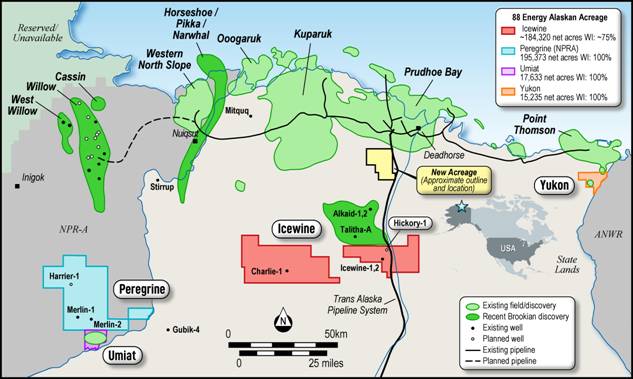

88 Energy (88E ), an Alaska-focused explorer, was announced as the highest bidder on 10 leases covering c. 25,600 contiguous acres immediately south of Prudhoe Bay on the North Slope of Alaska.

The acreage, now referred to as Project Leonis, is already covered by existing Storms 3D seismic data and contains the historical exploration well Hemi Springs Unit #3, drilled by ARCO in 1985. Project Leonis is directly adjacent to the Trans-Alaska Pipeline system and the Dalton Highway.

88 Energy said a review of the old Hemi Springs Unit #3 well indicated over 200 ft of logged net pay in the Upper Schrader Bluff (USB) reservoir, with good porosity and oil shows evident over the interval. An initial internal interpolation of the Storm 3D data indicated a prospect at the USB reservoir bound by faults on 3 sides.

Managing Director, Ashley Gilbert, commented:

"Award of the new acreage demonstrates 88E's commitment to continued exploration on the North Slope and presents as an attractive exploration proposition. The acreage benefits from a historical well, which indicated oil shows and calculated pay in the USB zone of interest, and an existing 3D data suite. There is much work to do to understand the regional setting and faulting that defines the potential exploration target before deciding on any future work program."

View from Vox

88 Energy's successful exploration of Alaska's North Slope continues with Project Leonis. The company's existing Project Icewine, to the South of Leonis, currently shows a prospective resource of 1.03 Bnbbls with the inaugural Hickory-1 well planned for 1H 2023.

88 Energy existing acreage and new acreage awarded

Project Leonis promises to build on Icewine's success on the North Slope. Leonis benefits from historical well Hemi Springs Unit #3 that indicated over 200 ft of low resistivity bypassed log pay within the Upper Schrader Bluff (USB) reservoir, with good porosity and oil shows evident over that interval. The USB reservoir has already been successfully developed at the nearby Orion, Polaris, West Sak and Milne Point oil fields.

Moreover, 88 Energy said an initial review of existing Storms 3D seismic data showed that the prospect appeared to be bound by faults on 3 sides, potentially serving as the trapping mechanism for the deposit. Pending further development work and analysis, investors should expect 88 Energy to issue an update on a potential target, exploration program, and timeline for Leonis.

Leonis is also ideally located directly adjacent to the Trans-Alaska pipeline system and the Dalton Highway, enhancing potential future development commercialisation. Leonis leases still remain subject to an adjudication process, regulatory approvals, and a formal award, expected in 1H 2023.

While 88 Energy's main focus remains in Alaska, the company also acquired in February a 73% interest in production assets located in the Texas Permian Basin (Project Longhorn) through its 75% investment in Bighorn Energy. Bighorn has now added A$22.1m to 88 Energy's net assets. Longhorn wells were delivering ~450 BOE/day gross (~70% oil) at the end of September 2022, representing an overall output increase of ~60% since completion of the acquisition in February.

In August, 88 Energy raised A$14.9m (£8.32m) to finance long lead items required for drilling at Icewine East, as well as strengthen the company's balance sheet and provide capital to finance new ventures. The new capital will ensure the company remains well-funded for the next 12 months.

Follow News & Updates from 88 Energy: