Mixed signal chipmaker EnSilica (ENSI) saw its revenue jump by a third to £20.5 million in FY 2022 in its first full year as a public company – 3% ahead of broker Allenby’s forecast - helping it to an unadjusted Ebitda profit of £1.56m and earnings per share of 2.3p, a huge jump on the 0.2p it managed a year earlier.

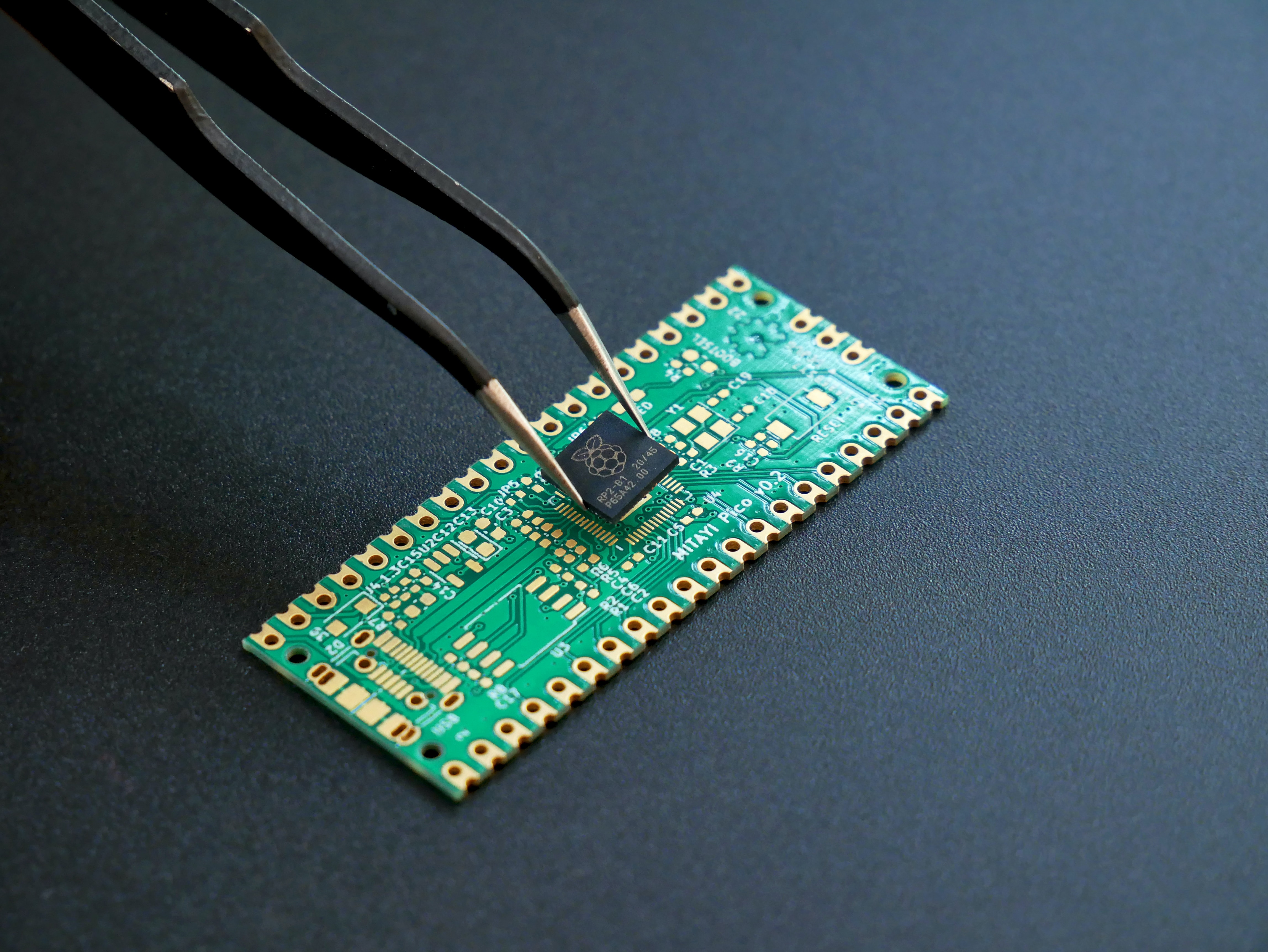

That coincided with key operational milestones that reflect the culmination of its strategy put in place in 2016, which saw it adopt a fabless model delivering customer specific ASIC chips for niche application in industries including automotive, industrial, healthcare, and satellite connectivity.

Having begun direct supply of chips to its first automotive customer in 2022, FY23 saw key contract wins and extensions including a significant $30 million design win in the industrial factory automation sector, an automotive ASIC contract contributing to a revenue forecast of $40 million, a €5 million contract awarded for Satellite Broadband Chip development from the UK Space Agency, and an e-mobility sensor ASIC contract estimated to be worth over $7 million.

EnSilica also finished the year with a record sales pipeline and reported strong progress pursuing a number of higher-lifetime value opportunities across both new and existing customers. That’s being helped along by investment in its sales function and new intellectual property. It all but doubled R&D investment to £4.13m, which saw the company slip to a small net debt position of £1.07m.

Prior to these expectation-beating results, brokers expected revenues in the year to May 2024 to climb 15.7% to £22.9m, generating EPS of £2.52m.

View from Vox

These results are even more impressive given the difficult economic backdrop, which has seen upheaval in both industrial markets and across the semiconductor value chain.

In fact, geopolitically charged ‘chip wars’ leave EnSilica well positioned to support European industry and reduce dependence on Asian semiconductors – it’s been actively contributing to the UK’s semiconductor plans, with Senior Independent Director Janet Collyer appointed to the UK Government's Semiconductor Advisory Panel.

Meanwhile, the company’s focus on a handful of high value markets is helping it deliver ever more profitable sales, while continued investment in its own intellectual property that can be delivered to multiple clients is creating high barriers to entry and larger returns.