Taking Stock on Friday 8th December 2023

This is one chart you need to keep an eye on

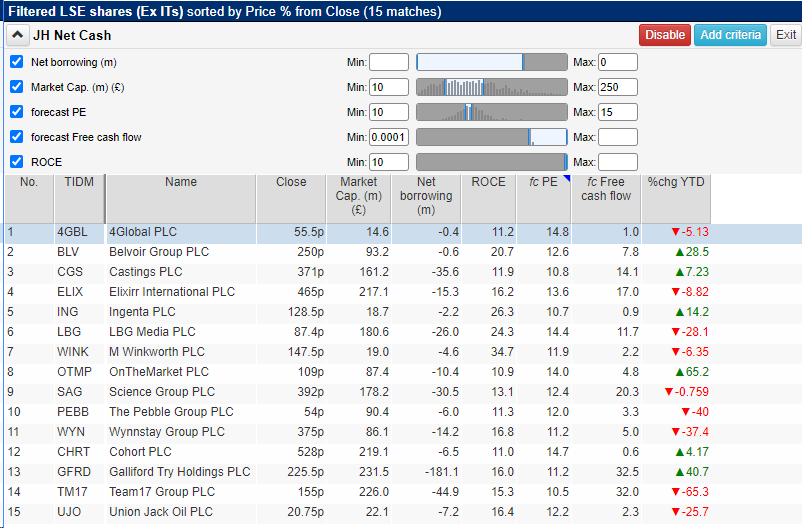

Friday's Screener: Net Cash

Companies Mentioned on today's, "Taking Stock":

07:45 Diageo #DGE

08:10 Burberry #BRBY

10:00 Focusrite #TUNE

10:10 & 19:15 Future Plc #FUTR

13:10 AstraZeneca #AZN

15:00 & 16:44 Belvoir #BLV

16:09 Motorpoint #MOTR

16:20 Vertu #VTU

18:20 Cohort #CHRT

19:00 LBG Media #LBG

20:00 Team17 #TM17

20:40 TinyBuild #TINY

21:20 Ingenta #ING

23:45 Pebble Group #PEBB

25:40 Rio Tinto #RIO

30:40 Eneraqua #ETP

33:30 Landore Resources #LND

34:05 Contango Holdings #CGO

34:35 eEnergy #EAAS

35:50 XP Factory #XPF

36:05 On The Beach #OTB

38:30 & 41:20 Vodafone #VOD

40:12 BT Group #BT.A

TOP BUSINESS STORIES

Average two-year mortgage rate falls below 6%

Mortgage rates on a typical two-year fixed deal have fallen below 6% for the first time since mid-June, according to Moneyfacts.

The financial information service said the average rate was now 5.99%.

Competition among providers has intensified as they face a battle to attract a small pot of new homeowners, and to maintain current custom.

They have been given added confidence as many analysts suggest the Bank of England's base rate has now peaked.

Rising energy stocks lift UK's FTSE 100 to near two-month highs

FTSE 100 gained 0.4%, hitting its highest level since Oct. 19, and the more domestically focussed FTSE 250 midcap index also rose by a similar margin.

Heavyweight energy stocks jumped 1.2%, after Saudi Arabia and Russia called for more OPEC+ members to join output cuts, driving up crude oil prices.

Both the FTSE 100 and the midcap index eye weekly gains, with travel and leisure set to be the best performing FTSE 350 sector this week and precious metal miners the worst.

Limiting gains, Anglo American (AAL.L) slipped 5.2% after the global miner said it was aiming to cut capital expenditure by $1.8 billion by 2026, citing weak demand for most metals it mines and a huge writedown on its British fertiliser project.

Focus will be on the crucial U.S. November nonfarm payrolls report, which is expected to show job growth in the world's biggest economy likely picked up in the previous month.

The upcoming week will see the U.S. Federal Reserve, the European Central Bank and the Bank of England announce their stance on monetary policy.