Equals (EQLS ) half yearly results for the six months to 30 June 2021 demonstrate the success of the strategy outlined last year as the Company pivoted towards B2B payment solutions.

Financial Highlights

The Group reported revenue increased by 23% to £16.9 for the six month period with B2B revenue up 25% to £11.6m as a results of continued laser focus on SMEs business, announced last year.

Gross profit increased 17% to £10.2m with strong cost control reducing overheads by approximately 14% on 2H20, resulting in an adjusted EBITDA increase of 128% to £1.6m (1H20: £0.7m)

Post Period End

For the ongoing 3Q21, the Group has reported record revenue of £9.2m, demonstrating a record quarter with 2 weeks left to go.

As of 10 September 2021, the Group held £12.3m of cash on the balance sheet with net liquidity of £10.2m demonstrating the positive cash generation the business is now delivering.

Commenting on the Interim Results, Ian Strafford-Taylor, CEO of Equals Group plc, said: “The planned pivoting away from retail and travel towards B2B has paid-off spectacularly in H1-2021. This trading performance and momentum has sustained since the period end and is being supported by fast growing revenues……. amounting to £9.2 million in the period from 1 July to 10 September, making this a record quarter with 14 business days left to run, with numerous new first-rate customers, and strong take-up of our enlarged product suite.”

Whilst, like other businesses we have seen market-forces led cost pressures, particularly in staff and IT, we have contained these robustly, sought further efficiencies and have grown revenue at a much faster pace.

“Equals finds itself with a unique position in the FinTech sector as, not only are we generating operational cash, but we remain very well-funded for both re-investment in product and marketing to drive further profitable revenue growth.”

View from Vox

Firstly, the beat at the top line for 1H21 in general and 3Q21 in particular is testament to the managements vision of its disruptive industry positioning outlined over 12 months ago.

Equals is now operating at the intersection of several structural growth trends within the finTech payment space and has clearly executed its pivot towards the B2B space flawlessly.

The finTech Landscape

(Source: EQLS)

However, unlike many new entrants into the market, Equals is profitable and cashflow positive, enabling it to invest in new product development and product marketing without requiring external debt or equity funding.

The outlook also remains strong for the Company as its “own-name” multi-currency IBAN capability is set to drive sustainable and recurring platform-related revenues forward over the near to medium term with both Equals Money and Equals Solutions providing further opportunities for growth to the individual product lines of International Payments, Cards and Banking services. Obviously B2C travel mostly dependent upon levels of lockdown, but any revenue growth in this area will drop straight to the bottom line.

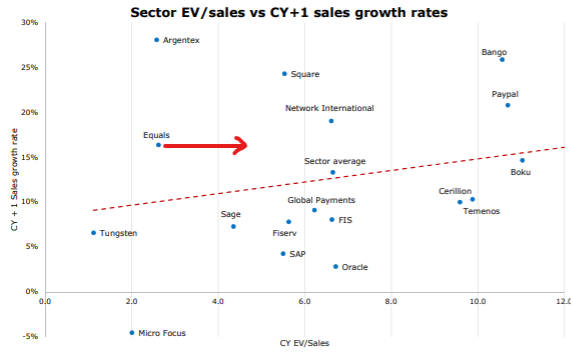

Whilst investor swill be rewarded well for their positions in the stock to date, forward valuation curves suggest there is much further for the shares to go towards double digit EV/Sales multiples.

Reasons to EQLS

Equals is an international payment services provider to both the retail and corporate segments of the UK market, which combined is estimated to be worth £60bn a year.

The cloud-based peer-to-peer payments platform is widely regarded in the industry as ‘best-in-class’ enabling personal and business customers to make low-cost multi-currency payments across a range of FX products, all via one integrated system.

The FairFX platform facilitates payments either directly to Bank Accounts or at 30 million merchants and over 1 million ATM’s in a broad range of countries globally via Mobile apps, the Internet, SMS, wire transfer and Mastercard/VISA debit cards.

Successful Acquisition Strategy

In recent weeks, Equals said it is ‘increasingly being approached by other international payments businesses’ and highlighted that it will continue to selectively acquire companies.

Last month, Equals acquired certain assets from the international payments business of Effective FX (EFX) for a consideration of £1.6m, to be satisfied from existing cash resources.

The ‘earnings enhancing acquisition’ primarily comprises the purchase of EFX's client book of more than 200 corporate clients, from a wide range of industries, which generated adjusted EBITDA of approximately £0.5 million for the 12-month period to 31 August 2020.

Equals said the acquisition showed the continuing growth of the Group in B2B international payments via its three routes to market: ‘firstly, directly to its own customers; secondly, via its Equals connect B2B2B strategy; and thirdly, via the acquisition of compatible businesses.’

CEO, Ian Strafford-Taylor, said the acquisition highlighted Equals’ key strengths in the B2B international payments arena; its openness to M&A opportunities, its versatility in acquiring volumes and revenues, and the strength of its payment’s infrastructure and technology.

Positive Trading

1H21 Results demonstrated revenue increased by 23% to £16.9 for the six month period with B2B revenue up 25% to £11.6m as a results of continued laser focus on SMEs announced last year.

Gross profit increased 17% to £10.2m with strong cost control reducing overheads by approximately 14% on 2H20, resulting in an adjusted EBITDA increase of 128% to £1.6m (1H20: £0.7m)

3Q21 reported record revenue with positive cashflow putting over £12.3m on the balance sheet.

Compelling Buy-Side Valuation

Recent research from PMH Capital has confirmed FY21 revenue & EBITDA forecasts have been upgraded to £37m (£29.0m LY) & £4.6m (£1.2m) respectively - pushing up the valuation from 70p to 78p/share.

Further out, turnover could climb to >£60m by 2025 - which on a 5x EV/revs multiple (vs peers >6x), would equate to a theoretical price of >150p vs 57p (2.6x).