The signs of economic trouble ahead have been there for some time now, but with the distraction of long-missed summer holidays in the rear-view mirror for many, households and investors are starting to wake up to the coming winter of discontent.

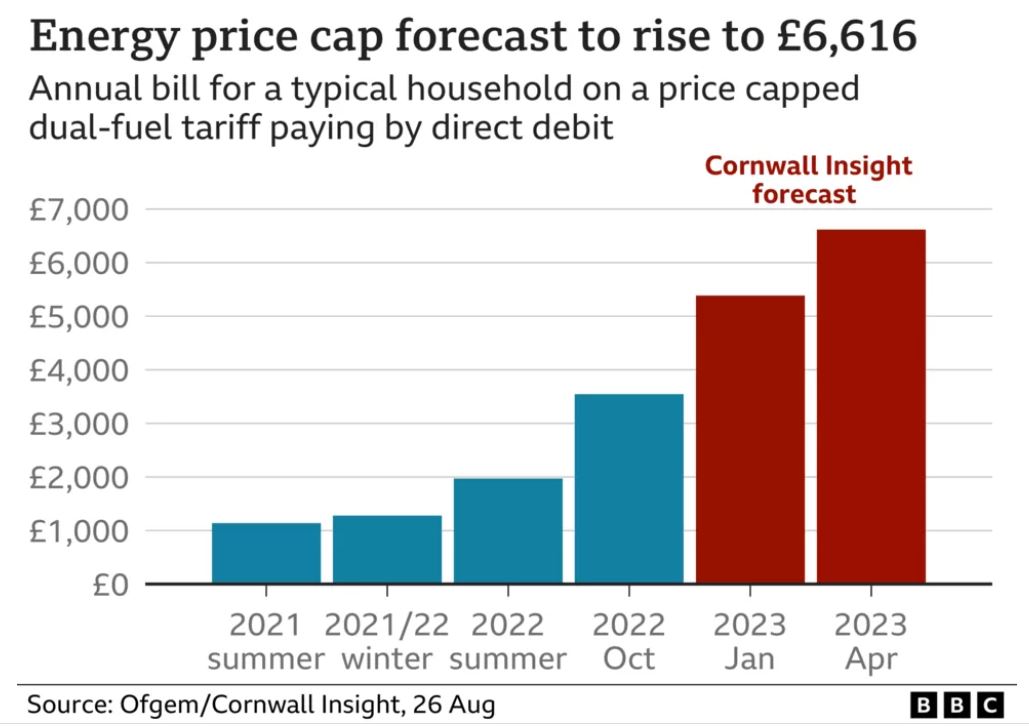

The main concern is, of course, the looming rise in household bills as the energy price cap is increased again in October. Following the 54% increase in April to £1,971, Ofgem increased the cap by another 80% today, to £3,549 a year. EDF managing director Philippe Commaret has warned that half of UK households face fuel poverty in January as a result.

That’s leading economists to further raise their inflation forecasts, with analysts at Citi grabbing headlines this week with their prediction that CPI could peak at 18.6% inflation by the end of January, far higher than the Bank of England’s current prediction that inflation will peak at 13%.

If Citi’s prediction comes true, it will be the highest level since 1976 when inflation hit nearly 25%, and according to the bank’s economist would force the Bank of England to raise interest rates to 7%.

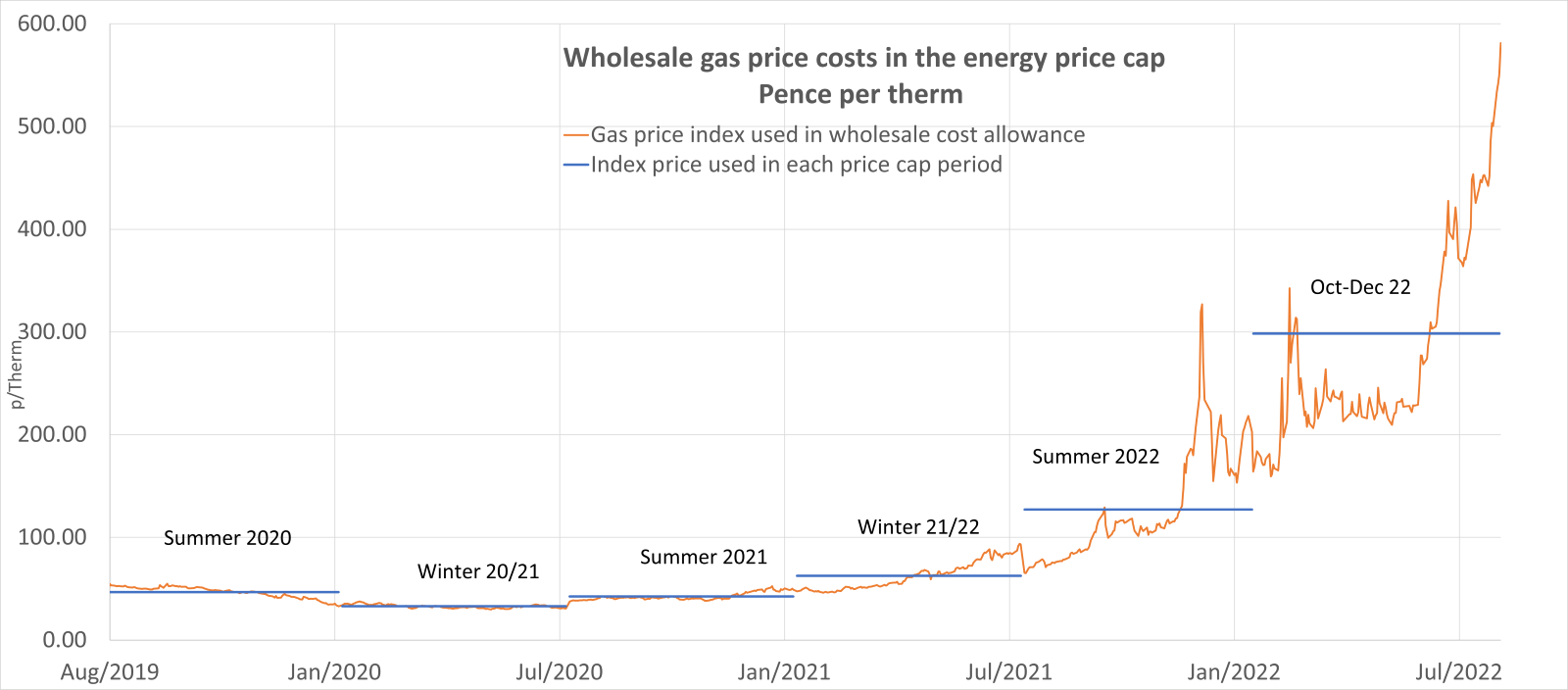

Citi’s extreme forecast has been dismissed by some as alarmist. But given that the trajectory of inflation so far has already caught so many by surprise, I wouldn’t be in such a hurry to discount Citi’s view, especially as it’s based on the currently very possible prospect that the still surging gas price could see the cap double again as we head into 2023. Be prepared for the worst and hope for the best as it were.

That, I would suggest, should be the mantra for any investor right now. No one knows for sure what’s going to happen next, bet there’s little to suggest the cost-of-living crisis is likely to ease any time soon, and it seems fanciful to think that this won’t start to show up more fully in the next round of corporate earnings.

That process has, in fact, already begun. According to research from EY, the number of profit warnings in the first half of the year rose by two-thirds to 136, of which more than half came from consumer facing sectors. Since then, there have been more, including Joules. Made.com and Angling Direct, and a huge warning from ad group S4 Capital.

But pressure on consumer-spending is only the canary in the coalmine because the same pressures afflicting households are hitting businesses, too. According to EY’s research, 58% of companies cited rising costs, with another 19% of warning related to labour-market issues.

A new survey from the Confederation of British Industry shows that 69% of businesses expect to be hit by higher energy costs, and without help – and with no business energy cap to minimise the pain - many could tip into financial distress. According to the Federation of Small Businesses, business have suffered a 424% rise in gas costs and 349% increase in electricity since February 2021, and many are now being asked for upfront payment from suppliers.

Source: Ofgem

What that help might look like won’t be clear until the conclusion of the Conservative leadership on 5 September. But their election promises so far don’t offer much hope that they’ll find a solution, especially as the idea of raising additional taxes on those companies that are benefiting from rising energy prices seems anathema to the Tories, meaning whatever support they offer will need to be picked up by higher taxes on everyone else in future.

I’m still unconvinced that public pressure won’t force our new PM’s hand towards some form of super-tax at some point - it is a very real risk that investors in the hydrocarbon industry need to be mindful of, along with the prospect of a serious, demand-destroying global slowdown as extreme price rises force businesses to shut up shop altogether.

An alternative – and less politically risky - energy trade could in fact be to look for those companies that rather than selling energy are helping households and companies use less of it. Last week saw updates from two such companies, Kinovo (KINO) and Sabien Technology (SNT) , but there are many more trading on London’s markets, specialising in everything from insulation to smart metering.

Given the scale of the current price increases, such solutions can only limit rather than mitigate the current pain entirely. But the energy crisis has awoken more interest in the economic importance of more frugal energy use in a way that Net Zero plans have not, and it’s hard to see companies returning to wasteful practices once it abates. If there is one good thing to come out of the crisis it is that green tech is here to stay – and Aim is a happy hunting ground for those companies developing it.