88 Energy (88E ), an Alaska-focused explorer, said it has executed a rig contract with Nordic-Callista for drilling of the Hickory-1 exploration well. Hickory-1 is part of 88 Energy's Project Phoenix (formerly known as Icewine East) on Alaska's North Slope.

Hickory-1 was designed to appraise 6 key reservoir targets and 647 million barrels of oil. 88 Energy said permitting and planning remain on track for scheduled spud in late February or early March 2023.

88 Energy also announced it has renamed Icewine East to Project Phoenix to reflect the "new focus on proven oil-bearing conventional reservoirs". Project Phoenix's unit application is open for public comment until 31 December 2022.

View from Vox

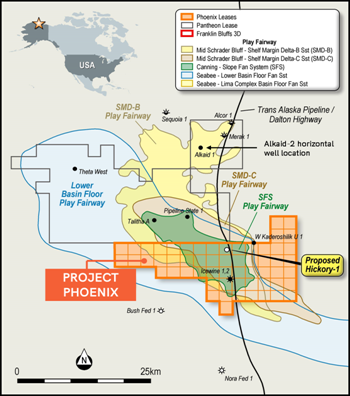

88 Energy's successful exploration of Alaska's North Slope continues, with Hickory-1 firmly on track for spud in 1Q 2023. The 82,846-acre Project Phoenix (formerly known as Icewine East) is located on the central North Slope of Alaska and holds an estimated conventional total of 647MMbbl of prospective oil resources, independently assessed in 3Q 2022.

The acreage has been significantly de-risked by recent Pantheon drilling and flowtests on their adjacent acreage, as well as data from the Icewine-1 well logs, FB3D seismic data, and AVO analysis.

Hickory-1's location was selected adjacent to the Trans Alaskan Oil Pipeline and Dalton Highway, with excellent infrastructure connections. The exploration well will drill to a permitted depth of 12,500 ft, and intersect and test potential oil volumes noted across all mapped play fairways, in particular the SMD, SFS, and BFF reservoirs.

Last month, 88 Energy further expanded its Alaskan portfolio with the 25,600-acre Project Leonis, also located adjacent to the Trans-Alaska pipeline system and Dalton Highway. The acreage is covered by existing Storms 3D seismic data, showing the oil resource trapped by faults on 3 sides, and contains the historical exploration well Hemi Springs Unit #3, drilled by ARCO in 1985.

Hemi Springs Unit #3 indicated 200 ft of low resistivity bypassed log pay within the Upper Schrader Bluff (USB) reservoir, with good porosity and oil shows evident over that interval. The USB reservoir has already been successfully developed at the nearby Orion, Polaris, West Sak, and Milne Point oil fields.

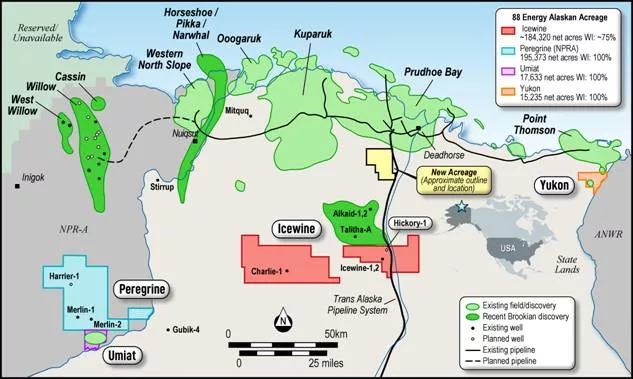

88 Energy's assets on Alaska's North Slope. Note that "New Acreage" refers to Project Leonis, and the eastern segment of Icewine has now been renamed to Project Phoenix.

Project Phoenix, formerly known as Icewine East

While 88 Energy's main focus remains in Alaska, the company also acquired in February a 73% interest in production assets located in the Texas Permian Basin (Project Longhorn) through its 75% investment in Bighorn Energy. Bighorn has now added A$22.1m to 88 Energy's net assets. Longhorn wells were delivering ~450 BOE/day gross (~70% oil) at the end of September 2022, representing an overall output increase of ~60% since completion of the acquisition in February.

In August, 88 Energy raised A$14.9m (£8.32m) to finance long lead items required for drilling at Phoenix, as well as strengthen the company's balance sheet and provide capital to finance new ventures. The new capital will ensure the company remains well-funded until 2H 2023.

88E shares were up 5% today on the news.

Follow News & Updates from 88 Energy: