Q2 2020 Production Results and Operational Update shows the company remains in line with market guidance and on target for net cash position in H2 2020, with the current bank loans fully repaid by end of H1 2021.

Yanfolila Operational Highlights:

Further significant near mine drill intersections have been received during the quarter, adding considerable confidence to the Company's underground extension programme, its resource programme and its greenfield exploration programme with :

- 24,054 ounces ("oz") of gold poured in Q2 2020 (27,466 oz in Q2 2019)

- US$983 per oz all in sustaining cost ("AISC") for Q2 2020 (US$998 per oz AISC for Q2 2019)

- 31,520 oz of gold sold in Q2 2020 at an average price of US$1,663 per oz

- 2020 exploration programme over 75% complete with over 12,000 metres of drilling completed

- Total Recordable Injury Frequency Rate ("TRIFR") at 2.3, meeting the Company's target of having a TRIFR lower than 2.5

Corporate Highlights

- Cash of US$6 million at 30 June 2020 (US$9 million at 31 December 2019)

- 4,000 oz gold inventory on hand at 30 June 2020 (2,900 oz at 31 December 2019) worth approximately US$8 million

- Bank debt of US$26 million at 30 June 2020, reduced by US$14 million since the 2019-year end (US$40 million at 31 December 2019)

- SPA signed to acquire the Kouroussa Gold Project in Guinea

- Earn in agreement with ARX Resources Limited ("ARX") to advance the Dugbe Gold Project

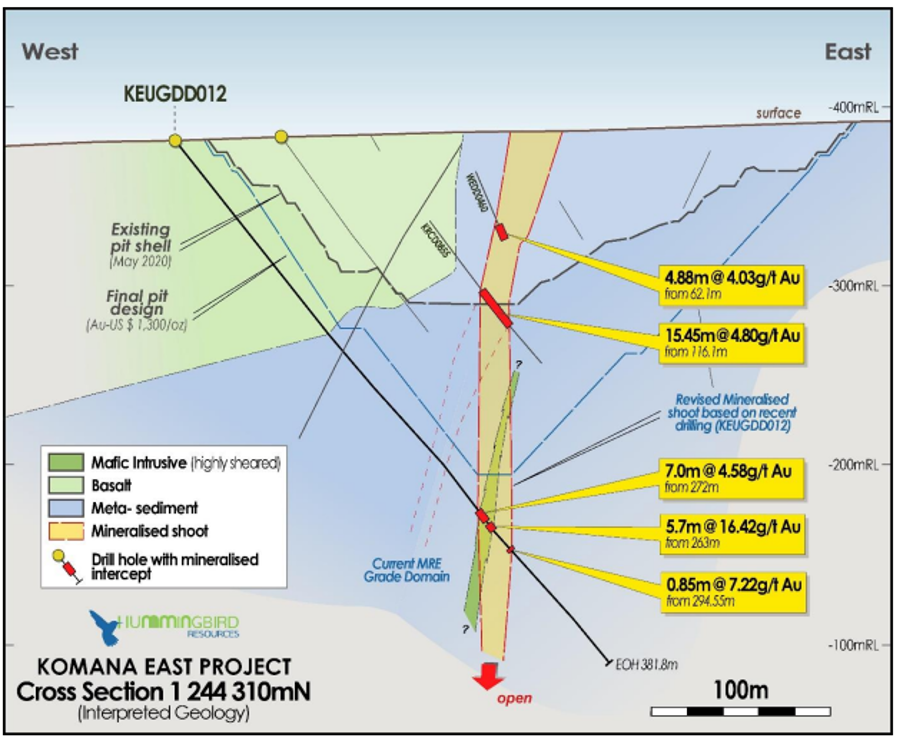

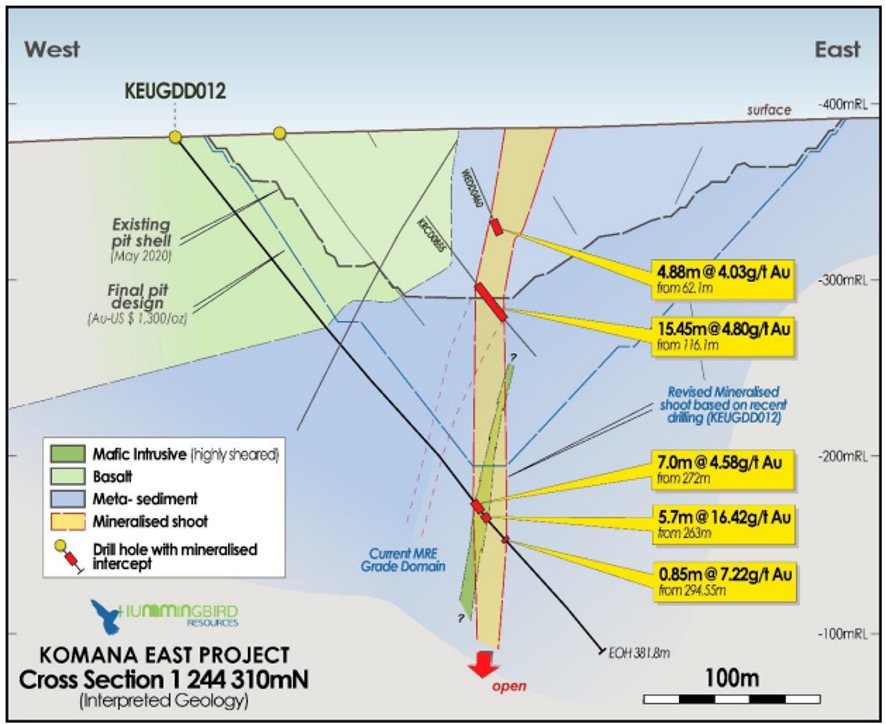

Komana East Underground "KEUG" Deposit

- 5.7m @ 16.42 g/t from 263m depth (KEUGDD012)

- 7m @ 4.58 g/t from 272m depth (KEUGDD012)

- 4.3m @ 4.02 g/t from 248m depth (KEUGDD005)

- 6m @ 5.44 g/t from 336m depth (KEUGGT004)

Image of drill Intersects at Komana East Underground Deposits

Sanioumale West "SW" Deposit

- 15m @ 2.57 g/t from 10m depth (SNWRC0310)

- 15m @ 9.92 g/t from 28m depth (SNWRC0310)

- 4m @ 2.71 g/t from 55m depth (SNWRC0303)

- 16m @ 2.23 g/t from 41m depth (SNWRC0317)

- 3m @ 4.57 g/t from 48m depth (SNWRC0320)

- 6m @ 2.54 g/t from 13m depth (SNWRC0321)

Image of drill intersects at Sanioumale West Deposit

Post Period Highlights and Outlook

- 2020 guidance maintained of 110,000 - 125,000 oz at an ASIC of up to US$995 per oz, as previously announced

- On track for targeted net cash position in H2 2020, with the current bank loans fully repaid by end of H1 2021

- Yanfolila predicted to generate in excess of US$60 million of EBITDA in H2 2020 (US$120m annualised) at current gold prices

- Exploration programme targeting improved mine plan on track

- Approval for the Change of Control of the Kouroussa project received from the Government of Guinea

- Dugbe earn in non-refundable deposit of US$2 million received from ARX with necessary consents/waivers received from Anglo Pacific Group Plc and the Government of Liberia

- ARX acquired (subject to final regulatory approval) by Pasofino Gold Limited, quoted on the TSX Venture Exchange (TSXV: VEIN) in a share for share exchange

- VEIN pro-forma market cap of approximately US$75 million representing a substantial indicative valuation for the Dugbe Project.

Shares in Hummingbird have performed particularly strongly overt he past three months from 27.5p to open at 41.25p in early trading.

Dan Betts, CEO of Hummingbird, commented: “ The COVID-19 pandemic has presented us all with a very challenging and dynamic operating environment over the last few months, which previously caused us to advise that we anticipated cost pressure across the board whilst we moved towards a more stable operating situation. While that proved to be the case in Q2, with logistical, mechanical and mining challenges all exacerbated by restricted movements and quarantine periods, I am pleased to say that the team has continued to perform well in these trying times and that we have established a stable footing enabling us have a robust outlook for the second half of the year.

"At Yanfolila, production for the quarter was below our initial expectations, largely due to re-sequencing of certain parts of the mine plan, and a reduced throughput strategy aimed at safeguarding the plant in the light of uncertainty over logistics for spares and specialist personnel, as well as the start of the rainy season. We anticipate a recovery in production in H2 2020 and we are therefore confident in maintaining our guidance for the year.

"I am extremely proud of the team at site, some of whom have now pulled extraordinary 150 plus day shifts through this crisis and have gone above and beyond in order to maintain operations.

"Looking beyond current operations at Yanfolila is very exciting. We are receiving some extremely positive results from our drill programmes, and whilst it will take some months to model all the data the indications are promising.

"Additionally the acquisition of Kouroussa gathers momentum as we have now received the change of control approval from the Government of Guinea and are preparing to commence works as soon as practical following the anticipated granting of the necessary exploitation licence.

"At Dugbe, our earn in partners have been working quickly to develop infrastructure plans ahead of an aggressive exploration programme, planned to both increase resources and complete a DFS at the project. ARX's recent transaction with Pasofino Gold (quoted on the TSX Venture Exchange) should provide it with enhanced access to the necessary capital and gives Hummingbird a substantial indicative valuation of the project. We look forward to providing updates as tangible progress is made and value is further demonstrated at the project."