Alien Metals (UFO ) has entered into a 60-day exclusivity arrangement with the owner of the tailings on site in the Elizabeth Hill Mining Licence which holds the Group’s silver project.

Located within the Company’s mining lease ML47/342, the company said there remains the partly retreated tailings from the original silver mine operations at Elizabeth Hill. This is currently subleased from Alien by Wombat Resource, the owner of the tailings on site.

The minerals exploration and development firm said this period will be used to carry out further assessment and potentially negotiate an acquisition of the rights and title to the Elizabeth Hill tailings project, if terms can be agreed upon between the two parties.

Alien’s preliminary assessment has indicated that there remains about 16,000 tons of tailings on site, based on tonnage of ore extracted from the mine however further work will be undertaken during the exclusivity period to confirm available tailings for reprocessing

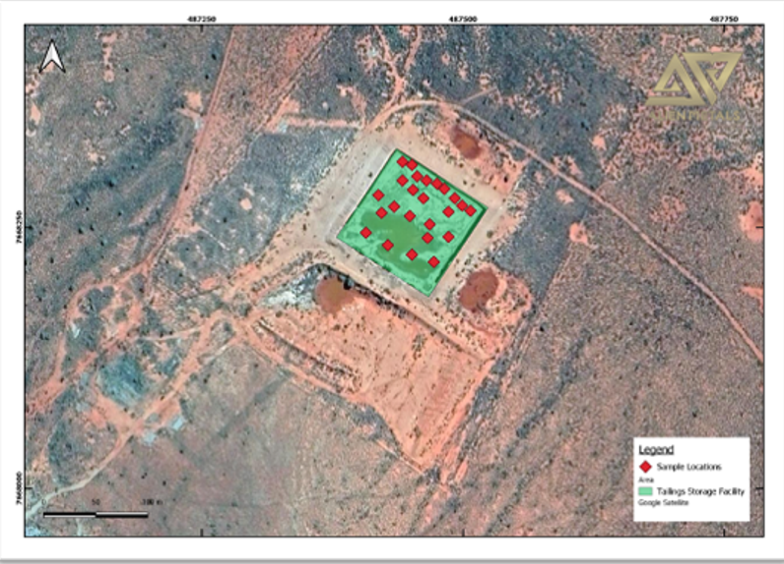

To date, sampling of the tailings undertaken by Alien have returned very encouraging results. 84 samples that were taken from 21 locations delivered silver grades up to 1,270 g/t (38 oz/t) while the samples returned an average grade of 472 g/t Ag (13.3 oz/t Silver.

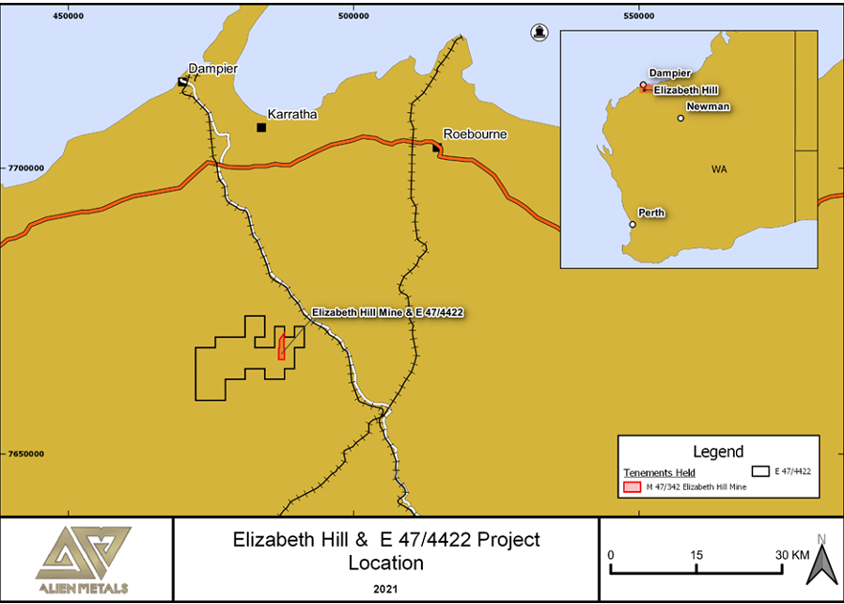

Bill Brodie Good, CEO & Technical Director of Alien Metals said that Alien Metals has been aware of the potential of historic silver tailings at Elizabeth Hill (Fig. 1) “for some time.”

Figure 1: Location of Elizabeth Hill Project, Western Australia, Jan 2021

(Source: Alien Metals)

He said, “Knowing that the Elizabeth Hill silver mine’s historic operations were somewhat inefficient and being very high-grade with abundant native silver we felt that, despite previous reprocessing activities, there is likely significant value remaining in the silver tailings.”

