Lords Group (LORD ) announced solid revenue growth in a trading update for the 6 months ended 30 June (H1 2022).

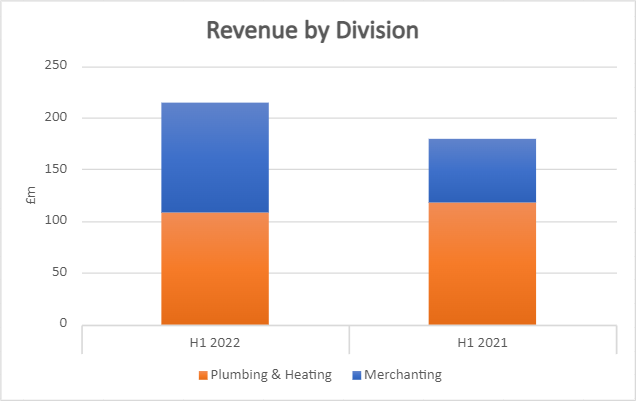

After a very strong showing in 2021, the building materials distributor announced today similarly robust performance in H1 2022. Revenue increased 19.9% YoY to £214.7m, compared to £179m in H1 2021, with adjusted EBITDA for the period to be £14m, a 33% increase from £10.5m in H1 2021.

By division, Merchanting saw robust demand with substantial 73.2% growth to £105.9m from £61.1m last year, as Lords continued to avail of its brand's now established position as a local market leader in premises across the UK.

Plumbing & Heating saw a small contraction to £108.7m from £117.9m in H1 2021. The company said it had taken action in H1 2022 to ensure profitability was upheld despite the industry-wide boiler component shortage, which they expect to abate in H2 2022.

Lords has completed 5 acquisitions since its IPO in July 2021, and the company reported all 5 performing in line with expectations today.

Lords summarised its H1 performance: "The Group continues to execute its strategy, through organic levers including product range extension, new site openings, and digital and operational leverage and in executing value added acquisitions."

Shanker Patel, CEO, further commented: "...I am also delighted with our strategic progress in the first half of 2022 and we have a substantial opportunity to grow the Group’s current < 1% market share through bringing in new customers, a greater share of customer wallet, product range extension, new geographies, digital capability and valued added acquisitions.

We have demonstrated that we are able to consistently grow our Group revenues and profitability as we deliver both our organic and inorganic growth strategies. Our size, reach and product range are ensuring the strength of our proposition continues to stand out in our markets despite ongoing macro-economic uncertainties."

View from Vox:

Lords has accomplished a lot in its first year of trading. Today saw a positive financial update with performance in line with market expectations for FY22, i.e. revenues of £435m, adjusted EBITDA of £26m, and adjusted pre-tax profit of £16m.

The strong momentum accumulated in H1 is being carried over to H2, and the company remains on track to deliver its strategic target of £500m revenues by 2024 and 7.5% EBITDA margin in the medium-term.

Lords' expansion strategy has also been successful so far, with the company's 5 synergistic acquisitions since IPO now very well integrated and delivering profits.

Similarly, its "product range extension" strategy has allowed it to expand offerings to existing customers while attracting new customers as well. In H1, Lords said it added new product ranges to support the decarbonisation of the UK housing stock, including heating controls, air source heat pumps, and underfloor heating within its P&H division.

In addition to acquisitions and new product development, Lords also expanded its footprint with new locations it identified as potentially offering a 20%+ ROI. These include a third location in Horsham for its George Lines specialist civil merchants brand; a tenth branch due to open in West Bromwich in Q3 for its Mr Central Heating P&H brand; and an integration of its Advanced Roofing Supplies acquisition, completed in Q1, into its Lords Builders Merchants Beaconsfield site, increasing returns at that location, the company said.

Overall, today's update demonstrated Lords is on track to reach its ambitious 2024 goal and whilst the shares have suffered along with the wider market in general and the retail sector in particular, the shares have already started to show early signs of recovery LORD in the last 5 days.

Half Yearly results are expected on 6 September 2022.

Follow News & Updates from Lords Group: