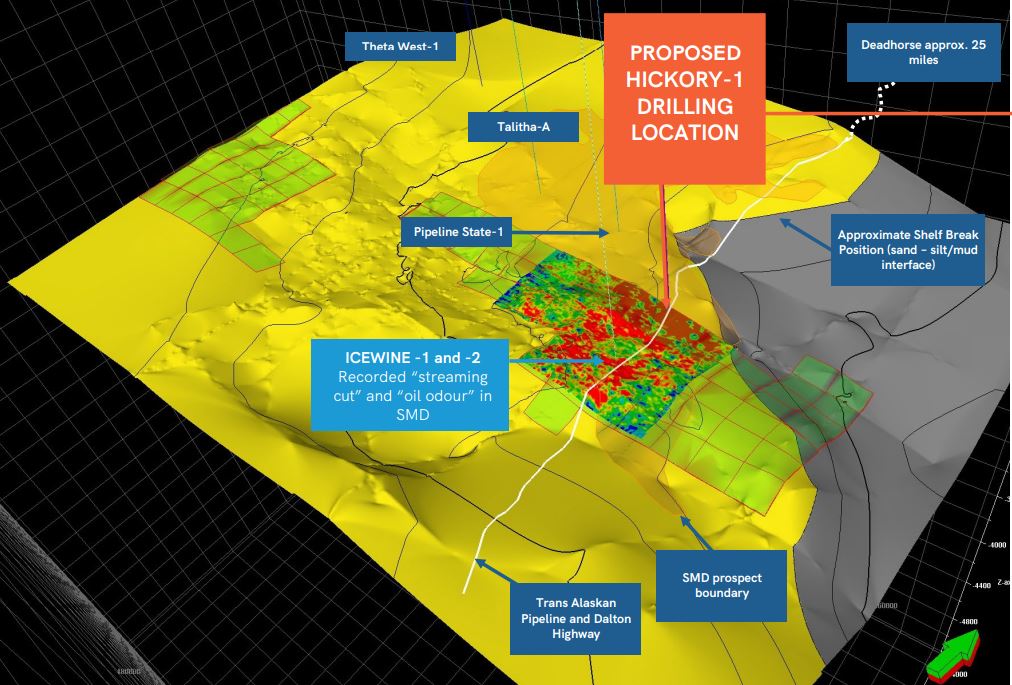

88 Energy (88E) has updated investors with further progress at its Hickory-1 project in Alaska, where it’s targeting an unrisked prospective oil resource is 647m barrels of oil.

It said that it had successfully intersected and drilled through the SMD-A, B and C reservoirs, and that interpretation of logging-while-drilling data had indicated the presence of hydrocarbons. It added that reservoir targets were intersected slightly shallower than expected at 8,820 feet, but that the reservoir thicknesses were consistent with pre-drill interpretation.

The company now plans to assess the prospect more fully with wireline logging and coring once the well hits its total depth of 11,000 feet, which the company expects to happen in the next 3-5 days. The logging programme is expected to take 5-7 days, and all operations at the site are expected to be complete by mid-April in advance of flow testing in the 2023/24 winter operational season.

View from Vox

The latest results provide further evidence of the potential of 88’s Alaskan exploration programme, which as broker Cenkos notes has been further derisked by recent drilling and flow test carried out on adjacent acreage by Pantheon Resources.

In addition, the completion of an oversubscribed A$17.5m (£10.1m) discounted placing earlier this month means the group’s activities are funded for the next 12 months. Hickory-1's final cost is expected to be lower than the previously drilled Icewine-1 and 2 wells on the Project Phoenix acreage at c. US$13.5m gross.

The Hickory-1 prospect is particularly attractive given its proximity to nearby infrastructure, including the Dalton Highway and Trans Alaskan Pipeline, which provides an immediate export route and is helping to minimise the cost of development activities.

Alongside Hickory, 88 has an extensive, exploration portfolio in Alaska comprising around 440k net acres, including the recently acquired Project Leonis acreage which has similar characteristics. Alongside the fundraising, cash flows from its conventional Texas production are available to reinvest in high-impact exploration.