Mercia is one of the largest investors in ‘regional’ (ex-London) UK growth businesses. Its primary focus is managing funds of around £1.6bn for third parties (FUM) in structures such as Venture Capital Trusts, EIS funds and funds for institutional investors. It deploys c£220m per year across venture capital, debt and private equity (100k to £20m per investment).

The business is scaling. FUM has more than doubled in two years. Record net flows exceeded £0.5bn in FY24. And growth is by far the highest among a London-listed peer group (page 4).

FY24 revenue grew 18% y-o-y to £30.4m, EBITDA 7% to £5.5m, a margin of 18.2%, likely to ratchet up over the longer term as the business scales further. Indeed, the newly announced Mercia 27:100% growth strategy aims to reach £3bn AUM (FUM + proprietary capital) and £11m EBITDA in 3 years.

Mercia also invests its own capital into a portfolio of ‘direct investments’ (NAV: £189m on 31 Mar 24). Its record is impressive. Since listing on AIM in 2014, it has realised nine exits, every one with a positive return and an aggregate return of 3.0x (page 20). However, FY24 highlighted the highs and lows of venture investing. Mercia successfully exited nDreams, realising £30.2m at a 2.7x return. But it wrote down its entire investment in Impression Technologies, taking an £18.6m impairment.

A strategic change is to be proposed at the 2024 AGM - to focus primarily on highly profitable and fast-growing fund management, and to stop making new direct investments (while supporting existing investments). This allows Mercia to reclassify from an investment company to a trading company under AIM rules, allowing gains made on shares to be IHT-exempt (under certain conditions).

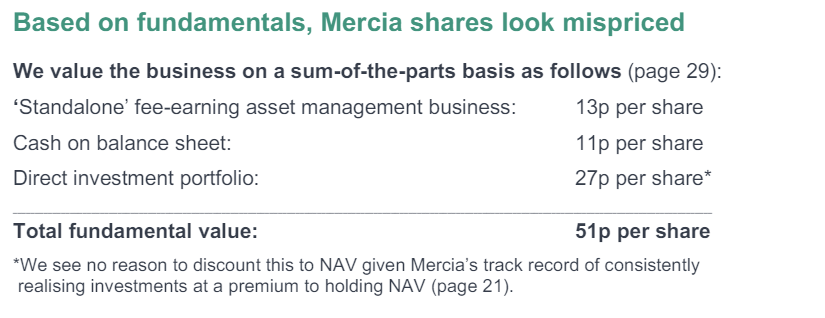

With a fundamental value 65% above the share price, we see potential for a significant rerating.

Read or download the full report here....