For the small caps space the question in recent months has not so much been share price levels, in general, quite painful, but the level of liquidity in the market. In particular, the amount of cash available for placings and IPOs. As far as the former are concerned, regular small cap investors should perhaps not be too concerned, as the less cash there is around, the bigger the discount on any given cash call.

But a lack of new IPOs, is rather more problematic, not only for investors, and the market, but the economy as a whole. Alas, the prevalence of high cost, over-regulation and massive red tape, may mean that for many private companies there is every incentive to remain private. This is before mentioning the new Corporation Tax rise from 19% to 25%. If you are an existing company deciding whether to boldly go on in the current challenging business environment, or, throw in the towel, this hike must have pushed many to the latter along with business rates et al.

Pricing Power

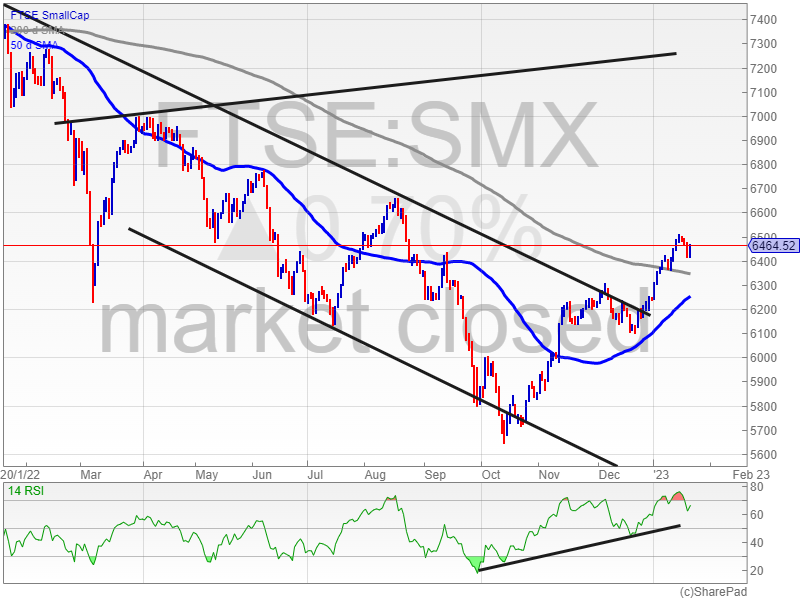

Although the FTSE 100 dipped during the week, at least we can say we are within spitting distance of all time highs. This may be a sell signal to some. However, the idea that corporates do have a degree of pricing power in an inflationary environment may be a point missed by some, given that it is easy to just think of rising prices as purely negative. For the small caps, we have had the index break above its 200 day moving average earlier this month, and so far it has stayed there. Given that the 200 day line is the line in the sand as far as deciding whether a market is in bull or bear mode, it will be key that we stay above this line. This is even though you would be hard pressed to find investors who say or even feel that small caps are in bull mode.

Kodal

In a week when there were perhaps fewer exciting stock highlights than one might have expected, it was Kodal Minerals (KOD) which genuinely blew the doors off. Even more interesting than the near 60% share price rise on the week, which should have perhaps been rather more, this was a situation where there were green flags in terms of buying into the story. For me, the stock being near 0.2p last month when I interviewed Bernard Aylward, the CEO, did stand out as a buy the bottom of the range opportunity. This was over and above how Bernard really comes across as an experienced guy in the field, and a gentleman. Such accolades are surprisingly rare in the small cap area, especially when one suspects, like elsewhere in life, being the nice guy enables you to be a winner. However, Aylward has his funding project for Bougouni, lithium is hot, and the shareholders de-risked. Even after the initial share price rise, a typically reticent London style so far, one can envisage 0.5p plus over the near term.

Rockfire

Rockfire (ROCK) did a mini-Kodal, as far as its latest announcement, which was released on Friday. The reason for this is just as Kodal has got OPM (other people’s money) to take it to the Promised Land, Rockfire’s JV with Sunshine Gold Ltd will see the latter fund the Plateau gold project’s exploration for three years. While shares of Rockfire did jump 9% on the day and 28% over the past couple of months, it could be the case that the appreciation of the company, and the re-rate has further to go. As recently as a year and a half ago the stock was 1.2p versus 0.19p, and last month the company unveiled massive sulphides at its Molaoi zinc/silver/lead/germanium deposit in Greece.

The Papers

One of the conundrums of the stock market that small cap listed companies have is how to get their message out, competing both against their peers, and the blue chips. The mainstream media will generally cover either the boring larger companies with zest, and only venture sub £100m when something goes wrong / bust, in which case the papers rejoice.

Alkemy / Harland & Wolff

A few of the tiddlers have made the grade in the recent past. Alkemy (ALK) made the BBC and others in the autumn when it got permission to build Europe's largest lithium hydroxide refinery in Teeside. More recently Harland & Wolff (HARL) hit the headlines as naval shipbuilding returned to Belfast. Nevertheless, unless you blow the lights out, it is still very much the case that smaller companies are “shadow banned” by the papers.

Orcadian

Indeed, it could be said that for a company that currently has a market cap of only £9.3m, Orcadian Energy’s (ORCA) CEO Steve Brown being featured in a Times article on Friday was quite a result. This centred around the madness of racing to Net Zero without having enough energy to go around, after pulling the plug on fossil fuels. Of course, post Ukraine there is something of a volte face required for those who wanted to mothball the North Sea and other national resources. Now we know that we need energy security, and supporting the likes of Steve Brown, at Orcadian would be the way to do so, especially given his company’s current paltry valuation.

The Age of Communication

So, what is the answer for those CEOs who want to get their message out? Those small companies who are judged to be on the case too aggressively are far as promotion are then said to be “pumping”. Of course, if “pumping” worked every company would eventually end up in the FTSE 100, and they clearly do not. It is quite right that investors can decide whether they are being sold a pup or not. Ironically, I would say that although it may be the more spivvy companies that stick in our minds as far as crash and burn situations, the majority of companies keep themselves under the radar, and overly so. Indeed, the challenge is to find them, even in an age of multiple communication sources.

EDX Medical

I was reminded of a couple of such situations this week. The first is EDX Medical Group (EDX) which arrived to Aquis as a result of a reverse takeover in the autumn. The key points to remember here with regard to the diagnostics group is that already in 2023, we have seen a decent bump to the upside for the life sciences space. Factors such as Artificial Intelligence to sift through data, and the persistence of strong strains of flu and coronavirus, have all underlined the value in this space after 2022’s declines. Popular shares such as Avacta (AVCT), Poolbeg (POLB), Genedrive (GDR) and Hvivo (HVO) have all made advances. As far as EDX itself is concerned, the presence of Professor Sir Christopher Evans, a serial entrepreneur in the space, and the group’s Chief Scientific Officer. The current £10m market cap appears pretty stingy given this pedigree.

All Things Considered

Another company which is off the radar, which perhaps should not be is All Things Considered Group (ATC). This is an independent music company involved in talent management. Back in September the company announced interim results which revealed revenue increased 19% to £6.0m (H1 2021: £5.0m) and gross profit rose to £2.6m (H1 2021: loss of £0.9m). The shares have fallen to 100p from 155p last summer. Again, this appears too harsh if the group is still making progress and after the swing in the fundamentals. Indeed, this just seems another of the many situations where cash strapped investors in the small cap space are throwing out the baby with the bath water.