He said that following discussions with the Wombat Resources silver, a first-pass sampling program was undertaken back in December 2020 to test the properties of the tailings.

This was conducted in order to get an initial understanding of the grade of the remaining material in the dump as review of historical reports did not give any clear outline of this.

ALS labs in Perth carried out an Aqua Regia ICP-AES assay on 84 auger samples (Fig. 2) from 21 locations, which returned consistently high values of silver and associated minerals.

Figure 2: Sample points on Tailings, Elizabeth Hill Mine, Western Australia, December 2020

(Source: Alien Metals)

UFO intends to undertake further sample work and analysis so it can “better understand the most efficient and cost-effective processes to extract the silver from the tailings.”

“We believe that the silver tailings project could generate near-term cash flow which could help underpin a range of exploration activities at Elizabeth Hill and the Munni Munni North project,” added Brodie Good.

Should further work be positive, Alien said it will undertake an initial scoping study of the project, including potential processing/treatment options and likely start-up costs.

Just week UFO kick-started its 2,500m drilling programme at the Donovan 2 copper gold project in Mexico ahead of schedule. At the same time, copper prices had hit a nearly 10-year high. UFO said it believes this project can “grow quickly into a significant entity” which it said should generate a positive re-rating for the shares.

Today’s announcement of a potential agreement to acquire 16,000 tons of tailings on the Elizebeth Hills site, just as silver prices trend towards 5 year highs, will also see investors benefit from the significant value remaining in the silver tailings. Shares in Alien Metals have increased by over 55% in value since the beginning of October 2020.

Reasons to Follow UFO

UFO’s portfolio of exploration stage assets includes volcanogenic massive sulphide style mineralisation (copper, zinc and lead), high-grade silver projects in Mexico and a 51% interest in two highly prospective iron ore projects in the Pilbara region in Australia.

The company said its portfolio may be expanded to include other minerals such as iron ore and lithium, and jurisdictions within Africa and Asia where its management has demonstrable expertise advancing assets in line with international reporting standards.

Expanding License Areas

In recent weeks, the company was granted a 208 km2 exploration licence by Ironbark Zinc surrounding the Citronen zinc-lead project, a high-grade metal project located in northern Greenland which is believed to be one of the world's largest undeveloped zinc-lead projects.

The minerals exploration and development company said the project holds a JORC resource of 131.1m tonnes @ 4.5% zinc and lead for 13bn pounds of contained zinc and lead metal.

The licence is valid until 31 December 2023 and continues UFO’s strategy of identifying counter-cyclical opportunities in first class mining jurisdictions with ‘excellent upside potential.’

"The Company and its advisers continue to assess new projects and identified an opportunity to secure an exploration footprint in northern Greenland on strike and adjacent to the world class undeveloped Citronen zinc-lead project,” said CEO, Bill Brodie Good.

IBK believes the projects offer an attractive entry into one of the world's premier silver belts and will soon start marketing them to a range of potential investors and project partners.

UFO said it will continue its efforts in exploring and developing the projects and simultaneously consider third party funding options to develop and mine the projects.

In other recent news, the company has also recently completed a detailed geological mapping and sampling programme at the Hamersley iron ore projects in Australia with field observations indicating that two of its prospects may be part of the same larger system.

The two projects, which have demonstrated “great potential” are located in the Hamersley Province which is known as one of the premier iron ore producing regions of the world.

Preliminary handheld XRF results are consistent with those observed in the 2019 field programme, with reported ranges of between 40% and 70% iron.

Alien Metals has now commenced preparing a Program of Works ("POW") for submission ahead of drilling.

Meanwhile, North American advisor firm IBK Capital has commenced the marketing process for the Company's San Celso and Los Campos silver projects which are located in Mexico.

The process for the silver projects follows the successful earn-in transaction with Capstone Mining announced earlier in October 2020 regarding UFO’s Donovan 2 copper-gold project.

Complementary Acquisitions

Alien Metals has executed an acquisition-led strategy headed by a high-quality geological team to build a strong portfolio of diversified assets including two recent acquisitions in 2019

These include the Brockman and Hancock Ranges high-grade iron ore projects and the Elizabeth Hill Silver projects both located in the Pilbara region, Western Australia.

In addition to progressing its portfolio of assets and following its strategic review of its portfolio of silver and precious metals projects in Mexico, Alien Metals has identified priority exploration targets within its 9 mining concessions which it is working to advance systematically.

The Company’s silver projects are located in the Zacatecas State, Mexico’s largest silver producing state which produced over 190m oz of silver in 2018 alone accounting for 45% of the total silver production of Mexico for that year.

Follow News & Updates from Alien Metals here: