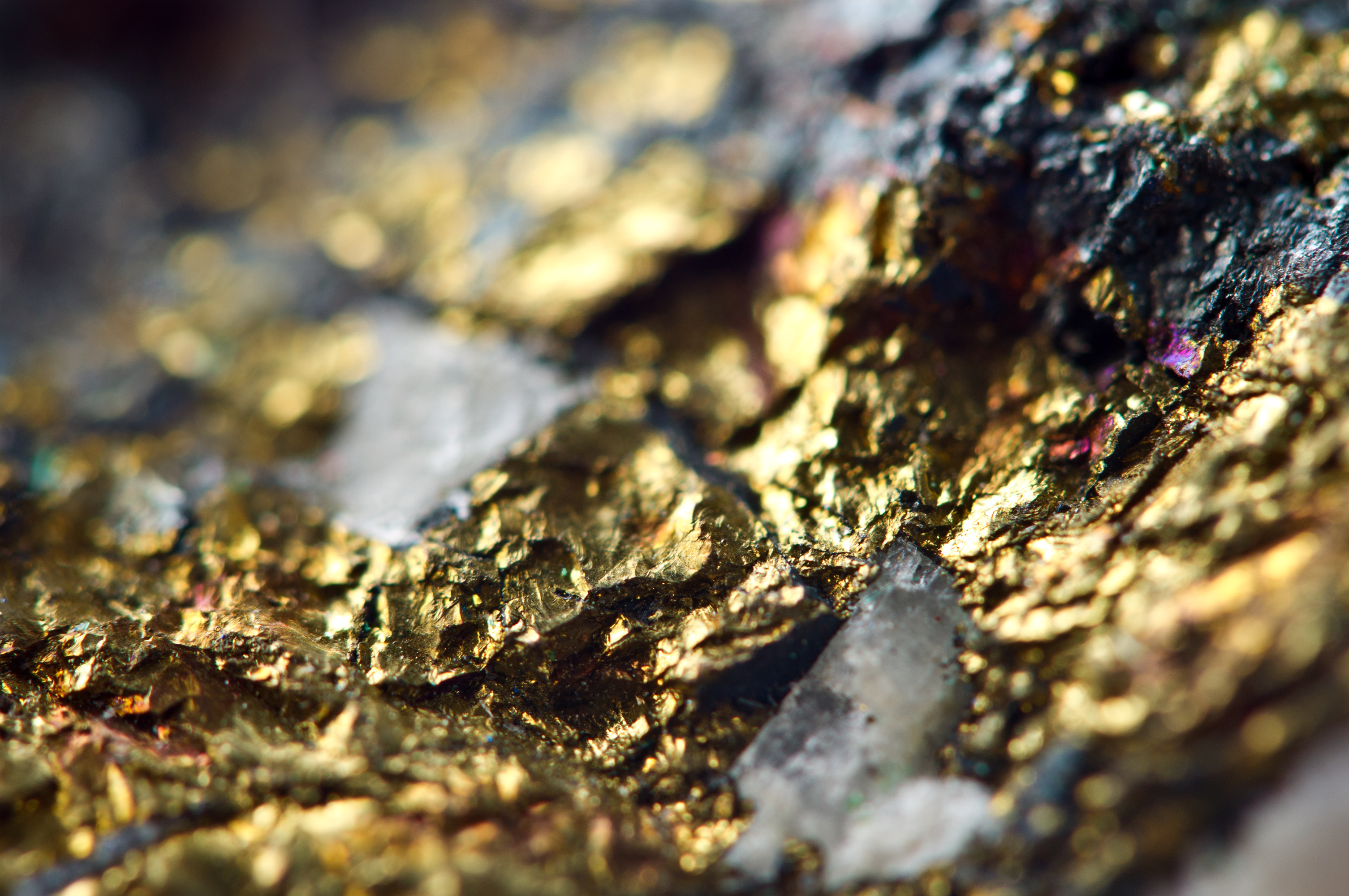

Bezant Resources (BZT ) has received ‘encouraging’ assay results from the Troulli Mine Development Project which forms part of its joint venture with Caerus Mineral Resources.

Bezant and Caerus’ JV is focused on the development of the Troulli Mine Development Project and other copper - gold targets in Cyprus. These latest assay results follow dump sampling and drilling undertaken at the Troulli, Kokkinapetra and Anglisides JV Projects.

At the Troulli Project, stockpile sampling returned an average grade of 1.2% of copper. The tailings sampling at the site were reported at double the projected grade while positive copper and gold mineralisation drill results were also reported outside the main Troulli deposit area.

Troulli stockpile sampling has returned a consistent average copper grade of 1.2% of copper over more than 639 metres of trenching with sections sampled at 5 metre intervals, it stated.

The tailings sampling over 44m returned an average grade of 0.4% Cu and 0.2g/t Au, double the projected grade, providing more ‘easily accessible low-cost resources for early cash flow.’

The resource companies said the Troulli project stockpile assays have met expectations and confirm Caerus’s view that they represent “an ideal target for early treatment to generate cash flow to meet a significant proportion of the anticipated capital cost of the processing plant.”

Martyn Churchouse, Chief Executive Officer of Caerus commented: “Troulli project drill results from the outer limits of the Troulli deposit indicate it is larger than anticipated and, in some cases, requires further step-out drilling to close off mineralisation. We will be looking to include these and historic holes with the objective of defining a global Mineral Resource.”

At Kokkinapetra, the 1.5km strike length between Kokkinapetra and Troulli is potential upside to the Troulli Project, Churchouse stated, meaning the companies now have “evidence of mineralisation at surface that can be backed up with positive copper and gold drill intercepts.”

He said a more detailed mapping and a ground geophysical survey will generate drill targets.

Meanwhile, at the Anglisides project, the perceived value of moderate sized high-grade partially drilled out deposits at localities such as Anglisides, St. Nicholas and Mala and the recent drilling at Anglisides has validated this view, Churchouse highlighted to investors.

The company said it now plans to complete a more detailed drill programme at Anglisides with the objective of defining a Mineral Resource for this project and to provide sufficient information for metallurgical test work as well as a preliminary economic assessment.

Caerus said it has increased its in-country technical staff “to meet the increased workload and work is now underway on 5 separate projects and further updates can be anticipated.”

Colin Bird, CEO of Bezant said “These results are highly encouraging in whichever way you look at them. We have good results from our stockpiles and tailings and extensions to primary copper are significant and will extend our known resources for mine planning purposes.”

He said. “I am particularly encouraged by the Kokkinapetra extension of the Troulli deposit. Since, drilled mineralised intervals were significant and consistent. With the widths being experienced, we have potential to build up considerable tonnage between the two deposits.”

“The potential to link these two areas is evident and will be included in our project planning. We intend to carry out an outline scoping study to define the annual tonnage and grade, whilst determining capital and operating cost. The results underpin our prognosis and expectations for an initial joint venture producing some 8,000 tonnes of copper for 8-10 years,” he said.

Addressing shareholders, Bird added that the combined scenario may present an opportunity for “a bigger operational plan,” which if evident, the company intends to pursue going forward.

Follow News & Updates from Bezant Resources: