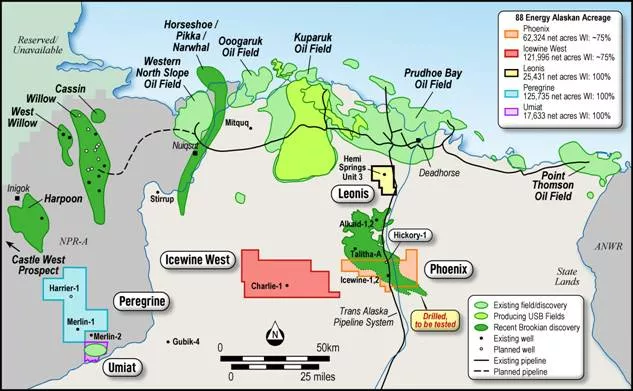

88 Energy (88E) , an Alaska-focused hydrocarbon explorer, announced a maiden prospective resource estimate for its Project Leonis acreage on Alaska's North Slope.

88 Energy reported a total estimated net mean prospective resource of 381 million barrels (MMbbls) of oil, recoverable from the Upper Schrader Bluff (USB) formation. The estimate ranges from an unrisked net of 3U (high) of 671 MMbbls, 2U (best) of 338 MMbbls, to 1U (low) of 167 MMbbls.

Additionally, 88E announced planning and permitting for the newly named Tiri-1 exploration well, designed to test the Tiri prospect in the USB formation. The Tiri prospect has shown exceptional porosity, averaging 30% over the 175ft of interpreted pay. 88E is in talks with potential farm-out partners to secure funding ahead of drilling.

Ashley Gilbert, Managing Director of 88E, commenting: "Following the recent success at Project Phoenix we are pleased to announce the completion of a maiden Prospective Resource estimate at Project Leonis. Being strategically located on the North Slope of Alaska, with TAPS running through the acreage and Deadhorse just six miles to the North, Project Leonis represents a significant resource and development opportunity. We have commenced permitting and planning processes for the Tiri-1 exploration well ahead of a future potential drilling event, to target the USB zone."

View from Vox

More good news from 88 Energy's North Alaskan portfolio. Following the company's successful flowtest of the Hickory-1 well at adjacent Project Phoenix, 88E has now announced an encouraging maiden resource estimate for Project Leonis. 88E acquired Leonis in April 2023 with a 10-year lease, and has a 100% WI in the project with a 16.7% royalty. The asset has been estimated to contain 381 MMbbls, with upside of 671 MMbbls. It is advantageously located next to existing infrastructure, with the Trans-Alaska Pipeline System (TAPS) running through it.

The USB formation within the Leonis acreage has already been proven by nearby producing Polaris, Orion, and West Sak oil fields to the northwest. These adjacent fields have helped calibrate the Leonis estimate, which was derived from extensive 3D and 2D seismic data and logs from the Hemi Springs Unit-3 and Hailstorm-1 wells.

The maiden estimate derisks and confirms Leonis as a significant exploration opportunity, with efforts already underway to drill the Tiri-1 exploration well. To this end, 88E has engaged 3rd parties for funding. Given the USB reservoir's rich resource and 88E's 100% WI in Leonis, there is significant potential to secure a proportionate carry on any future well.

88E's Alaskan strategy is now firmly focused on its two assets - Project Leonis and Project Phoenix. Following Hickory-1 successful flowtest, 88E is aiming to drill horizontal production wells at Project Phoenix and generate cashflow from the asset within the next 24 months. Phoenix is targeting 647 mmboe of prospective oil resources. With Leonis' concurrent development, investors have much to look forward to in the next 6-24 months.

Follow News & Updates from 88 Energy: