You see with the Dow (Fwd 19x PE), SP500 (21x PE) & Nasdaq (28x PE) trading near all time highs, the next 4 weeks is where this perhaps 'mis-placed euphoria' (or at least stretched optimism) needs to come true.

There's little margin for error.

My concern is that a lot could go wrong. Not least the US presidential election, 30th Oct Budget (UK only), wars in Ukraine/Middle East and possible belligerent Trump tariffs (ie if he wins on 5th Nov)

Worse still, these are not the biggest hurdles either.

The US Q3'24 earnings season kicked off last Friday with encouraging statements from a couple of US banks like #JPM.

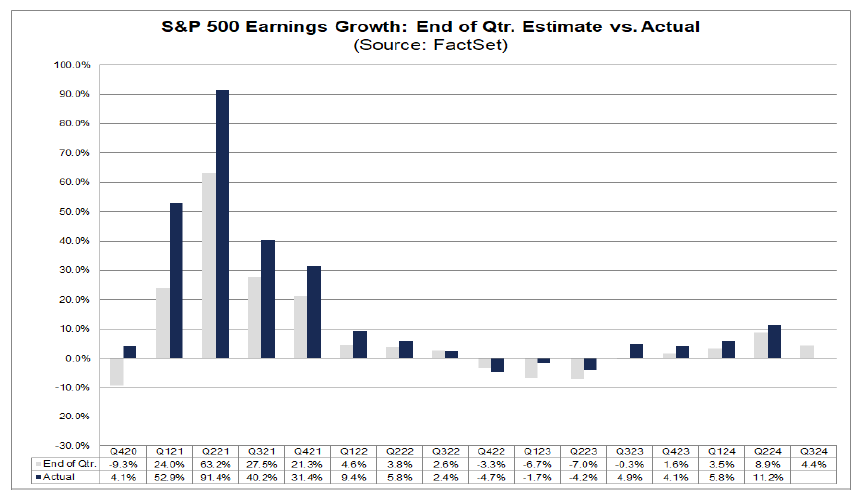

Here Q3 SP500 EPS estimates have been massaged down to a pedestrian +4.1% growth. That's the easy bit though.

The real 'rubber its the road' moment, comes with Q4 & FY25 guidance.

Indeed looking ahead, Wall Street analysts are forecasting YoY EPS growth of 14.2%, 13.9% and 13.1% for Q4'24, Q1'25 & Q2'25, respectively. For CY'25, they're 'praying' for +14.9%. In a low inflation world too!!

To me, this is simply too rich. Meaning there's a decent chance valuations will reset lower sometime this quarter.

Watch out for a bumpy road ahead.