As many investors know, I'm a big fan of the B2B payments space - owning stakes in Equals, PayPal and Argentex.

Yet despite my sector knowledge, one of the privileges of interviewing great stock pickers is that you learn and benefit from new ideas all the time. Which is exactly what happened last week, when talking to Paul Scott of Stockopedia.

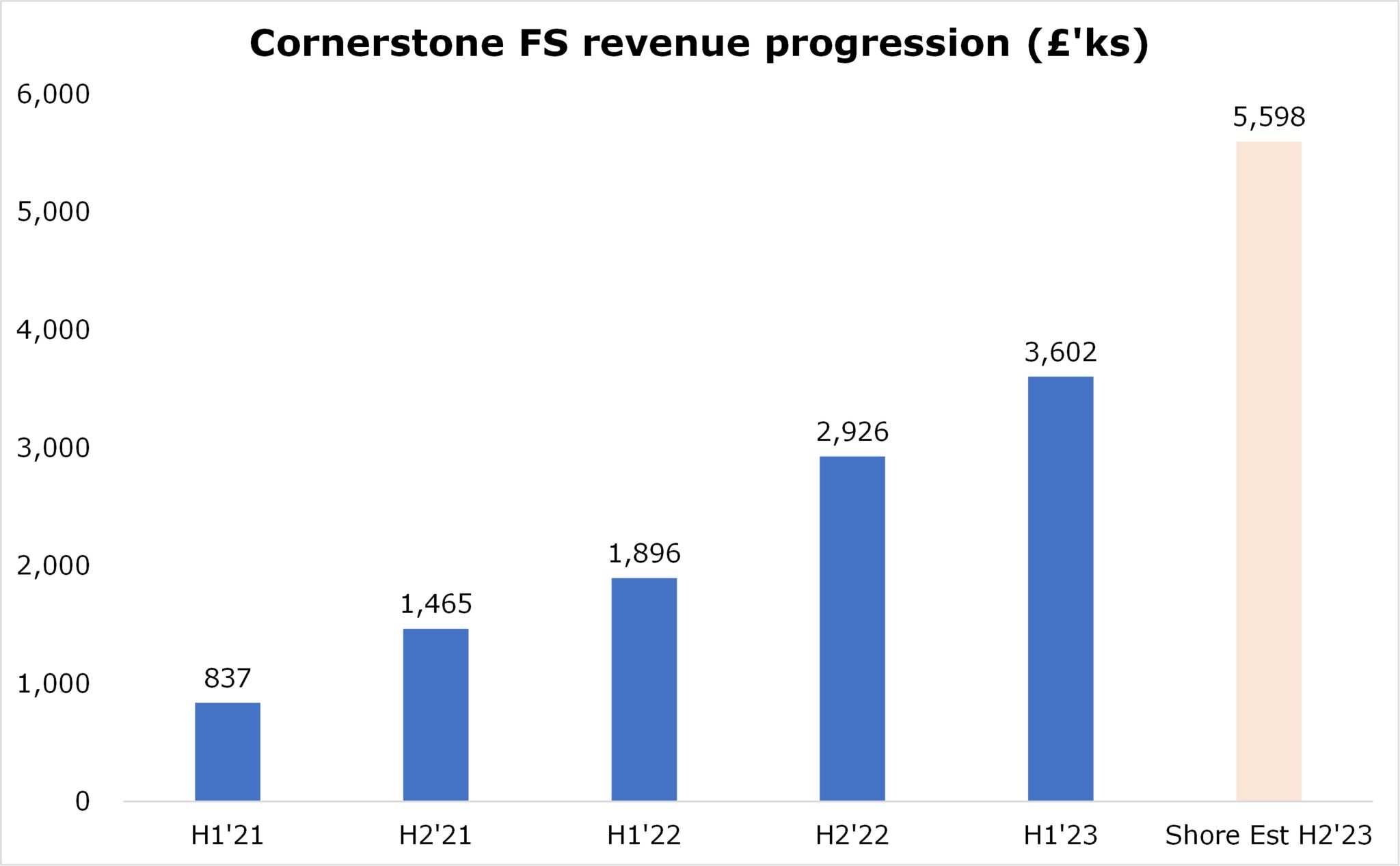

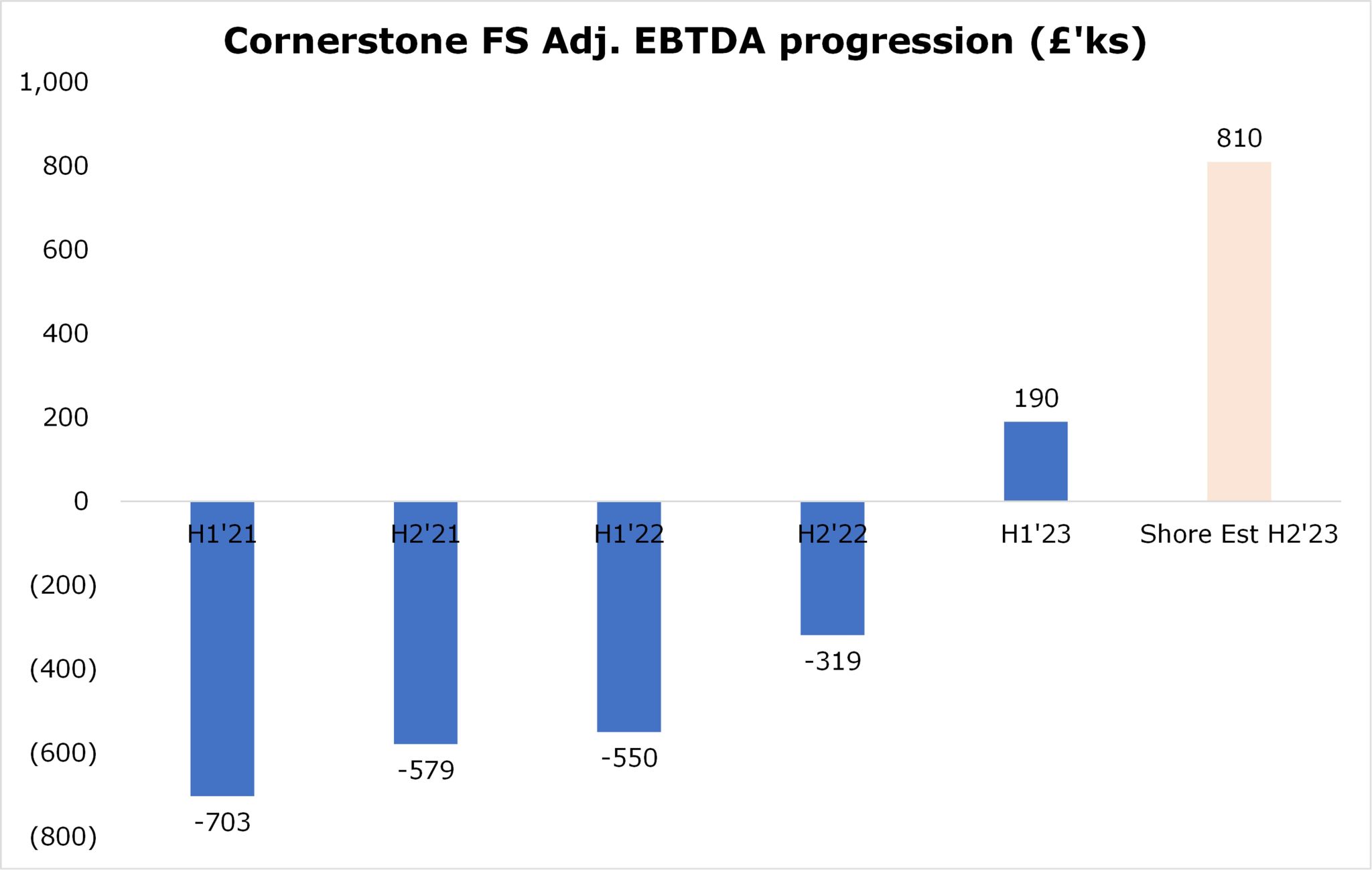

Here Paul highlighted UK specialist forex solutions firm Cornerstone FS (CSFS) (17.25p, mrkcap £10m). Indeed this smaller, yet equally ambitious and rapidly expanding (see charts) international payments platform is winning market share hand over fist - serving SMEs and HNW individuals with tailored 'white glove' services.

In fact, last Monday CSFS said that it continued to "experience strong trading, driven by acquiring more new customers (Est 900) & higher APRUs (Est £10k/client). With FY'23 revenues & adjusted EBITDA set to be "materially ahead of expectations".

A tremendous performance, especially in light of the challenging macro economic backdrop where much of Britain and Europe is probably already in, or near recession.

Afterwards, house broker Shore Capital upgraded their FY'23 sales, EBITDA, EPS and net debt forecasts to £9.2m, £1.0m, 0.9p and -£0.5m respectively, rising to £11.3m, £1.8m, 1.5p and +£0.7m 12 months later with a fair value 50p/share.

Thus putting the stock on FY'24 EV/revs, EV/EBITDA and PE multiples of 0.9x, 5.6x & 11.5x - which appears attractive given CSFS' projected 20%/60% top/bottom line growth, 60% gross margins & 10% free cashflow yield.

CEO James Hickman, commenting: "I am pleased to be able to report that we are continuing to experience excellent trading momentum. This reflects the actions that we have taken during the year to enhance our sales team and expand our offer, such as by broadening the range of currencies and countries where we can transact. With a highly scalable platform, along with careful management of our cost base, we are now benefitting from the operating leverage within our business as the increase in sales is driving even stronger growth in adj. EBITDA. Accordingly, the Board continues to have great confidence in the future of the Group."

Nonetheless Cornerstone FS is not resting on its laurels. Elsewhere the business plans to further enhance its proprietary payments platform, alongside expanding overseas into Canada (2024), UAE (2024) and Hong Kong (2025).

Follow News & Updates from Cornerstone FS: