GreenRoc Mining (GROC) , a Greenland-focused critical metals explorer, issued a statement regarding China's newly announced policy to implement export restrictions on graphite, a critical component in EV batteries. GreenRoc owns the Amitsoq project in Greenland, one of the highest-grade graphite deposits in the world (23.05 Mt @ avg grade 20.41%).

China's announced restrictions on exports of higher-grade graphite are scheduled to take effect by December 1 2023. Under the restrictions, Chinese companies must seek special export permits to supply the crucial raw material to international battery manufacturers. The restrictions target battery-grade graphite and do not apply to lower-grade graphite used for conventional applications such as in the manufacturing of steel.

China is currently the dominant force in the global mineral supply chain and the foremost graphite producer and exporter. It is responsible for 70% of the world's synthetic graphite production and 65% of natural flake graphite. Moreover, China processes more than 90% of graphite used in EV battery anodes.

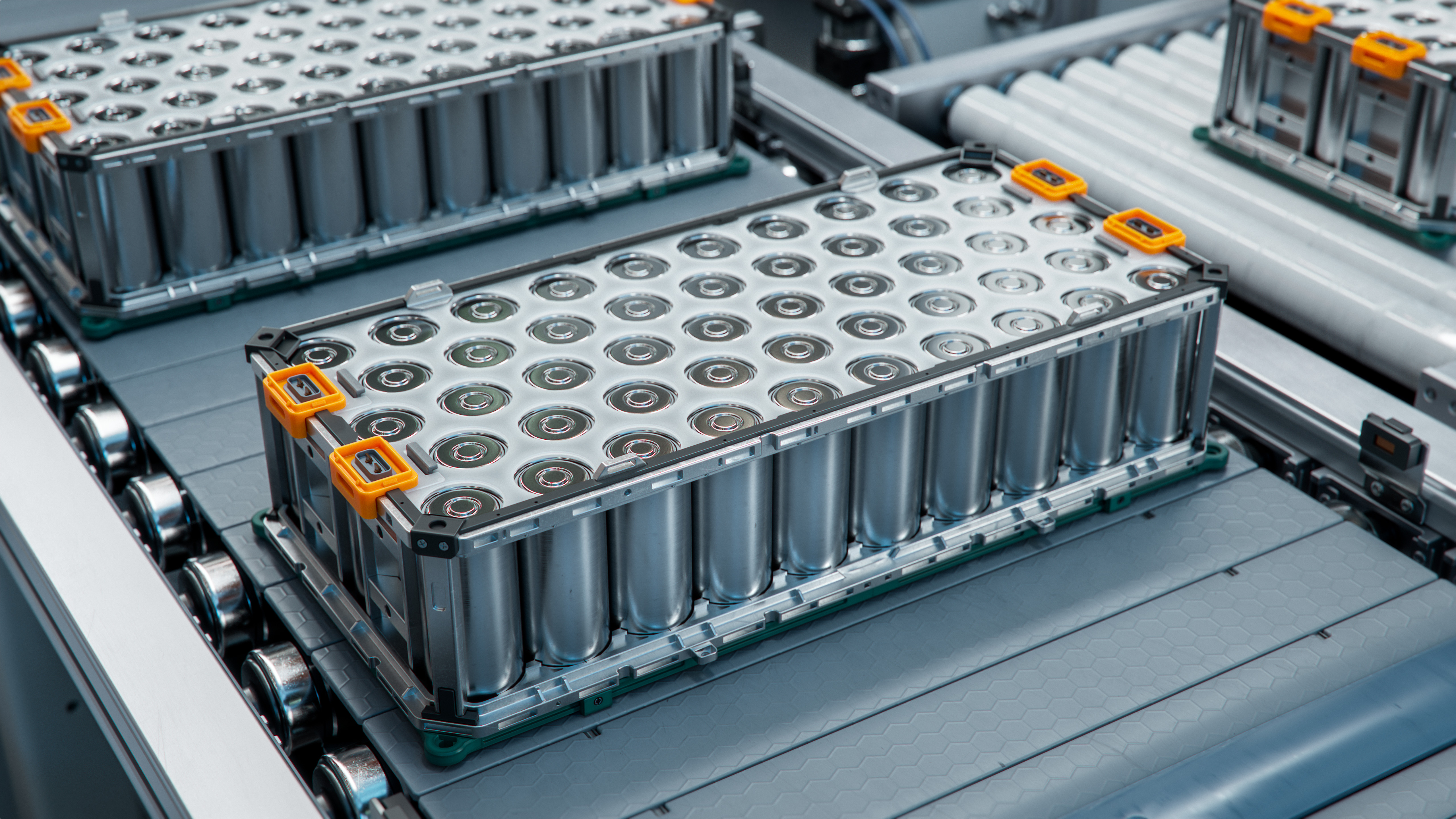

Graphite is a critical component of lithium-based EV batteries, which means a surge in demand is expected in the coming years - forecasts indicate a quadrupling of requirements over the next decade. In Europe alone, the demand for battery-grade graphite is estimated to reach 1 million tonnes by 2030, equivalent to the entire global graphite production in 2020.

China's announcement is good news for GreenRoc, which owns one of the world's highest-grade graphite deposits at Amitsoq, Greenland with a resource of 23.05 Mt at an average grade of 20.41% graphite following January's 3x resource increase. Amitsoq's Environmental Impact Assessment and Social Impact Assessment are on track for delivery in 2024, helped by a recent fundraise. GreenRoc has been steadily advancing toward production after confirming earlier in the year that Amitsoq graphite could be purified to exceed the EV battery requirement of 99.95%. Amitoq's preliminary economic assessment (PEA) is expected next week.

Naturally, with China's graphite exports significantly restricted, there will be a surge in demand for non-Chinese graphite, and a need to set up independent secure supply chains in Europe, North America, and elsewhere. GreenRoc shares gained 10% on the announcement, and we expect a broader boost to non-Chinese graphite producers and a rise in graphite prices as the restrictions are implemented.

Tirupati Graphite (TGR) is another non-Chinese graphite manufacturer whose shares jumped over 10% following the announcement. The company specialises in flake graphite, the largest constituent of Li-Ion batteries. It is one of very few current producers outside China, and one of only 2 quoted companies outside China that has brought globally significant new flake graphite production capacity into commercial production in the past decade. Tirupati's mines in Madagascar are in the early stages of production ramp-up, targeting 8% of global supply by 2030.

"The targeted nature of these export restrictions, focused only on battery-grade graphite while excluding conventional low-purity graphite material, should be of concern to everyone engaged in the energy transition. This selective targeting creates a substantial risk that ongoing actions to replace internal combustion engine vehicles with EVs will be slower and more expensive given that today no EVs can be manufactured without relying on battery grade graphite from China. Moreover, this move by China will bolster the competitive advantage of Chinese electric vehicle manufacturers." commented GreenRoc CEO Stefan Bernstein.

As GreenRoc's statement explains, the restrictions are meant to bolster China's booming EV and battery industries, as well as give it a significant geopolitical advantage by leveraging its dominant position in the production and processing of graphite, a critical metal for the energy transition. The move is part of the larger trend of resource nationalism whereby nations seek to establish stronger control over their domestic resources of critical metals, such as those used in semicondutors, EV batteries, and renewables.

As China's stated justification for the move was to "safeguard national security interests", we expect power plays of similar nature as used by OPEC in the oil and gas sector, to slowly develop in the critical metals space as EVs, renewables, and computer technology advance into the 21st century. Investors interested in critical metals should have plenty to bet on in the coming years. We recommend they GreenRoc, Tirupati Graphite as well as small and mid-cap lithium miners that we frequently cover on Vox.