Alba Mineral Resources (ALBA ) said it has identified a new high-grade regional gold target within the group’s exploration licence area close to the Gwynfynydd Gold Mine in Wales.

The discovery was made during a recent field exploration made by Alba over a gold target in the extensive exploration licence area which lies close to the Gwynfynydd Gold Mine.

The field was undertaken following a historical data review, during which Alba identified 5-6 topography-controlling north-south structures associated with historical mine workings.

During a ground-truthing exercise at the site, quartz boulders were found close to the historical mine workings, considered likely to be there due to historical mining activity.

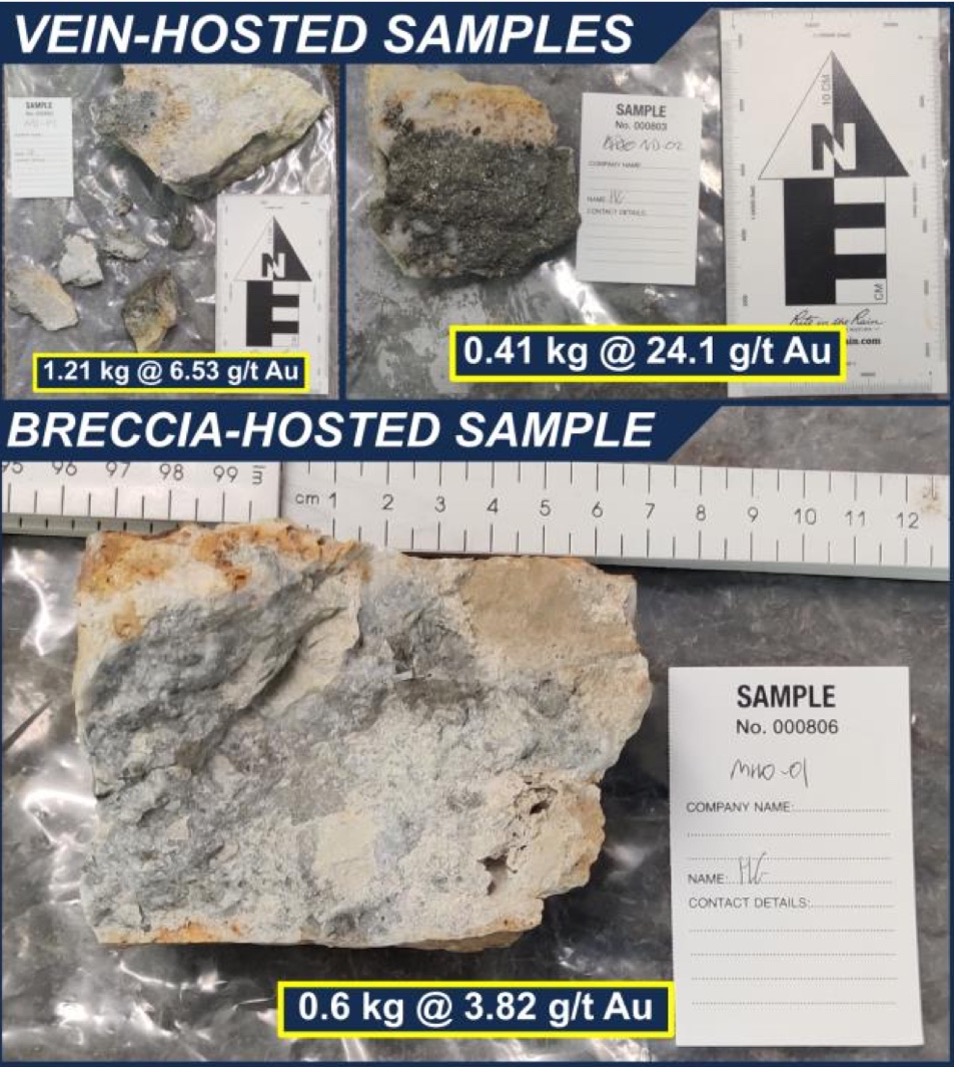

One boulder, which showed a multi-stage banded vein reminiscent of epithermal mineralisation, returned elevated grades from samples of 6.5 g/t and 24.1 g/t gold. A further float sample of breccia mineralisation which returned a grade of 3.8 g/t of fold.

Figure 1 (left): samples & assays

(Source: Alba Mineral Resources)

(Source: Alba Mineral Resources)

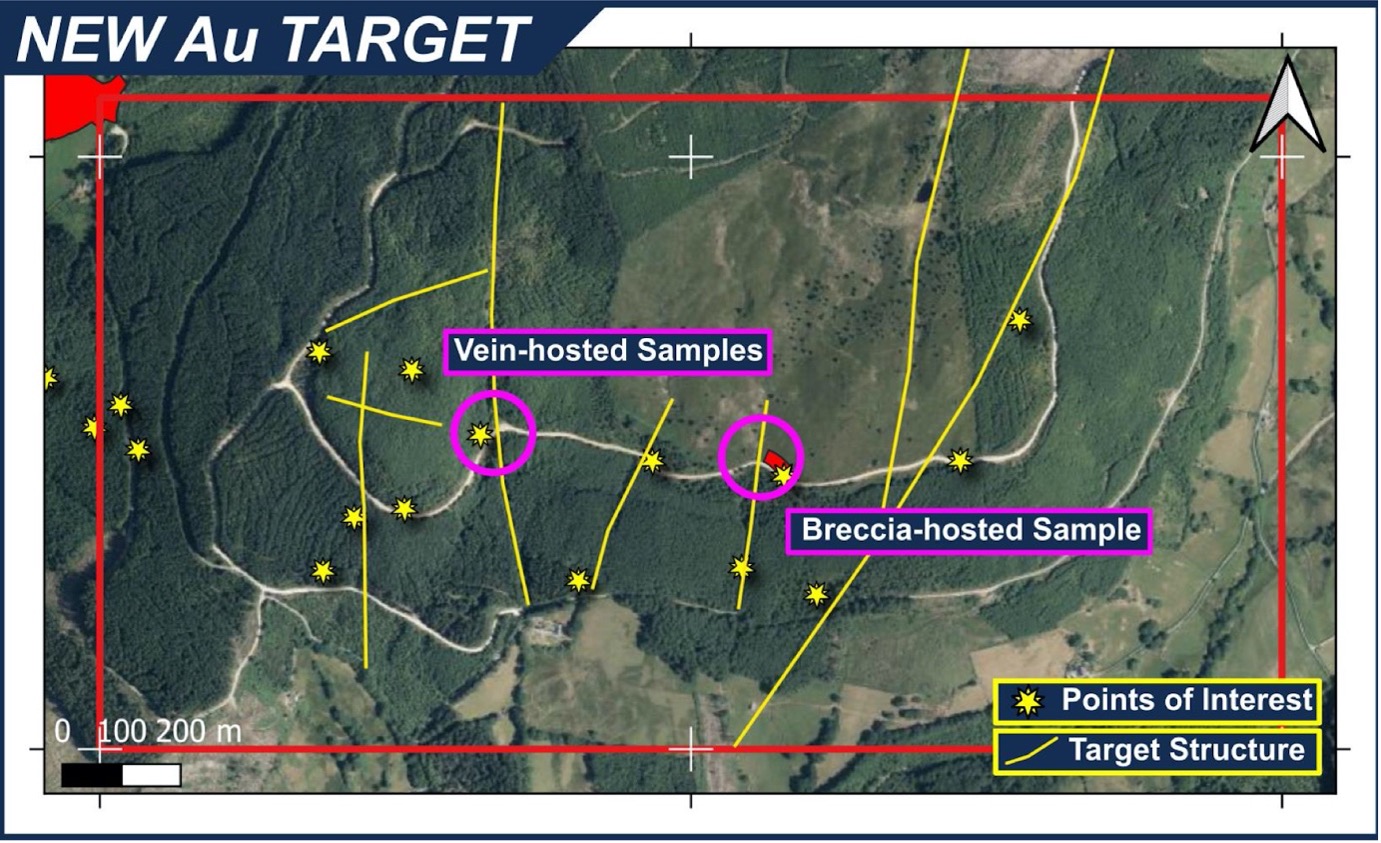

The Company highlighted to investors that these factors indicate that there is potential for both vein- and breccia-hosted mineralisation along and between the 5-6 target structures.

Executive Chairman, George Frangeskides, said, “The fact that our team have unearthed this new high-grade gold target on our licence area, grading up to 24 g/t, is a timely reminder of the great potential of the Dolgellau Gold Field, which is solely under licence to Alba.”

“There are some 300 historical workings in the Dolgellau Gold Field, not to mention no fewer than 11 past producing gold mines. We will be returning to this target area as soon as possible for follow-up exploration of the multiple structures we have identified,” he added.

Figure 2: Location map including target structures (yellow lines)

(Source:Alba Mineral Resources)

(Source:Alba Mineral Resources)

Alba is planning to undertake a follow-up field campaign of mapping and bedrock sampling in August 2021, which will aim to identify further examples of mineralisation and to better constrain the structures that are potentially critical for both styles of mineralisation.

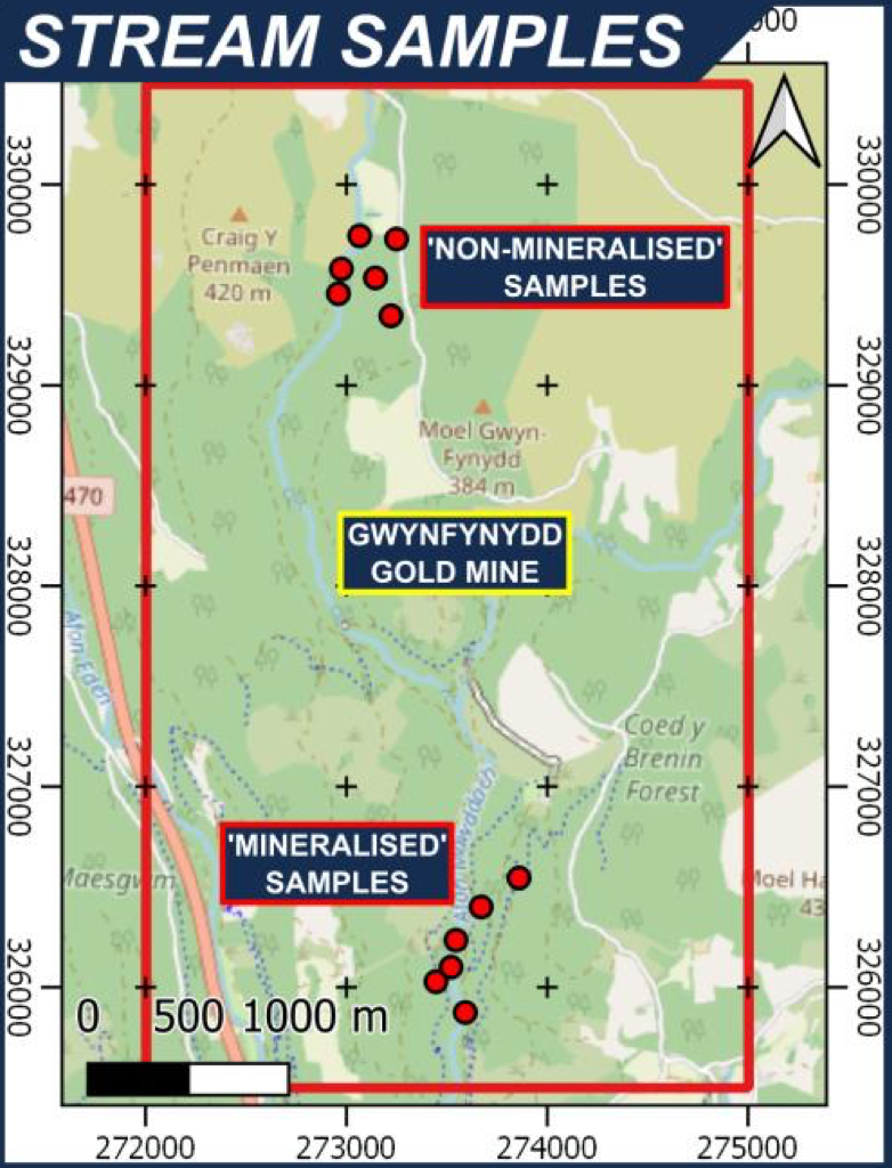

Additionally, Alba told investors that it has collected stream sediment samples within the Gwynfynydd exploration licence area which will form the basis of a study currently being completed by an MSc (Exploration Geology) student at Camborne School of Mines.

Figure 3: stream sediment samples

(Source: Alba Mineral Resources)

The Company explained that the study will identify the best sampling and analysis methodology for stream sediment sampling in the Dolgellau Gold Belt as well as including a comprehensive review of existing regional stream geochemistry and drainage basin analysis.

‘Drainage basin identification is important as it constrains the location of the gold mineralisation that is found in the stream sediment samples and therefore narrows down the target generation effort,’ the Company told investors.

Alba said it intends to identify a shortlist of drainage basins – an important factor in narrowing down Alba’s target generation effort - for follow-up sampling in order to explore for the presence of gold mineralisation in underexplored regions of high prospectivity.

View from Vox

Earlier this week, Alba said the Phase 2 Drilling Programme had commenced at the Company's wholly owned Thule Black Sands Ilmenite Project in northern Greenland.

The London-listed exploration company said it is seeking to drill 125 holes for up to 1,000 m with the aim of substantially increasing the existing JORC Mineral Resource at the project.

Specifically, the programme, which will focus on the higher-grade southern area as delineated by a previous 2018 drilling campaign, will target 125 holes at the site which will be drilled by sonic rig at an average depth of 8 metres which equates to 1,000m of drilling.

Meanwhile, Alba also gave investors an update on its plan to divest its Greenland assets, namely the Amitsoq, TBS, Melville Bay and Inglefield Projects, into a separate vehicle.

As outlined in May 2021, subject to regulatory approval, the Company’s separate vehicle, which is also referred to as “New Listco”, will seek to be admitted to trading on AIM.

New Listco will acquire the Greenland Projects from Alba for shares, and simultaneously with the listing New Listco will undertake an Initial Public Offering fundraising to secure the necessary working capital to fast-track the development of the Greenland Projects, it noted.

In addition, Alba's recently proposed Greenland-focused, spin-out company will enable it to form a new vehicle that could unlock ‘real and sustained value’ across its Greenland projects which the company views as being ‘materially undervalued’ within its current asset portfolio.

As part of the Spin-Out Transaction, Alba will receive New Listco shares valued on IPO at around £6 million, resulting in Alba becoming the majority shareholder of New Listco.

Shares in Alba Mineral Resources have increased by 12.5% in value over the past month with the group’s shares having reacted positively to the news of the spin out of assets based in Greenland. The stock was trading 1.18% higher this morning at 0.26p following the update.

Reasons to Follow ALBA

Alba Mineral Resources is a well-diversified exploration and development company which owns and operates mining projects in Greenland, Wales and Ireland. Its strategy is to identify and secure undervalued assets with a diversified commodity mix where there is potential for discovering further unexploited resources alongside the existing mine site.

Limerick Base Metals Project

Historically, only eight drillholes have been completed within Alba’s Project area of the Limerick Base Metals Project, the most recent being the three holes drilled in Q2 of 2019.

Alba said these low levels of drilling are unusual in the Irish context and, for this reason, the area is considered under-explored. Alba has previously identified a number of attractive targets that have never been drilled before.

Alba’s current technical team, led by Mark Austin, Alba’s COO and Senior Geologist, will undertake a comprehensive review of the licence area before determining the next phase of planned exploration activities.

The expenditure conditions attached to the renewal of PL 3824 require Alba to incur expenditure of €15,732 by 26 May 2021 with a further €50,000 to be spent by 26 May 2022.

JORC Resources expected

Despite losing field time to the COVID-19 pandemic, Alba said it is in a position to execute one of the most significant underground work programmes seen for several decades at its Clogau gold mine in Wales, just as the commodity is reaching all-time highs in value.

Alba said its mining projects remain on ‘a sound footing’, with JORC resources at both Thule Black Sands and Melville Bay, and plans to drill a maiden JORC resource at Amitsoq in 2021.

Amitsoq

In recent weeks, Alba said an independent testwork programme at the Group’s Amitsoq graphite project in southern Greenland has confirmed ‘very high carbon content.’ Due to the high carbon content, the product would offer ‘a significant advantage, as no purification would be needed to achieve that level,’ the Company explained to investors.

Accordingly, subject to certain follow-up testwork which the Group said is recommended, the testwork successfully indicates the suitability of Amitsoq graphite as feed material for Lithium-Ion Batteries ("LIBs"), the fastest growing market for flake graphite globally.

‘This finding that the concentrate appears to be suitable for LIBs is significant, as the market for LIBs is the fastest growing market for flake graphite, with massive growth rates forecast for the next decade due to the expected demand for LIBs in electric vehicles,’ Alba outlined.

Transition from Exploration to Production in Greenland and Wales

Other ‘significant’ progress has also been made in recent years towards Alba’s ultimate goal of achieving commercial production at one or more of its sites, including at the Thule Black Sands in Greenland, the Amitsoq project in Greenland and the Horse Hill well in Surrey.

In 2020, Alba announced that surface trenching activities would kick-start over the first of the group’s 10 regional gold targets over the Dolgellau Gold Field.

The trenching will target the first of 10 separate new gold targets over the Dolgellau Gold Field which have previously been identified by Alba.

Alba said up to eight trenches have been planned in this first phase, each varying in length from 40-90m for a total of 575m, with each trench being 1m wide and up to 2m deep.

Once exposed, the quartz veining and other structures from the trenches, those of which are pictured below, will be sampled, and those samples sent to a laboratory for assaying.

Follow News & Updates from Alba Mineral Resources here: