It’s well-known in investing that the market hates uncertainty. And the biggest uncertainty right now is the outlook for inflation, a key reason why many indices have fallen into bear market territory this year. The market has no idea how high inflation will go or when it’s likely to peak and investors are trimming their cloth accordingly as central banks try to fight an unknown enemy with higher interest rates.

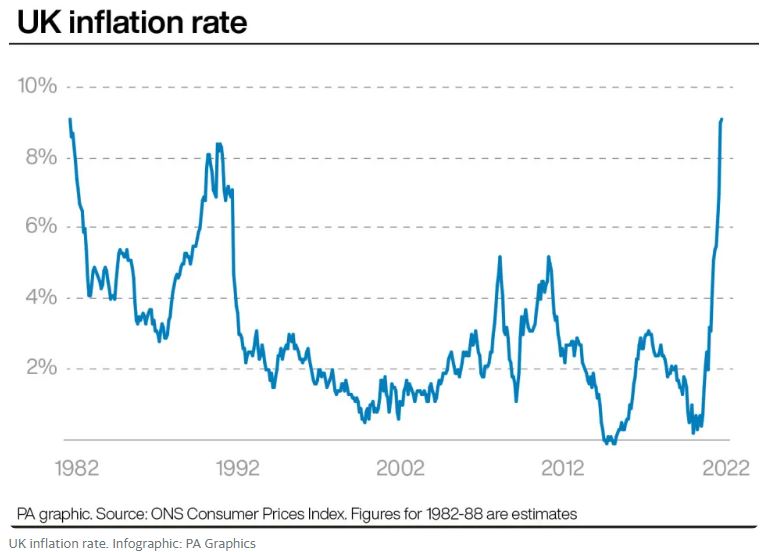

As yet inflation is still rising - to its highest level in 30 years - albeit at a less alarming rate of increase. UK CPI inflation, the rate at which prices rise, edged up to 9.1% in the 12 months to May, from 9% in April, the Office for National Statistics (ONS) said. The optimistic take is that it could have been worse following a higher-than-expected May reading in the US. The Bank of England is still predicting inflation to peak at 11%.

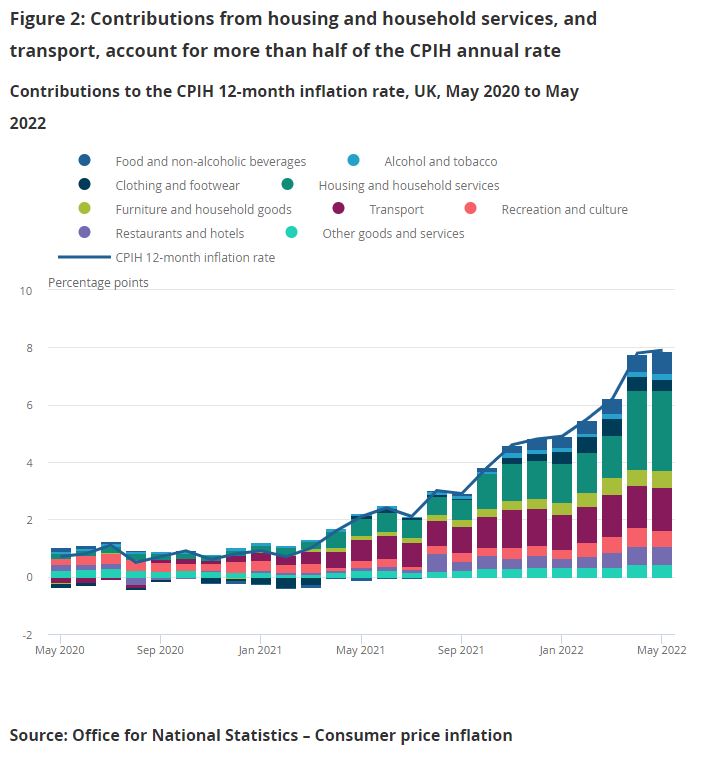

To understand whether that forecast may materialise it's probably worth looking at the most prominent inputs. Household costs, which include energy, made up the biggest proportion of the May reading, adding 2.79 percentage points, while transport accounted for 1.5 percentage points, principally from motor fuels and second-hand cars.

So it's worrying to see that pump prices have continued to rise throughout June, with the cost of filling up the average family car recently breaching the £100 mark. Meanwhile MoneySavingExpert’s Martin Lewis has warned that the energy price cap could skyrocket to around £2,980.63 for the next period - which runs between October and December.

But there’s another old saying that might bring some comfort on the inflation front: that the best cure for inflation is inflation. In other words, as prices soar and – despite a wave of public sector strike action - wages don’t, people will adjust their spending behaviour. Following on from Tesco’s gentle warning that it was “seeing some early indications of changing customer behaviour as a result of the inflationary environment” in its latest trading update, Lord Stuart Rose, Chairman of ASDA, put it more bluntly. "What we're seeing is a massive change in behaviour" he said, noting people are setting themselves £30 limits at checkouts and petrol pumps.

If that’s the case, then it’s highly likely that broad-based consumer demand will slump and tip the economy into recession. Economists at JP Morgan warned that the structure of the UK’s consumer and import-heavy economy – and weak currency - leaves it vulnerable to recession within the next two years. Think tank the National Institute of Economic and Social Research is even more gloomy, predicting that the UK will print two-consecutive quarters of negative growth even sooner, before the year end. It’s a similar story in the US, where analysts’ odds of a recession within the next twelve months are rising fast.

That might sound like unwelcome news for markets, but one side effect could be a fall in energy prices as demand evaporates – oil prices have fallen in recent weeks reflecting the possibility of a broad economic slowdown, which could start to temper future inflation readings. That might also reverse the recent rush into stagflation-resistant commodity sectors, but it would give the rest of the economy a much needed opportunity to reset.

Certainly, a meaningful drop in inflation isn’t likely to happen until energy costs come down. However, the market doesn’t need to see a meaningful improvement, it just needs to see uncertainty removed. In other words, peak inflation or inflation not getting worse. This would give the central banks a measure of the enemy and the market - which often leads the economy - some certainty.

When is this likely to happen? No one knows for sure, but possibly not that far off, when you consider moderate increase in CPI inflation in May after a huge jump from 5.5% to 9% between January and April, the cycling out of some inflationary pressures, and the demand destruction we're starting to see in places. Even if we see June’s CPI come in at the same level, many will be shouting, “it’s peaked!” and the market should respond positively.

But by then the next big question will already be being asked - what’s happening to corporate earnings as companies struggle to push up prices onto customers unable to pay them? Inflation or no inflation, there are few places to find much certainty right now - finding shares with pricing power is key, but you have to look hard to find them.