Atlantic Lithium (ALL ), an Africa-focused lithium explorer, announced ongoing discussions with the Minerals Income Investment Fund of Ghana (MIIF) as of 16 February 2023, regarding MIIF's interest to invest up to US$30m in Atlantic.

Atlantic did not specify terms or timeframes, and noted that further updates will be made as discussions progress.

Background on Ewoyaa lithium project in Ghana:

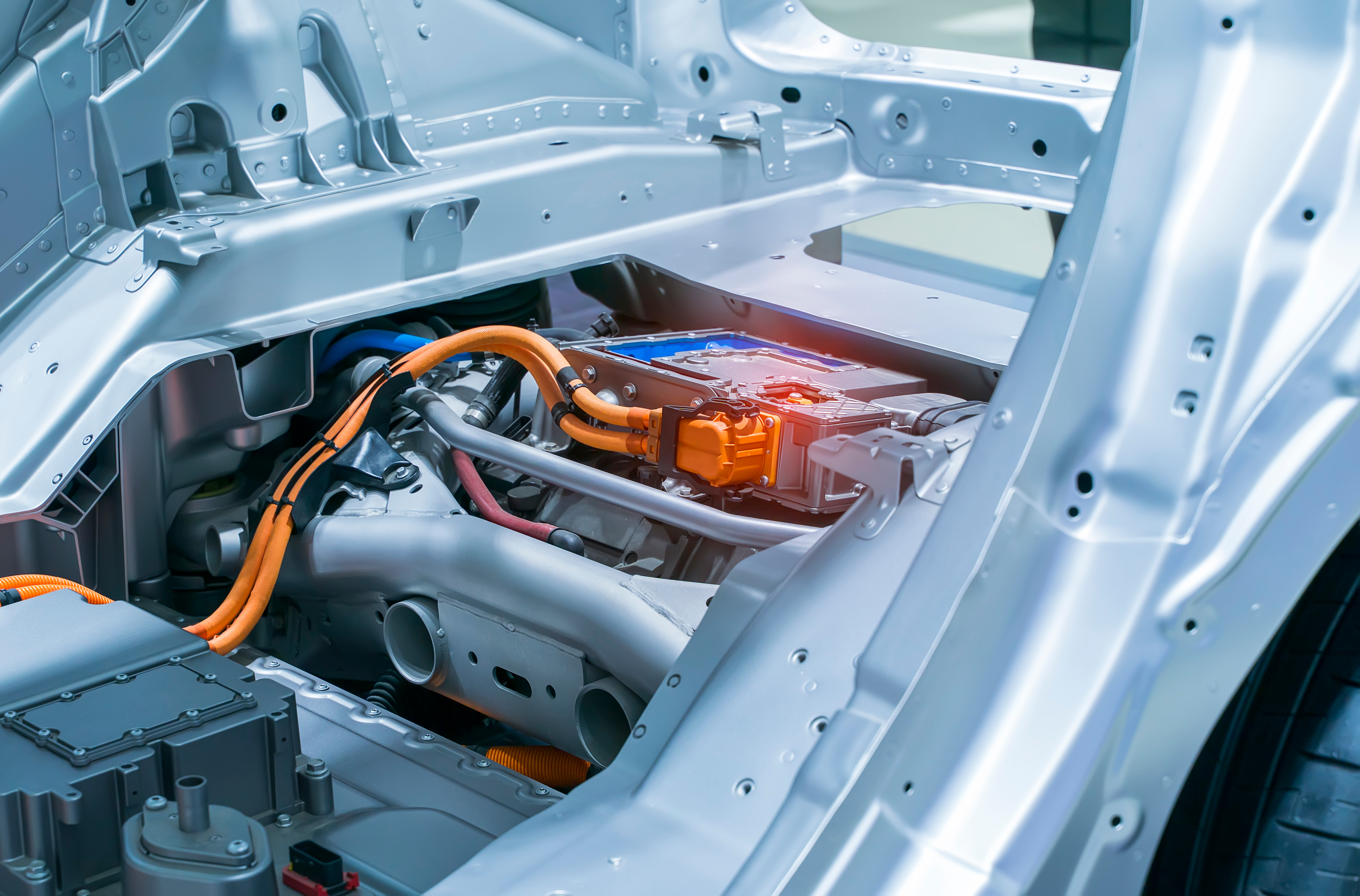

Atlantic's flagship Ewoyaa lithium project in Ghana aims to be the country's first lithium-producing mine, having secured a US$103m project development funding via a partnership agreement with NASDAQ/ASX-listed Piedmont Lithium. The project, located approximately 100km southwest of the capital of Accra, has proven to produce a premium SC6 product suitable for conversion to battery-grade lithium carbonate and hydroxide.

Earlier this month, Atlantic announced a much improved mineral resource estimate (MRE) for Ewoyaa of 35.3Mt at 1.25% Li2O, including 28Mt or 79% in the high-confidence Measured and Indicated categories.

Ewoyaa's recently announced pre-feasibility study forecasts significant profitability potential for a 2 Mtpa operation, producing an average of 255,000 tpa of 6% Li2O spodumene concentrate (SC6) over a 12.5-year life of mine (LOM), based on an earlier MRE.

Specifically, the pre-feasibility study delivers LOM revenues exceeding US$4.84bn, a post-tax NPV8 of US$1.33bn, and IRR of 224% over 12.5 years. Capital costs were US$125m with a short payback period of less than 5 months , and average LOM EBITDA was US$248m/year. The study used average annualised US$1,359/dry metric tonne SC6 pricing and US$1,200/dry metric tonne long-term pricing.

Potential MIIF deal:

ASX and LSE-listed Atlantic Lithium is funded to production through its 50% offtake agreement with US-based Piedmont Lithium. Piedmont also has a 50% offtake agreement with Tesla. Atlantic summarised its Q4 activities at Ewoyaa in its recently issued trading update.

Ewoyaa's strong economics and Atlantic's robust balance sheet have attracted the interest of the Minerals Income Investment Fund of Ghana, a sovereign minerals fund seeking to manage and invest the mining royalties of the country, established by act of Parliament in 2018.

MIIF is currently in negotiations with Atlantic for a $30m investment into the company. MIIF sees the investment as part of a broader development plan for Ghana's lithium resource, to support a full renewables value chain, from mining and processing lithium, to battery and EV manufacturing, to byproduct opportunities.

MIIF CEO Edward Nana Yaw Koranteng recently explained: "Electric vehicles represent a US$7 trillion market opportunity between 2023 and 2030 and US$46 trillion between 2023 and 2050. This represents opportunities for Ghana which can be leveraged by the current automobile development plan that has seen six car assembly plants already established in Ghana."

View from Vox

What this suggests for Atlantic is a nod by the Ghana government that the country is fully onboard with its activities and invested in Ewoyaa's outcome, as well as other potential lithium assets in the country. With government support behind it in the form of a $30m equity stake, Ewoyaa will be derisked further, assuming the deal goes through.

MIIF aims for an IRR of 125% in 4 years and projected revenue of more than US$1.5bn over 8 years from its direct equity investment in Atlantic. MIIF is also making investments in Ghana's salt and gold resources, seeking to become Africa's biggest sovereign minerals fund.

MIIF also wants to develop Ghana's commodity markets to support its lithium and EV ambitions. To this end, Atlantic will list on the Ghana Stock Exchange, giving a chance for local investors to buy into Ewoyaa.

The next step for Ewoyaa is a definitive feasibility study (DFS) targeted for Q2 2023, to evaluate an extended mine life and increased throughout, to further enhance the project's economics. Given the projected deficit in lithium supply, and Atlantic's strong funding position, this is one to watch.

Follow News & Updates from Atlantic Lithium: