Taking Stock on Friday 2nd February 2024

Who will Win this year? Bulls or Bears?

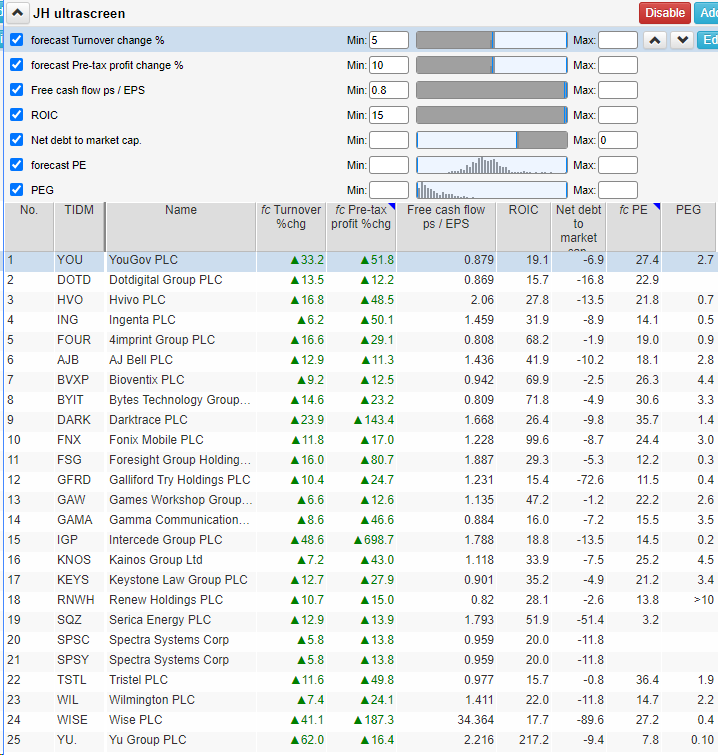

John's Ultrascreen!

Companies mentioned on, "Taking Stock" today:

05:20 BT Group #BT.A

07:10 Diageo #DGE

09:00 & 19:45 YouGov #YOU

09:15 Hvivo #HVO

11:28 AJ Bell #AJB

12:30 Ingenta #ING

13:30 Intercede #IGP

14:25 Tristel #TSTL

14:45 Keystone Law #KEY

15:03 Gamm Communications #GAMA

17:40 Bioventix #BVXP

19:45 YouGov #YOU

27:10 Venture Life Group #VLG

28:20 Cambridge Cognition #COG

28:48 IQ-AI #IQAI

31:15 Tertre Rouge #TRA

35:50 Hemogenyx #HEMO

36:50 Revolution Beauty #REVB

37:38 Superdry #SDRY

TOP BUSINESS STORIES

AI will not be mass destroyer of jobs - Bank chief

Artificial Intelligence (AI) will not be a "mass destroyer of jobs" and human workers will learn to work with new technologies, the governor of the Bank of England has told the BBC.

Governor Andrew Bailey said while there are risks with AI, "there is great potential with it".

The Bank says businesses expect to see the benefits to productivity soon.

Almost a third told the Bank they'd made significant AI investments in the past year.

UK public's long-run inflation expectations rise to 9-month high: Citi/YouGov

The British public's expectations for inflation increased in January, potentially because of worries about disruption to shipping in the Red Sea, a survey published by U.S. bank Citi showed on Friday.

Public expectations for inflation in the next five to 10 years rose to 3.6% in January from 3.4% in December, their highest since April 2023, according to the survey, which is conducted by online polling company YouGov.

Apple iPhone sales slump in China as Huawei's foldable phones gain momentum

Apple shares slumped in after-hours trading - driven by disappointing iPhone sales in China and a warning that future revenues will fall well short of expectations on Wall Street.

The gloomy market reaction overshadowed an otherwise strong financial performance in Apple's first fiscal quarter.

In the three months to 30 December, the tech giant reported sales of $120bn (£94bn) and profit per share of $2.18 (£1.71) - comfortably beating targets set by analysts.

However, Apple's chief financial officer has warned that revenue in this current quarter will be at least £5bn (£3.9bn) less than the same period a year ago.

Sales of iPhones in China - a key market - are in sharp focus, as they were $3bn (£2.35bn) less than what analysts had anticipated.

The latest results will fuel concerns that Apple is losing ground here, with consumers switching to foldable smartphones and devices made by local rival Huawei.

In an interview with Reuters, Apple CEO Tim Cook admitted that China is the most competitive smartphone market in the world.