed. The CEO's increase in holding is also a good sign that management believes in the long-term profitability of the company's core assts.

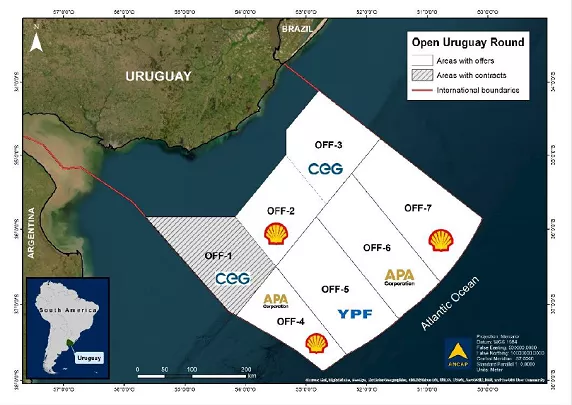

In June, Challenger doubled its offshore Uruguay footprint with the addition of the AREA OFF-3 license, the last remaining available block in offshore Uruguay. All other offshore exploration licences are held by energy majors Shell, Apache, and YPF, the Argentinian national oil company. The acquisition doubled Challenger's total Uruguay acreage to 28,000 km2, making it the second largest offshore acreage holder in Uruguay behind Shell.

Industry interest in Uruguay increased substantially following large discoveries made in offshore southwestern Africa in 2022. Challenger then quickly emerged as a major participant in this new global exploration hotspot. AREA OFF-3 is located in relatively shallow water and has a current estimated resource potential of up to ~500 million barrels of oil equivalent (mmboe) and up to 9 trillion cubic feet gas from multiple exploration plays. As the block was held by BP until 2016, Challenger is inheriting significant modern 2D and 3D seismic, in particular 7,000km2 of 2012 vintage 3D seismic. Challenger expects the cost of the programme during its initial 4-year exploration period to be low at approx. US$100k/year.

Meanwhile, the oil producer is continuing its farm-out process for AREA OFF-1 where it recently identified 1-2 billion barrels of oil. The new funding facility will help develop the technical case underpinning the farm-out, keeping it on schedule for completion by end of 2023. The facility can also help accelerate technical work for the AREA OFF-3 license, to speed up its timeline to production and further support the AREA OFF-1 farm-out process.

In general, the facility can provide capital for further acquisitions and bridge working capital needs through to delivery of several cash generative events over the next 6 months, including the AREA OFF-1 farm-out and sale of non-core assets in Trinidad. It should be noted that Challenger has not required any external funding until now as it relied on the US$10m it raised in March 2022, which was sized for approx. 12 months.

Overall, we expect the new facility to help Challenger maintain its strong momentum, should additional funding be required past the initial £0.55m drawn, and not to present any long-term obstacles to profitability.

Follow News & Updates from Challenger Energy: