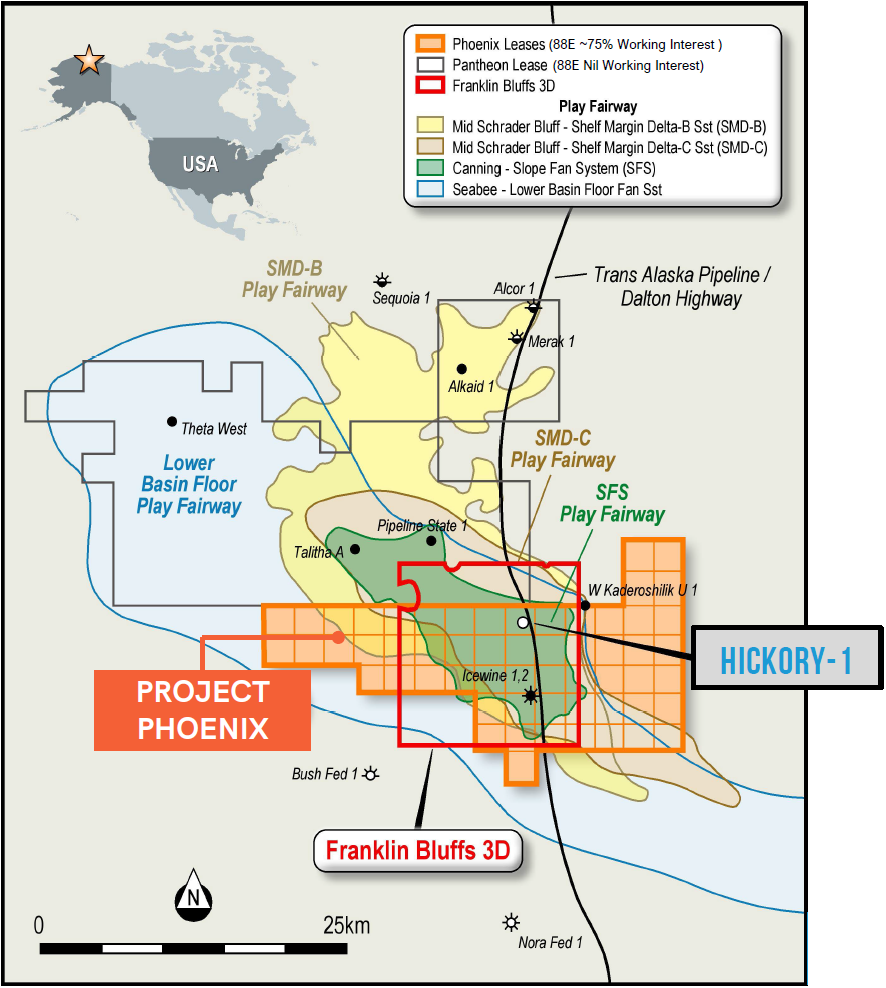

88 Energy (88E) , an Alaska-focused hydrocarbon explorer, updated markets on its Hickory-1 well, part of 88 Energy's Project Phoenix (formerly known as Icewine East) on Alaska's North Slope.

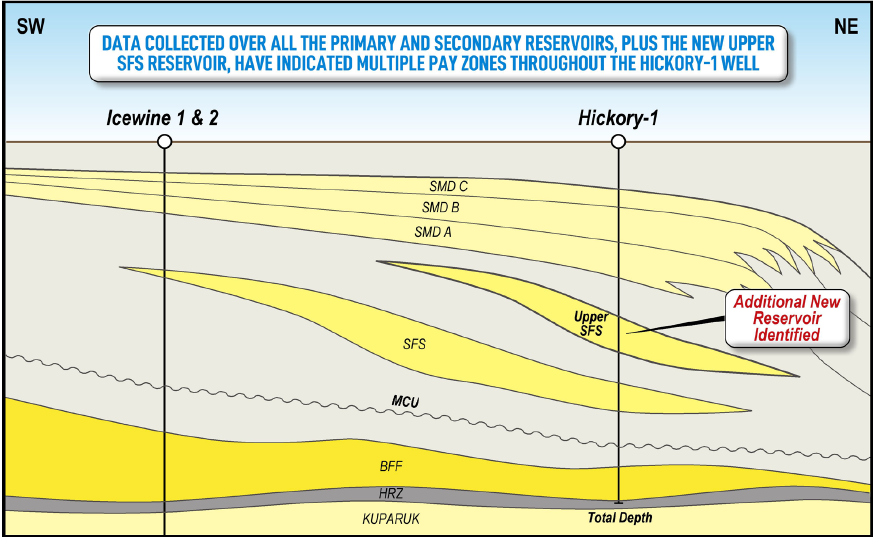

Initial results from Hickory-1 indicated intersection of all primary and secondary targets (see figure below). Additionally, drilling uncovered a new Upper SFS reservoir, not previously intersected. 88 Energy has commenced work to define the lateral extents of the new prospect and its resource potential.

88 Energy said its pre-drill expectations on reservoir quality and thickness were "met or exceeded". A post-well analysis of cores and wireline data is set to commence, including assessment and classification of resources across all reservoirs, including maiden resource estimates for the Upper SFS reservoir.

The company will update Project Phoenix's prospective resource estimates post-drilling of Hickory-1, expected to be completed in the second half of 2023.

Hickory-1 will then be cased and suspended in preparation for carrying out a flow test programme in the 2023/2024 winter season. 88 Energy said preliminary planning had already begun, including identification of suitable rigs.

View from Vox

Initial results from Hickory-1 are encouraging. 88 Energy confirmed the presence of multiple hydrocarbon bearing pay zones across all pre-drill targets, as well as the identification of a new Upper SFS reservoir. 88 Energy said its pre-drill expectations were "met or exceeded" on reservoir quality, with higher than expected porosity and thickness.

Estimated net pay calculated from wireline data was approx. 450 ft over all pay zones, and gross pay was estimated to be over 2,000 ft. Average total porosity across all pay zones was 9-12% and key zones identified for potential testing in the Upper and Lower SFS had 11-16% total porosity.

88 Energy's wireline programme has successfully validated data necessary to design and plan a targeted flow test of Hickory-1. Flow testing is expected in the 2023/24 winter operational season in Alaska.

Other wells in the immediate vicinity to the north have flowed and recovered light oil to surface from all the SMD, SFS and BFF reservoirs, which should derisk subsequent development.

While 88 Energy's main focus remains in Alaska, the company also acquired in February 2022 a 73% interest in production assets located in the Texas Permian Basin (Project Longhorn) through its 75% investment in Bighorn Energy. Bighorn has now added A$22.1m to 88 Energy's net assets. Longhorn wells were delivering ~450 BOE/day gross (~70% oil) at the end of September 2022, representing an overall output increase of ~60% since completion of the acquisition in February 2022.

Follow News & Updates from 88 Energy: