1Spatial (SPA), a global leader in geospatial management software and solutions, has reported its interim results for the first half of FY 2024. The company delivered robust growth, with group revenue up 11% to £15.5 million, fuelled by a 24% increase in recurring revenue, now constituting 53% of total revenue.

Furthermore, Term Licences revenue doubled to £3.4 million, including contributions from newly launched SaaS offerings, and the US market exhibited impressive growth with a 27% revenue increase during the same period.

However, although revenue growth meant the company's gross profit margin improved from 50% to 52%, adjusted EBITDA slipped 16% decline to £1.7 million due to investments in sales resources, inflationary cost increases, and foreign exchange fluctuations. In response, approximately £1 million of annualized non-revenue generating costs were trimmed from the business, primarily in Europe.

Despite these challenges, the company's board remains confident in achieving results for the full year 2024 in line with market expectations, pointing to a healthy sales pipeline and anticipating high level of renewals in the second half of the year.

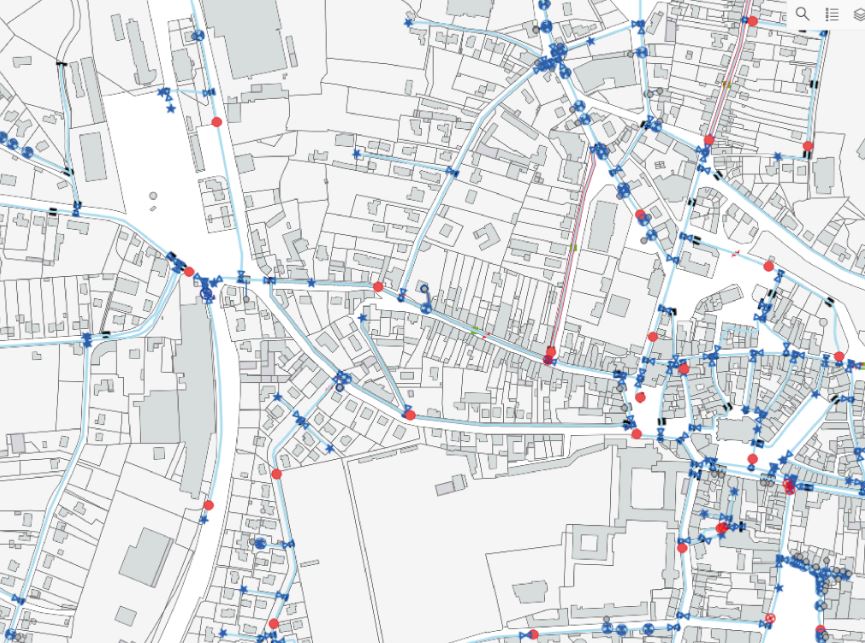

It said that top line strength had enabled it to invest in two new SaaS solutions, 1Streetworks and a SaaS version of its NG9-1-1 solution, which are now its primary sales focus. 1Streetworks is a solution for automating traffic management plans, diversion routing, and asset management, a market valued at £400 million in ARR. The product has commenced five ongoing trials, with the anticipation of signing its first substantial contract soon, a large utility provider.

Meanwhile, the new “light” version of NG9-1-1 is targeting a 15% share of the $345m ARR market, giving 1Spatil the ability to target cities and states individually.

Both developments should help it build on recent contract successes, including a first contract with the State of Oregon, bringing the number of US States as customers to 18, a raft of deals with new water companies in the UK, Europe and Australia, and contract upgrades with the US Federal Highways agency and Ordnance Survey Great Britain.

View from Vox

Geospatial data is vital across a variety of industries, including mapping agencies, utility companies, transportation organisations, and government and defence departments, and 1Spatial’s solutions ensure both its accuracy and ease of use.

That’s translating into strong demand, with brokers forecasting full year sales to climb 6% to £31.8m, delivering 20% Ebitda growth to £6m and EPS up 154% to 2.28p. That leaves the shares trading on a forecast PE of 20, which is supported by the rapid rate of profit growth likely to be delivered as the group continues its transition to a SaaS-based model.