If I had been given a pound for every time I've heard or read one of the numerous stock market rules of thumb I probably wouldn’t need to worry very much about stock market rules of thumb – or indeed, the stock market full stop – such is the regularity with which they are trotted out.

If, on the other hand, I had tried to make money in the stock market by religiously following such heuristics, I would probably still be a very long way from the dream retirement most of us are investing for.

Indeed, whether it’s ‘running your winners’ or ‘not losing money by taking a profit’ – which seemingly contradict each other - or ‘selling in May and going away’, the evidence of their effectiveness is very much mixed. Many, including Sell in May, depend upon market timing – which is very difficult – and churning one’s portfolio over and over again. That, of course, would mean high trading costs, which maths rather than folklore tells us is the fastest way to erode your long-term returns.

We certainly don’t have to look too far back to see that selling in May and getting back into the market might not be worth the trouble, at least not any more. Having worked between 1970 and 2012 across most major indices, the strategy has hardly worked since.

According to research from JP Morgan staying invested from May to October would have beaten selling in May by between 0.8% and 13.9% in every year between 2010 and 2020 except one, 2011. Had you dumped your S&P 500 shares at the end of April 2021, you would have lost out on the pandemic’s May to November bounceback from the fastest bear market in history of over 20%.

And even though May was a horrible month on the markets this year, a strong performance since mid-June means major indices including the Nasdaq, S&P 500 Nikkei, Euronext and FTSE 100 are largely back where they were at the beginning. Turning to another rule of thumb, time in the market seems to have beaten timing the market this summer.

But assets don't all move in lock step – Sell in May might not have worked on some indices, but it has worked in others so far, notably the Aim All-share which is down 10.5% or the FTSE Small Cap, down 4.6%, and further afield Germany’s Dax down 4% or the Hang Seng index down 5.1%.

On an individual share basis, the disparity is even more noteworthy, with over 1000 London-listed territory in negative territory since 1 May, more than double the number in the green over the period. Many individual shareholders who sold in May won’t, in fact, be regretting it.

But the big question – and putting oversimplified stock market adages to one side for now – is whether the improved sentiment will spread across the market and sustain the summer rally.

The answer to that, and to assess whether what we’ve seen since mid-June is a classic bear market rally, remains complicated. US earnings season wasn’t as bad as some had expected, but there’s plenty to suggest that the real profit pain is yet to come for many companies dependent on squeezed consumers. As Neil Birrell, chief investment officer at asset manager Premier Milton Investors, recently put it, the consensus of analysts’ estimates “looks like they are in cloud cuckoo land.”

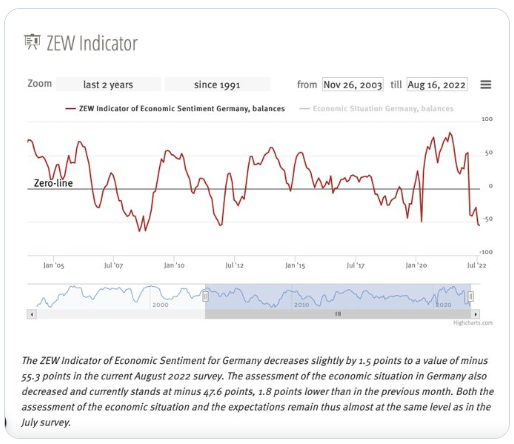

Supporting that view is the generally bad economic data coming from everywhere – a cooling UK housing market, a collapsing Chinese housing market, terrible US manufacturing data and plummeting economic sentiment in Germany to name but four examples.

That offers investors hope that the Fed will change course - as Swissquote analyst Ipek Ozkardeskaya put it this week, "the weak data again made its magic: revived the expectation that the Federal Reserve could not raise the rates at full speed, if the economy starts crumbling.”

But it is certainly still far too early to suggest that inflation – the cause of so much pain - has peaked. Falling energy prices may have meant the latest US CPI reading was lower than expected at 8.5%, against 9.1% the month before. But even if it seems to have reached a plateau, that doesn’t mean it’s going to fade quickly, with lots of other important components of the index still rising, not least shelter. You can hear a great explanation here.

That would suggest the idea that the Fed may take its foot off the pedal of rate rises is wishful thinking – getting back to the 2% target is its number one priority. And the same, of course, is true for other central banks, not least the Bank of England which is today having to digest the UK inflation figure hitting double digits for the first time this year, at 10.1%, and expected to top 13% by the year end.

All in all, risks abound, whether on the growth front as recession creeps up, or on the valuation front as interest rates rise. Selling in May could yet be vindicated this year.