Europa Metals (AIM:EUZ ) has released positive results from an independent Preliminary Economic Study which proposes a “significantly expanded potential mining operation” at its wholly owned Toral lead, zinc and silver project located in Castilla y León, north-west Spain.

The lead-zinc and silver developer said the study, which was conducted to update the economics of a previous scoping study from late 2018, incorporated positive findings generated from the workstreams of Europa and its consultants in the last 12-18 months.

Mining

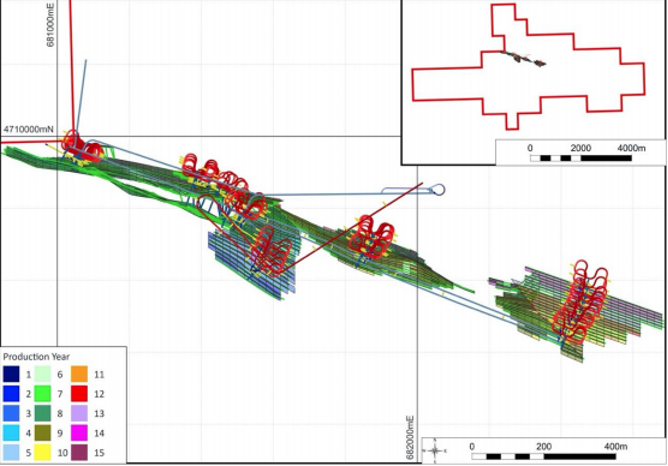

Following previous Geo Studies, Sub-Level Longhole Stoping (SLOS”) has now been selected as the preferred mining option.

SLOS offers the Company higher productivity rates, whilst reducing overall costs

Figure 1 Toral Mining Plan

[Source: Company]

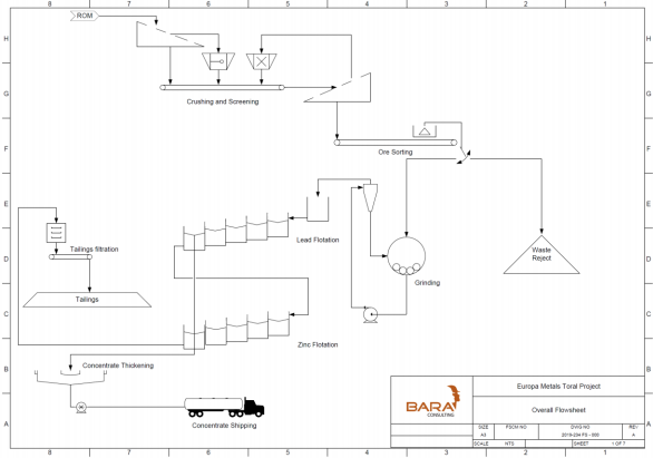

Metallurgy and Processes

Updates to the metallurgical approach and process design including Ore sorting delivered several benefits to the project, including reducing capital costs for the same metal production, increasing metal production for the same capital cost, or reducing the overall costs of production.

This proven method of pre-concentration was considered key to increasing the value of material mined from such zones prior to subjecting it to conventional flotation.

Based on sampling results, EUZ decided to adopt sorting as a pre-flotation stage for all material generated in the Toral mine plan in order to fully exploit the benefit of this technology.

Grinding and flotation test work including grind calibrations, bond work index determination, and froth flotation was then undertaken on two fresh samples as well as on the products of the abovementioned sorting test work undertaken.

Figure 2 Toral Crushing, Sorting, Grinding and Flotation Flowchart

[Source: Company]

Toral’s Key Financial Metrics

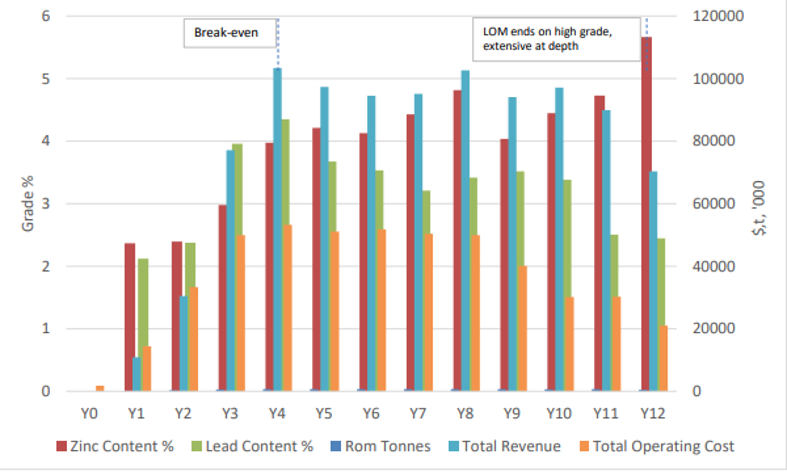

The economic study attributed a $156m =Net Present Value (“NPV”) at an 8% discount rate, a 31.3% Internal Rate of Return (“IRR”) and 700k tonnes per annum production rate over the 12-year life of the mine within ‘a highly robust operating regime’ with a projected 49% operating margin.

The NPV and IRR results indicate significant production expansion from the 2018 study, with enhanced economics derived from a change in the mining method, increased run-of-mine, the ore sorting addition, and increased understanding of the project’s metallurgical characteristics.

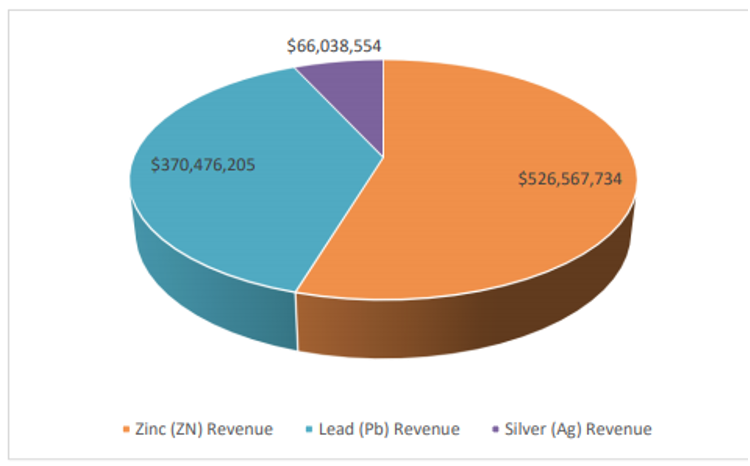

Figure 3 illustrates the total revenue of $962m over the life of the mine with Zinc being the major contributor of $526m

Figure 3 – Revenue Contribution

[Source: Company]

Upfront Capex for the project is estimated at $79m with a $73m peak funding requirement.

Figure 4 demonstrates Payback is calculated as occurring in year 4, however it must be noted that this is extended somewhat by the low mining rate and low grades in the early years, and belied by higher rates and grades in the intermediate years of the project.

Figure 4 – Projected Revenue and Costs

[Source: Company]

Study Conclusions

The updated study concluded that Toral’s production profile demonstrates ‘a very robust project capable of producing high grade saleable concentrates within an EU jurisdiction.’

Europa said the ‘robust updated economics’ (+/- 30%) for the Toral project are also ‘well supported’ by the global supply situation for lead and zinc, which the Company's Board believes will put such higher-grade potential producers at a distinct commercial advantage.

“With a mining grade of 7.6% zinc equivalent and as a potential high margin operator, Toral has the scope to generate over $470m EBITDA from $963m of revenue over the life of mine from upfront capex of $79m and estimated payback in year 4,” said CEO, Laurence Read.

He said, "Having recently secured a new three-year Investigation Permit for Toral and with today's updated economics attributing a $156m NPV and a 31.3% IRR, the Board shall progress our strategy to secure the most value-accretive pathway to advance the project.”

Progress to Pre-Feasibility Study

Bara has advised EUZ to move to the Pre-Feasibility Study ("PFS") stage, although it noted that the mine plan outlined in the Study would accommodate further production expansion ‘if further resource targets were successfully developed prior to, or during, production.’

Aided by the drawdown of the initial tranche (€163,380) of the group’s recent innovation grant from the Centre for the Development of Industrial Technology (“CDTI”), Europa will now progress work streams towards the PFS and seek to make an application for a mining licence.

“All necessary programmes needed to move the project towards a PFS have been completed and we now look forward to advancing all these studies to put the Company in the best position to assess all options,” said Myles Campion, Chairman of Europa Metals.

Shares in Europa Metals have ticked up gradually over the past two weeks to open 6.98% higher this morning at 11.5p following the announcement.

Reasons to Follow Europa Metals

EUZ is a European-focused lead-zinc and silver developer focused on The Toral Project, which is located around 400km northwest of Madrid, near Ponferrada in the province of León.

Certain elements of a PFS for Toral are now also underway with the bore hole for hydrogeological testing now complete, which will enable monitoring to commence.

Last week, the company renewed its investigation permit for Toral, following a consultation process by regional authorities, for a further three years until 15 November 2023.

The Company said that over the period it will prioritise the completion of ‘all necessary tasks’ in order to enable an application to be made for a mining licence at the project.

"As work progresses at Toral over the next three years, Europa Metals will seek to make an application for a full mining licence for the project, at the appropriate time, in accordance with the laws governing non-energy, sustainable metals projects, in order to move the Toral Project towards being permitted for a potential future full development phase,” said Read.

Follow News & Updates from Europa Metals here: