Shares in 88 Energy (88E) soared on Monday after the group raised $6.48 million at a 225% premium to a prior placing as it continues to advance the Merlin-1 exploration well in Alaska.

The Alaskan-focused explorer said it has entered into a share subscription deal with ELKO International, one of the major contractors for the current drilling operations at Merlin-1.

The group said ELKO is buying 360 million new shares at a price of $0.018 cents a share, a price marked at a 225% premium to a prior placing undertaken by 88E back in February 2021.

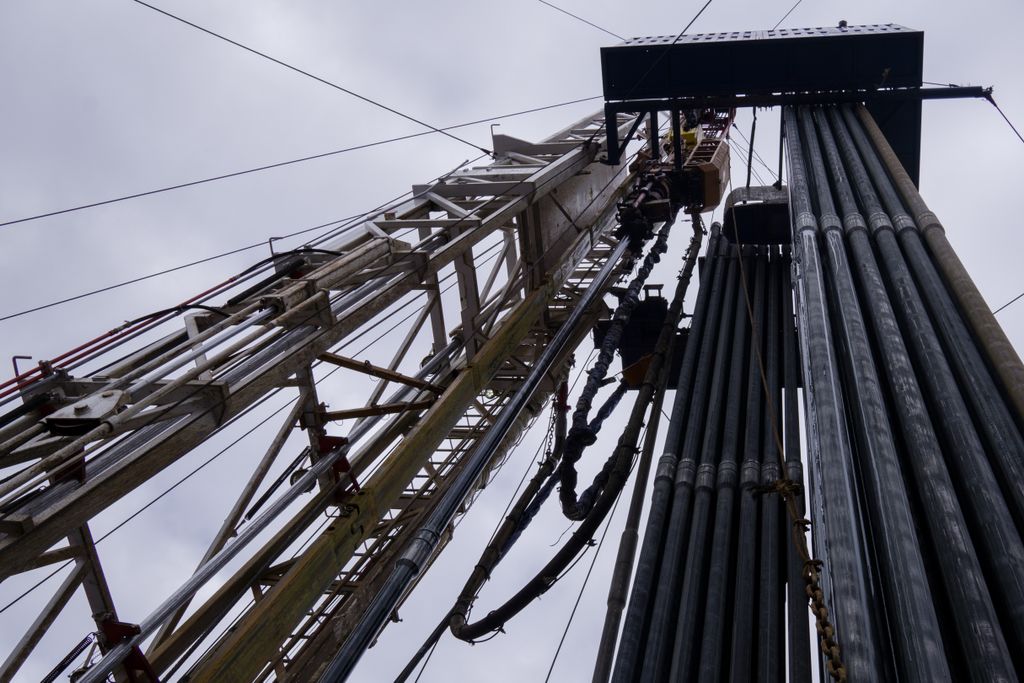

The drilling programme at Merlin-1 forms part of the Alaskan-based explorer’s Project Peregrine which holds nearly 200,000 contiguous acres on the North Slope of Alaska.

The Company holds a 100% working interest in the Peregrine project that will reduce to a 50% interest post the completion of funding as part of a recent farm-in, whereby 88E is carried on the first US$10m (of an estimated US$12.6m total cost) for the Merlin-1 well.

Today’s fundraising occurs as Merlin-1 is drilled down towards its primary Nanushuk targets. To date, the Merlin-1 surface hole has been successfully drilled to 1,512 feet, as planned.

88E said surface casing has now been cemented and the blowout preventer system tested. A formation integrity test (FIT) was successfully undertaken and the rig is now drilling ahead to a depth of 6,000 feet in the production hole where the primary Nanushuk targets are located.

It said logging while drilling and mud logging, which is expected to take three to five days, will provide initial indications as to the prospectivity of the well during this part of the operation.

88E said a sophisticated wireline logging suite will then be run, including sidewall cores and downhole sampling, for around five to seven days. If the results from the wireline logging are encouraging, then the well will be completed with casing and a flow test conducted, it noted.

Commenting on today’s raise, Managing Director, Dave Wall, stated that, "The endorsement of the project by ELKO as we enter the critical phase of the drilling is encouraging and will serve to fund the Company's share of the recently announced cost overruns.”

Success at Merlin-1 could yield over 300 million barrels net to 88E and open up further prospectivity at Project Peregrine, in addition to unlocking the substantial proven resource at the adjacent Umiat oil field, which is 100% owned by 88 Energy,” Wall told investors.

He added, “Metrics for discovered oil were demonstrated by the late 2017 Oil Search transaction where US$3.10 per barrel was paid, in a low oil price environment, for an interest in the Pikka Field, which is a discovery in the Nanushuk Formation.”

Harrier-1, which is to target gross mean prospective resource of 417 million barrels and will cost c. US$7m, is intended to commence immediately following completion of operations at Merlin-1 and will be subject to results from Merlin-1, schedule and permit approvals.

Shares in 88 Energy have almost tripled in value since the beginning of 2021. The recent news that 88E had commenced drilling at the Merlin-1 well marks “an exciting and pivotal time” for the Company and its shareholders, commented Managing Director, Dave Wall.

Drilling at the Merlin-1 exploration well follows the Crude Oil WTI Index reaching its highest level since October 2018 this month, with the commodity reaching highs of $67.98 per barrel.

Successful drilling would underpin a company developing a solid project for its shareholders, with the proven resource at the recently acquired Umiat Oil Field “adding substantial value."

Reason to Follow 88E

Project Portfolio Across Alaska’s North Slope

The Alaskan explorer completed its acquisition of XCD Energy, which holds a 100% Working Interest in the highly prospective Alaskan North Slope, back in August 2020. The merged entity has formed a diversified portfolio of exploration projects on Alaska’s North Slope.

The combined company will have increased scale, market presence along with higher funding capability and trading liquidity across the ASX and London AIM exchanges.

The three key projects include Project Icewine, Yukon leases and Project Peregrine with the assets at various stages of development, the company previously outlined this summer.

In late 2020, 88E was also formally re-assigned the "Area A" leases at Project Icewine meaning its working interest in around 40% of the project has increased from 30% to 75%.

For more news and updates on 88 Energy: