Tough markets mean it’s been a quiet few months on the IPO front. But one company, Fulcrum Metals (FMET), is braving the choppy conditions in one of the first flotations of 2023, having successfully raised approximately £3m gross to support its short-term strategic goals.

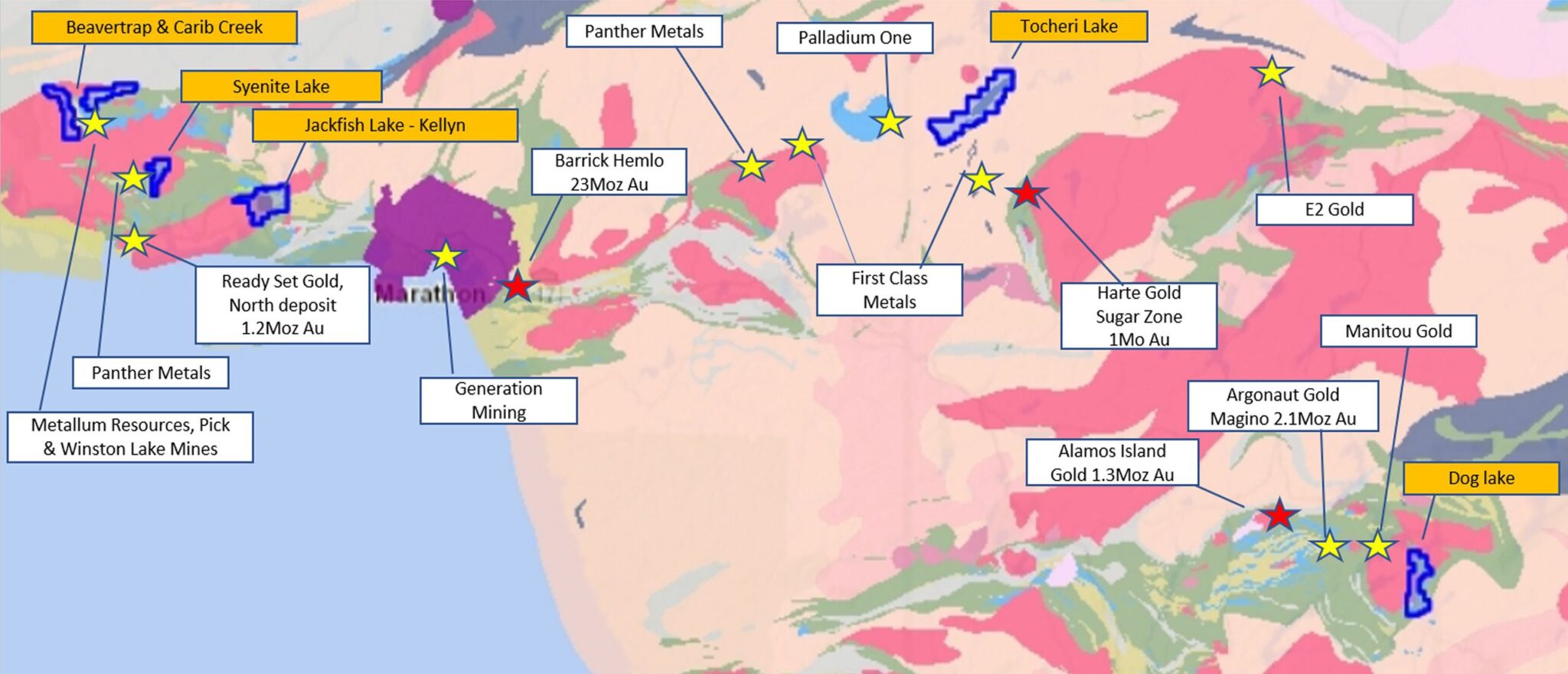

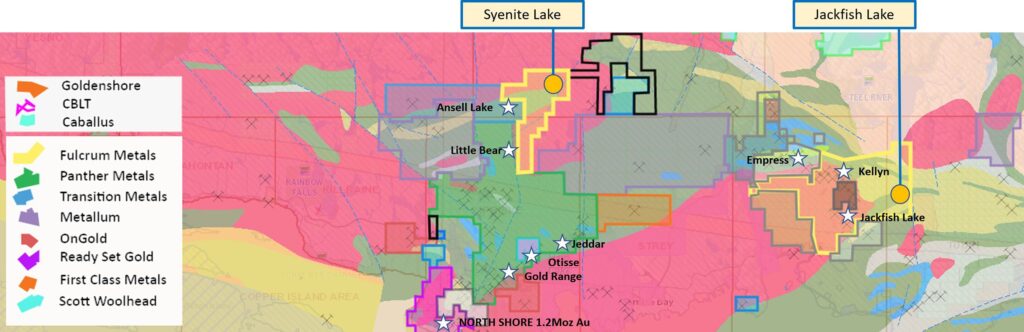

Fulcrum is the holding company of a mineral exploration group with base, precious and energy metal projects in Canada, including six gold and base metal projects in Ontario totalling 252km2 and two uranium and gold projects in the Northern Athabasca Basin region of Saskatchewan totalling 136km2.

Although the projects are pre-discovery, historical sampling, analysis of geology, and the presence of nearby producing mines and deposits suggest there is potential for the development of an economic mineral deposit. The high-grade Big Bear Project has rock samples of up to 53.7g per tonne of gold, soil samples up to 0.71g per tonne, and historical bulk sampling reported at 150t averaging 17.6 grams per tonne, while Jackfish Lake Project has widespread mineralisation and rock samples of up to 38.9g per tonne of gold and 1.01% copper.

Half of the IPO proceeds will be used to advance its Schreiber-Hemlo Project in Ontario comprising the 113km2 Big Bear and Jackfish Lake properties, where 38 mineral occurrence and high-grade gold in rock samples have previously been recorded, with drilling, survey work and geophysical modelling expected to begin this year.

The remainder will be used to advance the rest of its portfolio, including establishing the prospectivity of its wider Ontario and Saskatchewan portfolio with a view to securing third-party interest. The company noted increased recognition of the need for nuclear energy to decarbonise base load power.

Ryan Mee, Chief Executive Officer of Fulcrum Metals, commented: "We are delighted to be announcing our listing on AIM and the successful fundraise of £3 million. The funds will be used to support our strategy - to focus on discovery and the commercialisation of our projects through targeted exploration programmes with a view to bringing them up the value chain and ultimately to secure potential joint venture partner or acquisition interest.

Dealings will commence at 8:00am on 14 February 2023 under the TIDM "FMET" with a market capitalisation at the Placing Price of £8.725million.

View from Vox

Although still in their early stage projects, the successful listing gives Fulcrum the firepower to take what looks like an interesting asset base forward. The uranium deposit, in particular, could be a good way to gain exposure to the renaissance of nuclear energy as part of the green energy transition.

Notably, fellow Canadian miner Panther Metals (PALM) will retain a 20% interest in the newly floated company worth £1.745m at the Placing Price, having sold the Big Bear mineral claim to Fulcrum whilst retaining a 2% net smelter return royalty. The company said the project has outstanding potential and well deserves the injection of capital that Fulcrum are planning.