Hummingbird Resources plc (AIM:HUM ) has provided investors an operational update following the senior management site visit to the Yanfolila mine last week.

FY20 Operational Update

Following managerial changes [announced last week] the agenda for the site visit included reviewing site processes and mine operations and finalising the budgets for FY21.

What can be seen is that some of the unintended consequences of :

- 2Q20 - Re-sequencing processing of softer oxide material in 2Q20 to preserve equipment as no repairs would be possible, due to the border closures under COVID-19 travel restrictions, should machinery fail catastrophically

- 3Q20 - Extreme weather events resulted in lower grades, particularly for Komana East (“KE”) pit

- 4Q20 - Further border closures, following the military coup in Mali, extenuated the already difficult logistical operations across Mali

Despite the weather now improving, it has become apparent that the above factors have compounded to result in material uncertainty of the Company meeting the lower–end of production guidance of 110,000 – 125,000 oz in 2020.

Dan Betts, CEO of Hummingbird, commented: “2020 has been a difficult and frustrating year. The harsh reality is that should we fail to meet guidance, no matter what the circumstances, it will be viewed as such and this is a fact that weighs heavily on the team. That said, I remain extremely proud of our people on the ground and all that they have overcome this year in challenging times.”

Outlook

Production

It is important to note that ounces not produced this year are expected to be recovered in future mining periods.

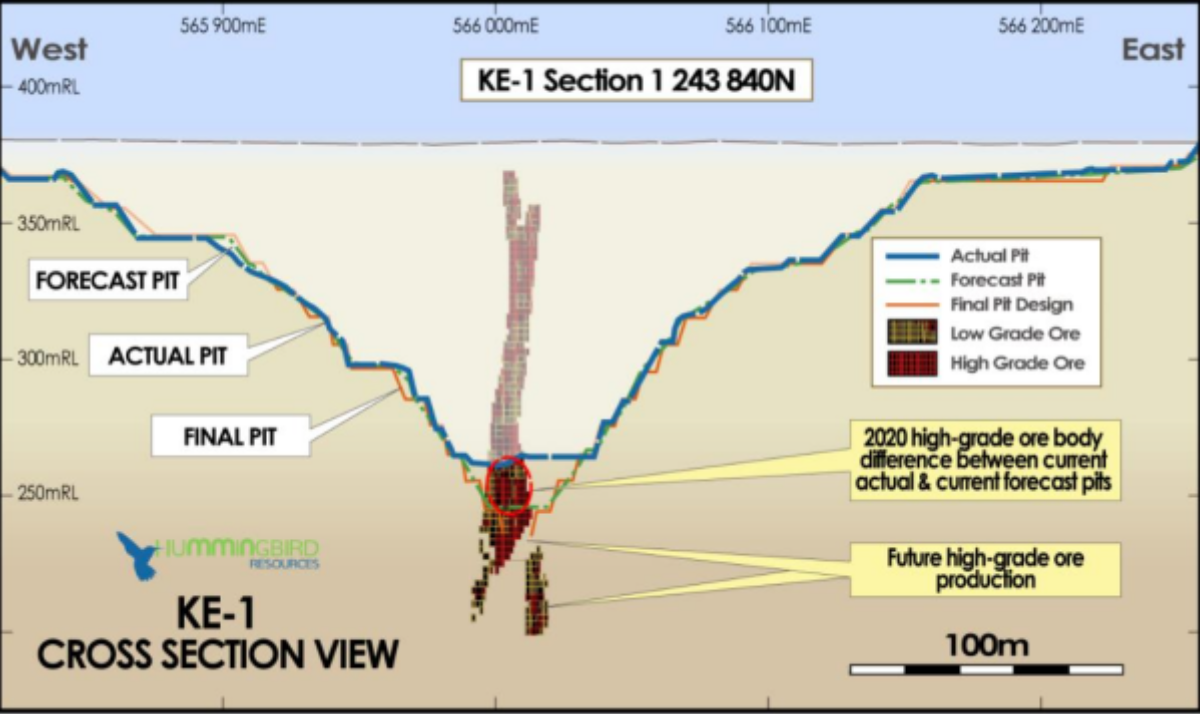

Figure 1 below illustrates where the where the high grade ore remains at a depth below the current pit floor at KE, which was due to be mined in the original 2020 mine plan.

Figure 1. KE-1 Pit Cross Section View

[Source: Company]

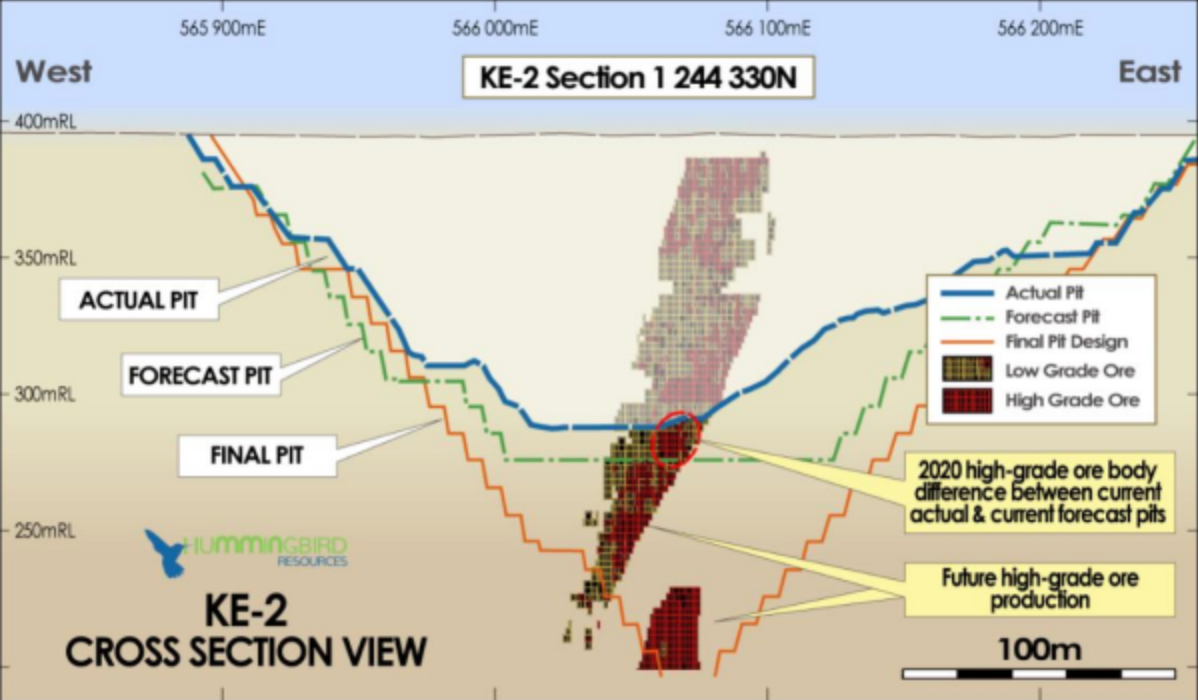

The ore highlighted in Figure 2 remains available and is currently being mined with full extraction now expected in 2021.

Figure 2. KE-2 Pit Cross Section View

[Source: Company]

Drilling

A final drilling programme is being carried out at the Sanioumale East ("SE") deposit. Results to be released before year-end to complete Hummingbird's, to date, successful 2020 exploration and drilling campaign.

Development

Pre-development plans for the Kouroussa Gold Project are continuing. The Company is awaiting the award of the mining license by the government to then move into the development stage of this exciting gold project once pre-development plans are complete.

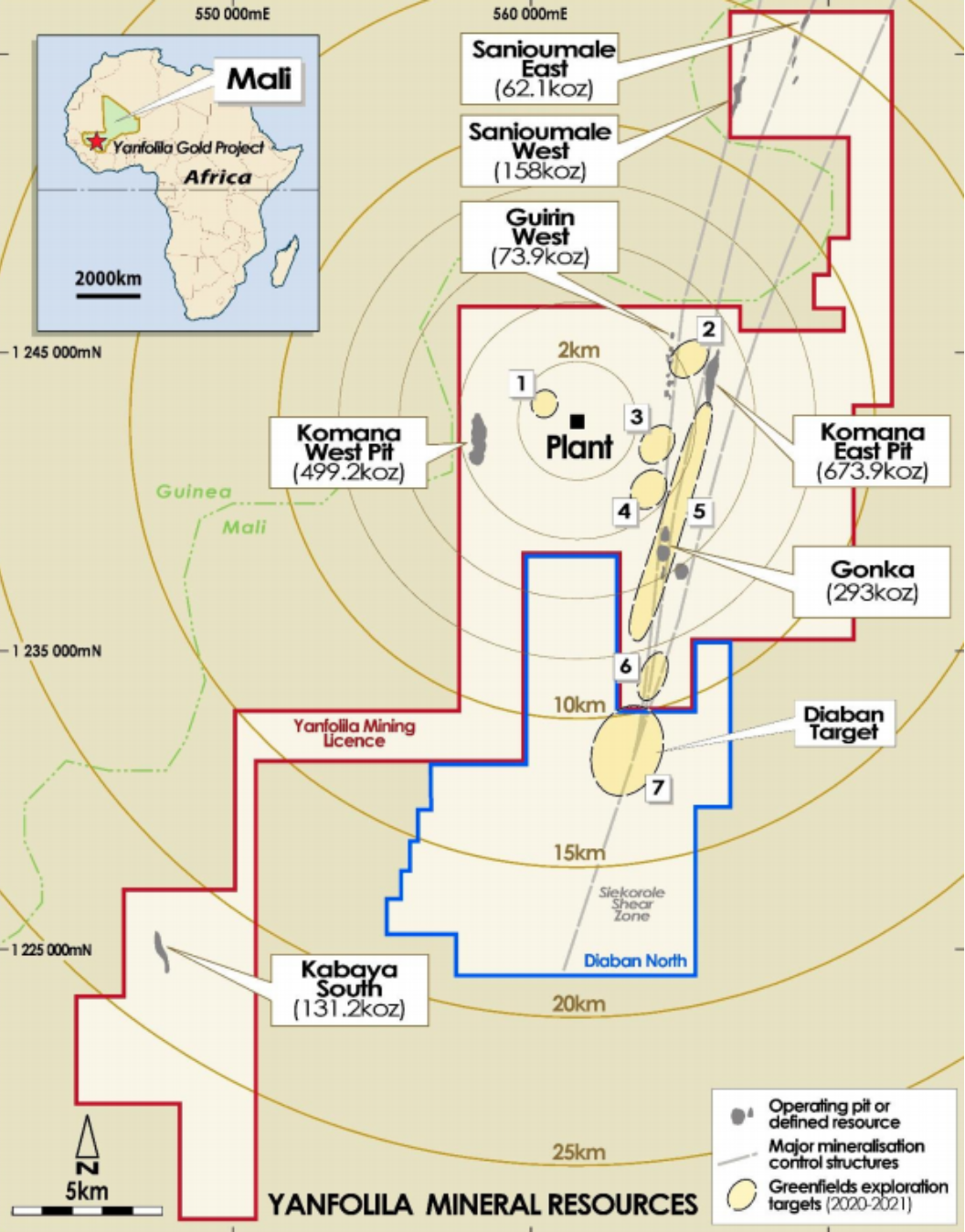

Resource Modelling

Once drilling at Sanioumale East is finalised, Hummingbird will update the Yanfolila mineral resource models and aim to release those findings in 1Q21.

Figure 3. Yanfolila Mineral Resources Map

[Source: Company]

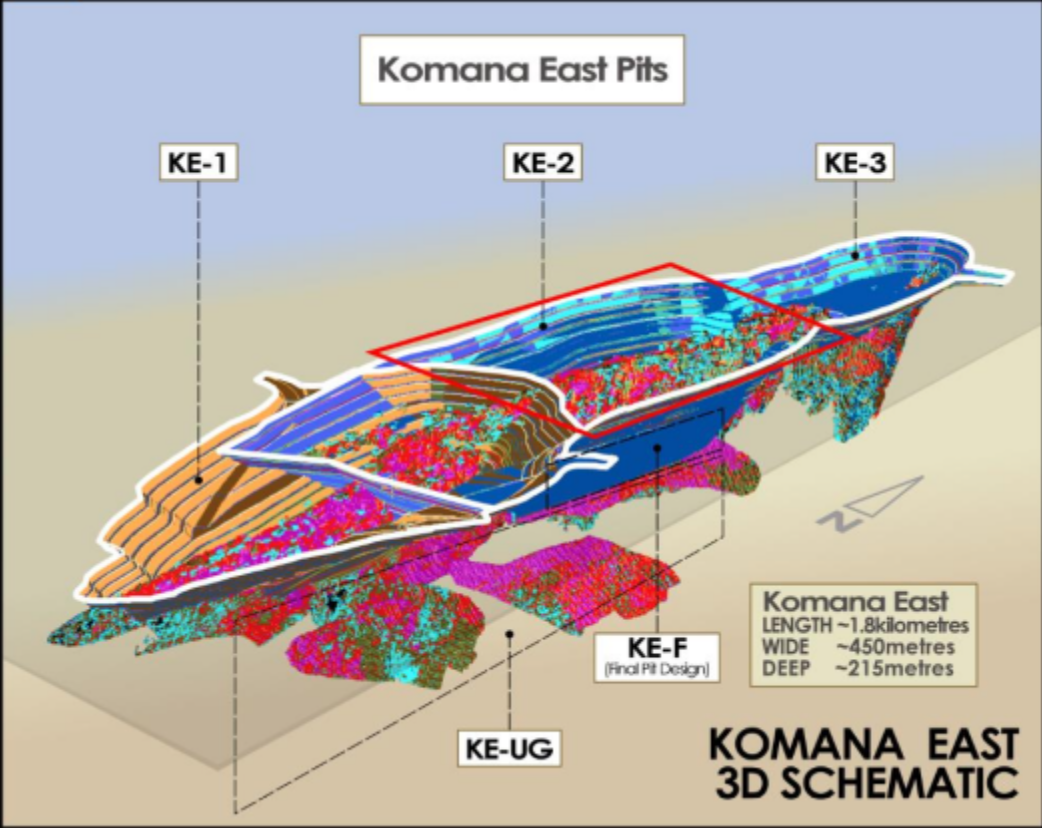

Figure 4. Komana East Pits

[Source: Company]

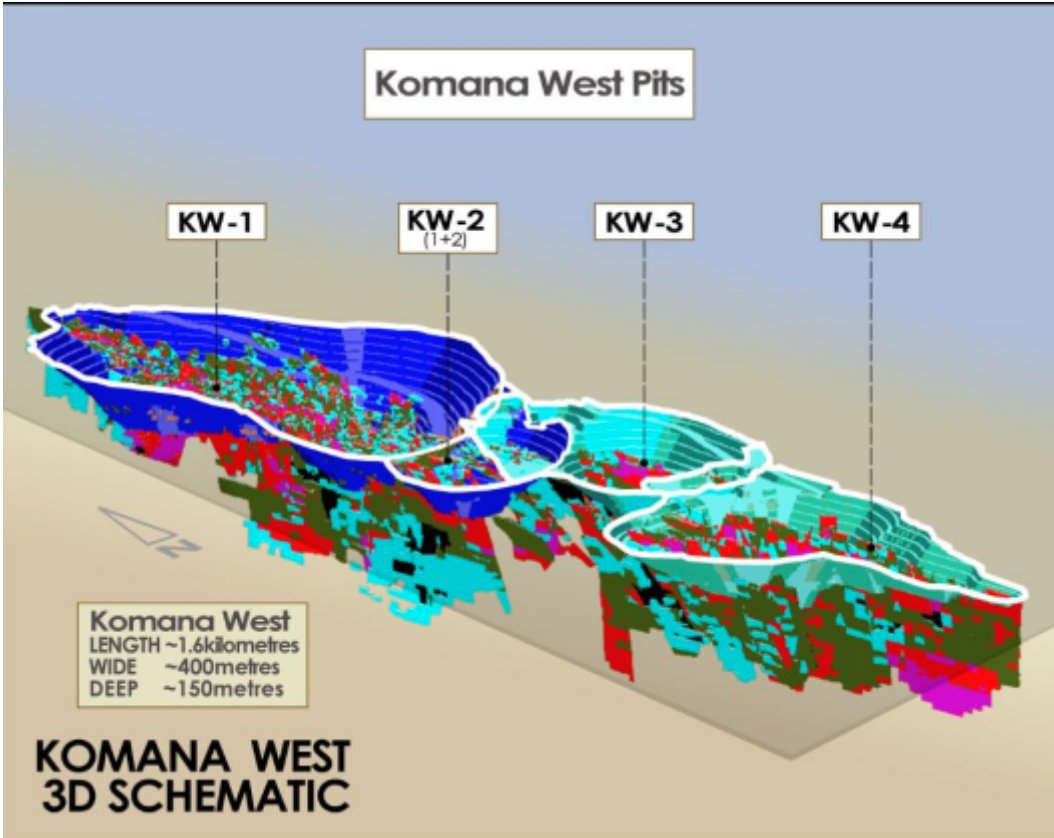

Figure 5. Komana West Pits

FY21 Expectations

The Company’s 2021 budget is currently being drafted and the expected to be finalised in the coming weeks, with the aim to release in Q1 2021, including key findings and production forecast and financial estimates.

Dan added: “I do believe that Yanfolila, which will have paid off all its debt in the first half of next year, is well set up to deliver solid production for the years to come. Our exploration programme this year has produced many encouraging results which we are confident will contribute to additional resources being included into the mine plan to extend mine life.

Our pre-development plans at our new mine, Kouroussa, in Guinea continue and we are confident the mining license will be awarded soon. We will then move towards the development stage following completion of the pre-development plans of this exciting project, which will see us become a multi-asset producer in the coming years producing in excess of 200koz pa.

Becoming a multi-asset producer is key not only for the Company’s growth but also to mitigate single mine risks factors as demonstrated this year at Yanfolila. Further, we are finalising our 2020 exploration and drilling campaigns and look forward to releasing those updated results then finalised soon, followed by our updated mineral resource models in the new year.”

Shares in Hummingbird reacted negatively to the operations update opening down 14% at 27p but recovering to 29p in early morning trading.

Reasons to Follow HUM

-

Strong underlying geological indications at Yonfolila, Kouroussa and Dugbe with more drilled expected to drive resources and production higher

-

Hummingbird has put a strong management team in place since 2015 with expertise in mining commodity markets and in-region experience of West Africa who have a track record of delivering projects on time and on budget

-

Significant growth potential of this multi-asset and multi jurisdiction mining company with appetite to expand the number of projects going

-

Lots of positive news events expected in FY