Taking Stock on Tuesday 17th October 2023

Taking Stock: Is a look at today's top business news & investment views plus we cover the winners, losers, the most read company news & the most followed. Today this includes:

Download the FREE Vox Markets app and receive RNS's via notification, by clicking the link below:

https://www.voxmarkets.co.uk/app

What's been your biggest Winner? What lessons did you learn from it?

TOP BUSINESS STORIES

UK regular pay growth slows for first time since January

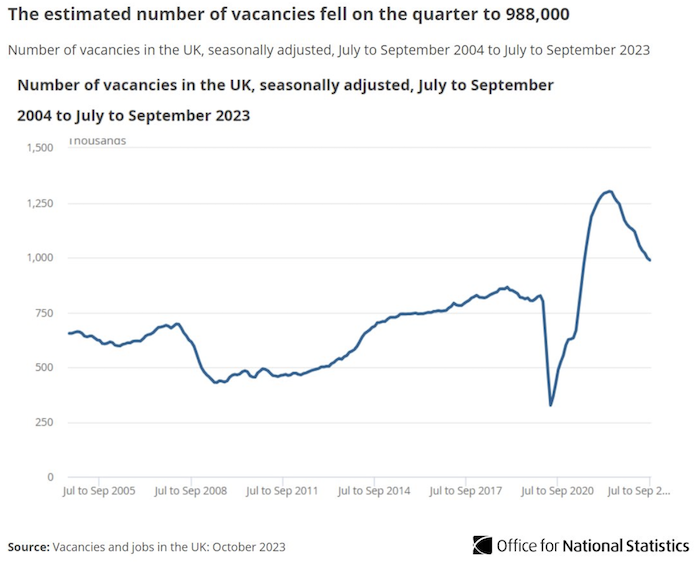

Growth in British workers' regular pay - which is being watched closely by the Bank of England - slowed from a previous record high and job vacancies also declined, official figures showed on Tuesday, in a sign that the labour market is losing momentum.

British average earnings, excluding bonuses, were 7.8% higher than a year earlier during the three months to August, down from an upwardly revised 7.9% in the three months to July, the first such fall since January.

"While wage growth is still much too strong for the Bank of England's liking, there's nothing in the latest data that's likely to push the committee into a rate hike at the November meeting," ING economist James Smith said.

The number of job vacancies in the UK continued to fall, dropping by 43,000 to 988,000 between July and September.

Real estate companies had the sharpest fall in available jobs compared to other industries, with vacancies plunging by almost 30% compared to the previous three months.

"Cooling labour market conditions appeared to start feeding through into an easing in wage growth in August," said Ashley Webb, UK economist at the research firm. "That supports our view that interest rates have peaked at 5.25%.

As inflation eases and employers grapple with the impact of higher interest rates, economists expect wage rises to slow.

Food producers lower prices at fastest rate for three years

Prices charged by food and drink manufacturers fell at the fastest rate in more than three years in September, raising the prospect that inflation is set to ease significantly in the coming months.

The latest Lloyds Bank UK Sector Tracker showed the sector posted a reading of 48.8 on the measure of output charges, down from 50.5 in August. It is the lowest reading since February 2020 (46).

A reading above 50 indicates an increase, while below shows a fall. Of the 14 sectors monitored by the tracker, food and drink was the only sector to record a decrease in output charges.