Money talks.

Why has Saudi Arabia been chosen as the location by Russia and America to discuss ending the Ukraine war? Equally, why hasn't President Zelenskyy been invited to the talks?

Naturally, there are lots of conspiracy theories. But one increasingly getting 'aired' by investors is what this means for the oil & gas markets.

You see, Saudi Arabia, the US and Russia are the world's 3 biggest energy producers - suggesting that oil & gas will almost certainly be on the agenda in Riyadh.

Plus, if an agreement was reached to roll back today's tough sanctions, that would likely lead to lower power and pump prices in the West... and probably inflation and interest rates to boot.

On the other hand, who would be the losers?

Well, at the top of the list would be India and China who have been hovering up enormous quantities of cheap Russian energy over the past 3 years. Alongside of course the producers and integrated oil majors who have benefitted from the artificially high crude prices.

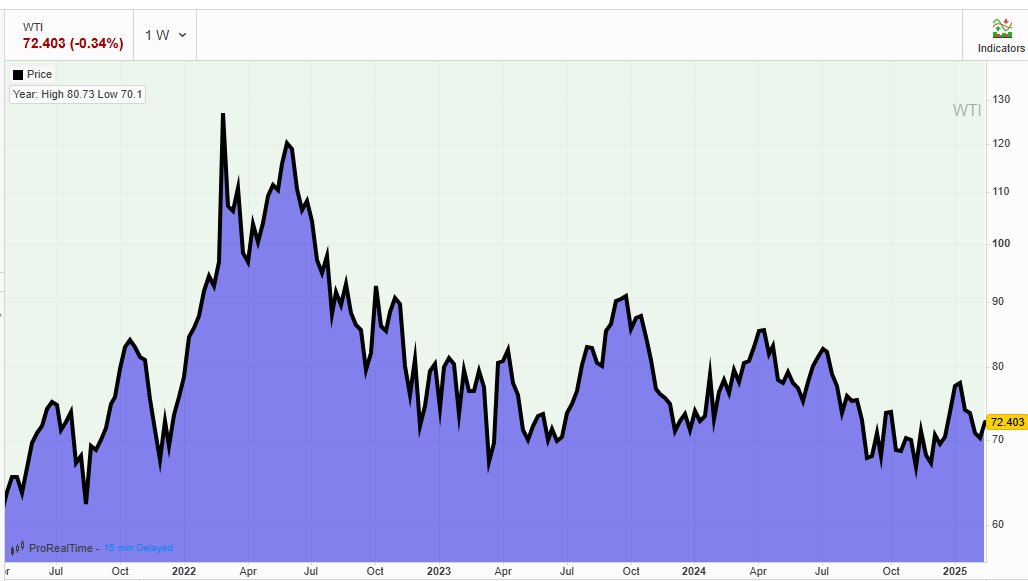

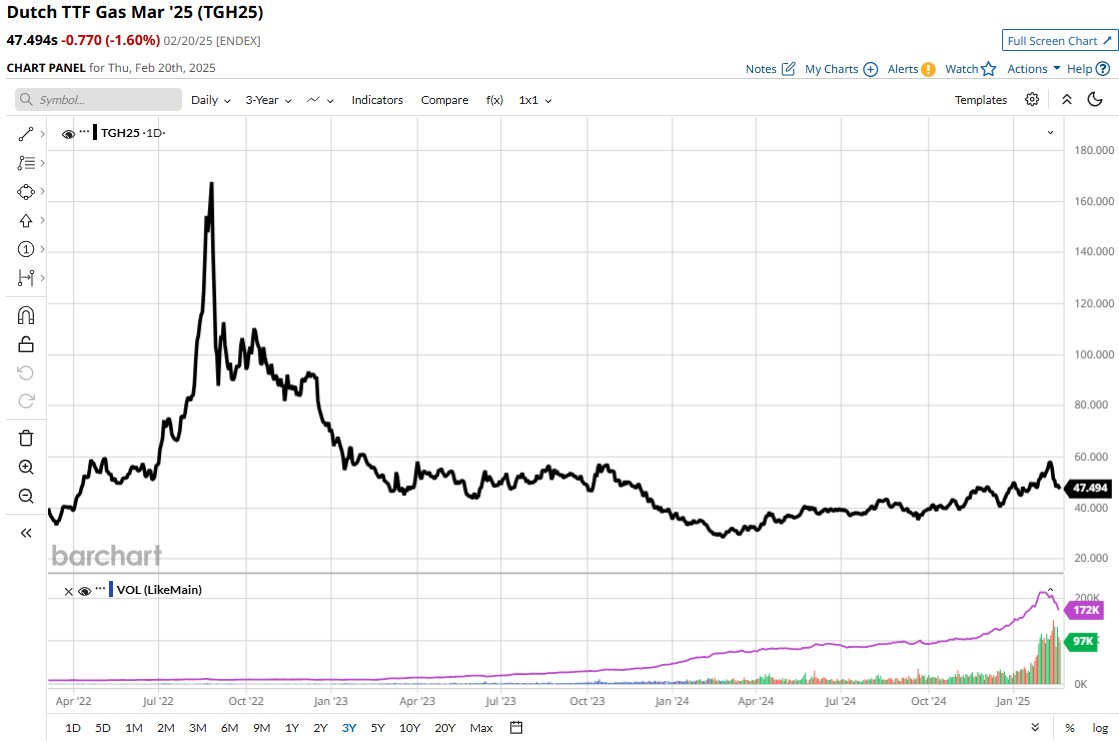

In fact, JP Morgan and Citi see oil declining into the mid-$60s/barrel by H2'25, whilst natural gas could see an even bigger fall given that before Russia invaded Ukraine, it supplied about 40% of Europe's gas vs c. 5% today.

Interesting times.