Union Jack Oil plc (AIM: UJO) which holds a 27.5% interest in the Wressle oilfield, confirms that the operator, Egdon Resources , has renewed its economic model and has demonstrated the project has a cash break-even oil price estimated at $17.62 per barrel.

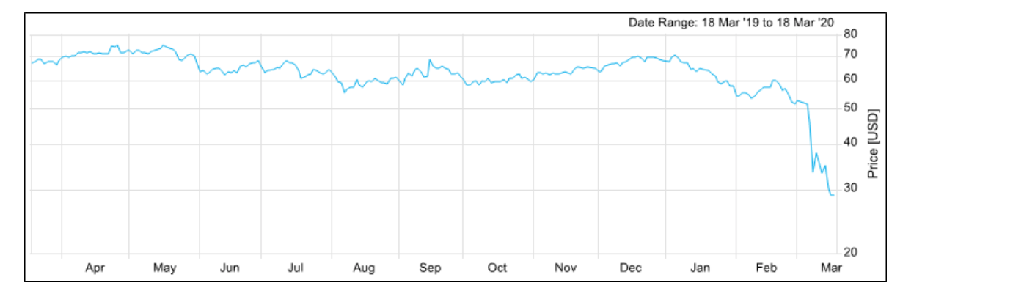

This is welcome news for investors given the recent collapse in crude Brent Oil prices which have tumbled from$60 per barrel at the beginning for the current year to less than $56 per barrel today.

The forward plan for the Wressle oilfield located in North Lincolnshire licenses PEDL180 and PEDL182 where gross oil production is anticipated to be circa 500 barrels per day, has now been updated with the following key stages:

-

Discharging the planning conditions, finalising detailed designs, tendering and procurement of materials, equipment and services and finalising all HSE documentation and procedures

-

Installation of the ground water monitoring boreholes and establishment of baseline conditions through monitoring

-

Reconfiguration of the site

-

Installation and commissioning of surface facilities

-

Sub-surface operations

-

Commencement of production

Progress to date has concentrated on the enabling works highlighted in point 1 above. The initial work on site will be the installation of the groundwater monitoring boreholes with the main site operations occurring in the last months of the work stream. On current plans, first oil is envisaged during H2 2020.

Importantly, with in excess of £6.2 million in cash and no debt, Union Jack is funded for all testing and drilling commitments for 2020.

David Bramhill, Executive Chairman of Union Jack Oil plc commented: "Economic modelling demonstrates that the Wressle oilfield development is robustly economic at current oil prices with a cash break-even oil price estimate of $17.62 per barrel. The Wressle oilfield remains one of our more advanced development projects within our business, with an expectation of first oil and associated cash flow in the second half of 2020.

"Progress on our other key projects, at West Newton and Biscathorpe, continues apace. We look forward to providing further updates on these two additional significant projects in our portfolio in the near future. Importantly, with in excess of £6.2 million in cash and no debt, Union Jack is funded for all testing and drilling commitments for 2020."

Shares in Union Jack Oil are currently trading up 6% in early trading on the back of this positive news.