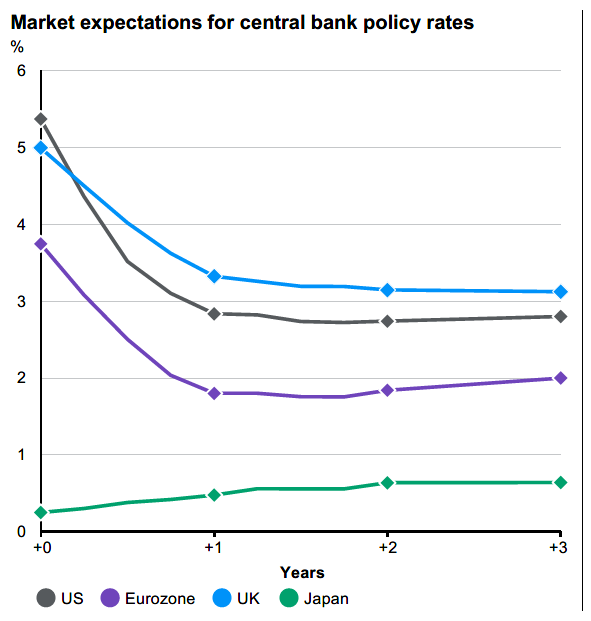

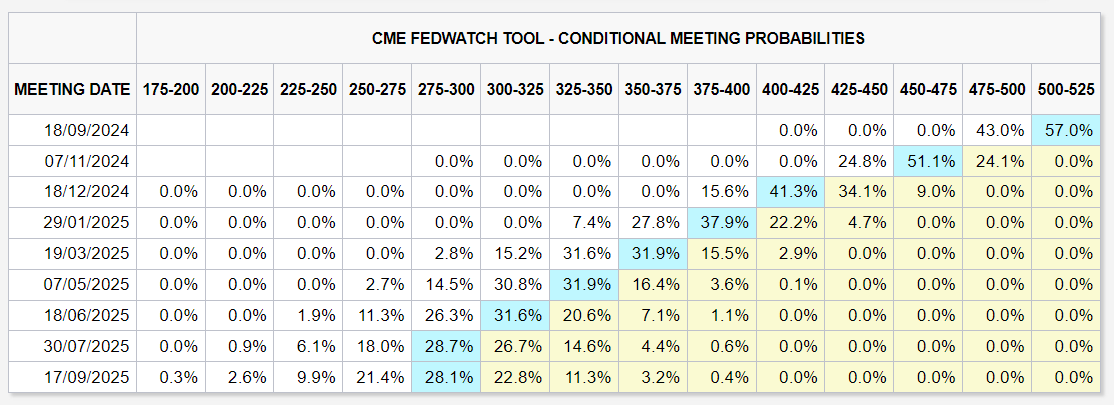

The US economy looks to be late cycle (oil and commodity prices weak, unemployment climbing, etc) with the treasury market (see above) pricing in ten 0.25% interest rate cuts to 2.75%-3.0% over the next year - basically saying that the Federal Reserve is way behind the curve.

So in this more challenging environment, where should investors put their money?

One approach is to go up the food chain. Albeit today, US megacap tech stocks and the S&P 500 are generally expensive - with the latter trading on a 21x forward PER and forecast to deliver 14% of EPS/share growth in 2025, offering little 'margin of safety' in the event of a hard landing.

Alternatively, a better option might be to bet on the UK. Indeed, after navigating last year's soft patch, the UK economy now seems to have stabilised with valuations much more reasonable, especially in smallcap land.

Either way, I suspect there's going to be a lot of volatility over the next few months.