If you find this podcast useful please give it a rating and review on iTunes by clicking here

Vox Screens Stocks: John & Justin pick a stock from a Ben Graham's "net-nets" screener

Net-net is a deep value investing technique developed by legendary investor Benjamin Graham, in which a company's stock is valued based solely on its net current assets per share (NCAVPS).

Current assets include cash and other assets that are likely to be turned into cash over the next twelve months, including receivables - money owed by customers - and inventores. To calculate NCAVPS, we deduct a company's total liabilities from this figure and divide by the number of shares in issue.

Ben Graham believes that a company's ability to generate cash from its current assets was one of the truest measures of its value - and that if a company was trading below the value of its current assets, longer term assets were essentially in the price for free.

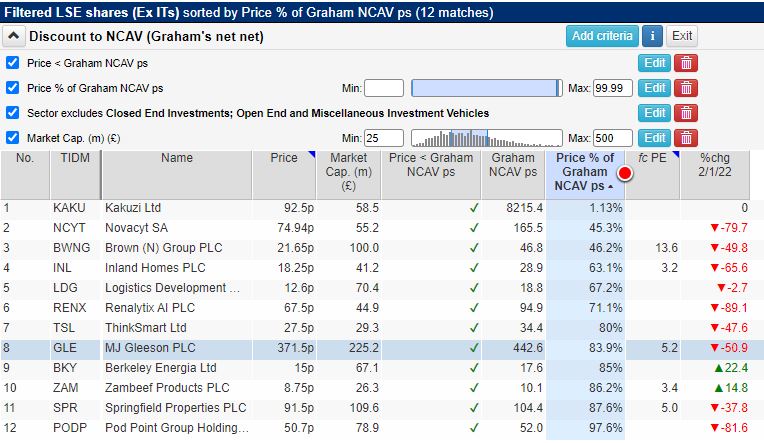

He calculated that the best returns would come from companies trading at two thirds or less of the value of their NCAVPS, but this screen is simply looking at companies trading at any discount to the value of current assets.

Here are the full screen results, compiled using SharePad:

John & Justin's Pick is: MJ Gleeson

Although house prices have continued to rise over the past year, concerns are mounting that rising interest rates and the cost of living crisis could usher in a period of weakness for the UK housing market. So, while the UK's listed housebuilders have continued to deliver decent figures, their shares have sold off heavily in anticipation of trouble ahead.

However, that has left them looking extremely cheap, as reflected in the three builders in the screen results. And on a PE basis, shares across the sector have derated into single figures, reflecting the possibility that demand could falter more than the builders currently expect.

But sector constituents aren't financially stretched - debt levels across the sector are low, and the build cost inflation that has dogged the sector this year is abating. Meanwhile, the imbalance between housing supply and demand hasn't gone away - there simply aren't enough houses in the UK, especially for increasingly stretched first time buyers, a major political problem that is likely to be a key focus of Rishi Sunak's new government.

With affordability likely to be a key issue for the sector, MJ Gleeson looks the best positioned housebuilder in the sector. It operates two businesses: Gleeson Homes which builds low-cost homes in the North of England and Midlands - which sell houses for an average price of £167,300 - and Gleeson Land which promotes land through the planning system for residential development in the South of the country.