AfriTin (ATM ), an Africa-focused mining company, updated markets on its lithium and tantalum drilling programme at its flagship Uis Mine in Namibia.

AfriTin's 50-hole drilling programme at Uis aims to increase the confidence of the existing lithium and tantalum mineral resource estimates over the deposit. The programme comprises of 29 diamond and 21 reverse circulation (RC) drill holes.

All 50 drill holes have now been completed and are being processed. The results of 25 previous holes were announced on 8 June 2022, 20 July 2022, 10 October 2022, and 22 November 2022. Today, AfriTin reported assay results of the next 5 drill holes.

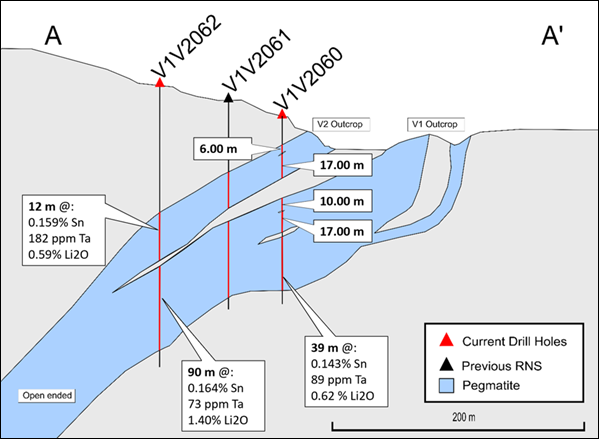

AfriTin reported pegmatite intersections in all holes at depths and apparent widths predicted by its geological model. Significant pegmatite intersections include:

- 90 m at 0.164% Sn, 73 ppm Ta, and 1.40% Li2O from 134 m to 224 m; and 12 m at 0.159% Sn, 182 ppm Ta, and 0.59% Li2O from 115 m to 127 m for drill hole V1V2062

- 96 m at 0.150% Sn, 68 ppm Ta, and 0.72% Li2O from 142 m to 238 m for hole V1V2039

- 71 m at 0.166% Sn, 81 ppm Ta, and 1.05% Li2O from 157 m to 228 m; and 10 m at 0.091% Sn, 323 ppm Ta and 0.41% Li2O from 139 m to 149 m for hole V1V2065

Notable intersections of lithium mineralisation within the pegmatite intersections include:

- 76 m at 1.56% Li2O from 136 m to 212 m for drill hole V1V2062

- 26 m at 1.00% Li2O from 180 m to 206 m for drill hole V1V2039

- 25 m at 1.65% Li2O from 193 m to 218 m for drill hole V1V2065

AfriTin will provide the results of the outstanding 20 drill holes once received.

View from Vox

The drill results announced by AfriTin today contain the highest average lithium grade for a full pegmatite intersection at Uis to date, namely the 90 m at an average Li2O content of 1.40% with a continuous portion of 76 m at 1.56% Li2O.

Results so far are in line with expectations and indicate consistent mineralisation of lithium, tin, and tantalum across the entire strike of the V1/V2 pegmatite. AfriTin said the lithium grade appeared to increase with depth, and the company plans to further explore the down dip potential of the pegmatite.

Map displaying the localities of the reported holes, the drill holes of the 2019 exploration programme, and the holes from the current programme previously reported. Line A-A' indicates the area represented by the cross section in the next figure.

Section line A-A' displaying a projection of the holes drilled during the current programme

Investors should expect an upgrade to Uis' lithium and tantalum resources as AfriTin wraps up its exploration programme at the site. The company aims to fast-track lithium production and become the only AIM-listed lithium producer.

In September, AfriTin negotiated a US$53.6m funding package that will ensure the company remains well-funded to accelerate growth in tin operations, and fund its development of lithium and tantalum by-product opportunities.

With the price of tin dropping in recent quarters, a refocusing on lithium and tantalum will be a valuable hedge for the company, as demand of those tech-critical metals is on the rise.

Additionally, investors should take further comfort that global asset manager Orion has been proposed as a key strategic investor for AfriTin, providing a conditional US$25 million investment.

Orion has a strong history of cultivating sustainable shareholder value in the mining sector. As such, their interest in AfriTin constitutes a compelling endorsement of the company's current work and future potential.

As AfriTin has now completed the Uis Phase 1 expansion, investors should expect much higher production levels from the mine in 2H22, to over 1200 tpa of tin concentrate.

Follow News & Updates from AfriTin Mining: