Alien Metals (UFO ) has received ‘encouraging’ initial results from its drilling program on its Hancock Iron Ore project, widening its understanding of the mineralisation of the project.

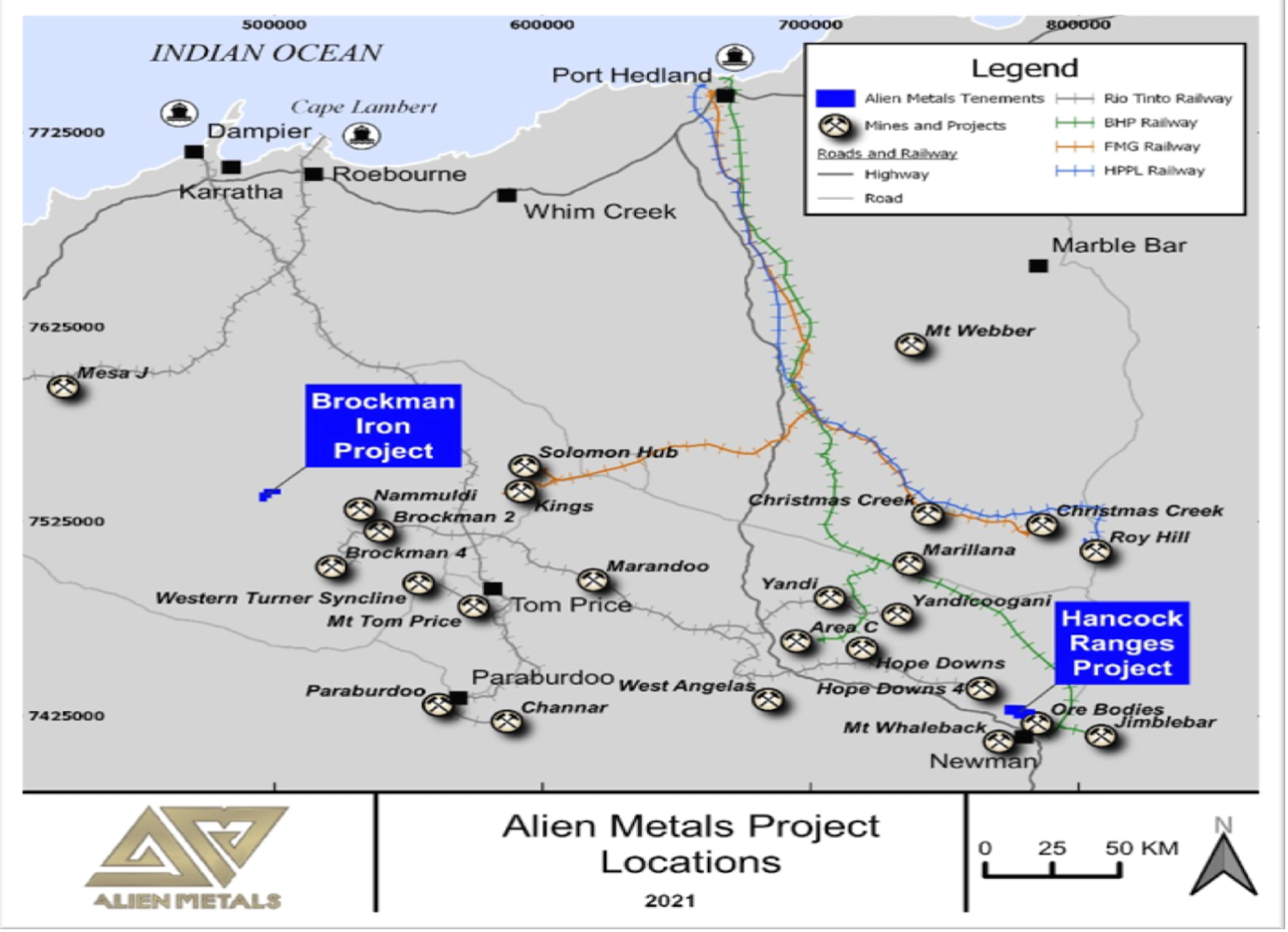

The project is part of the Hamersley Iron Ore Project in the Hamersley Province of Western Australia which is known as one of the premier iron ore producing regions of the world.

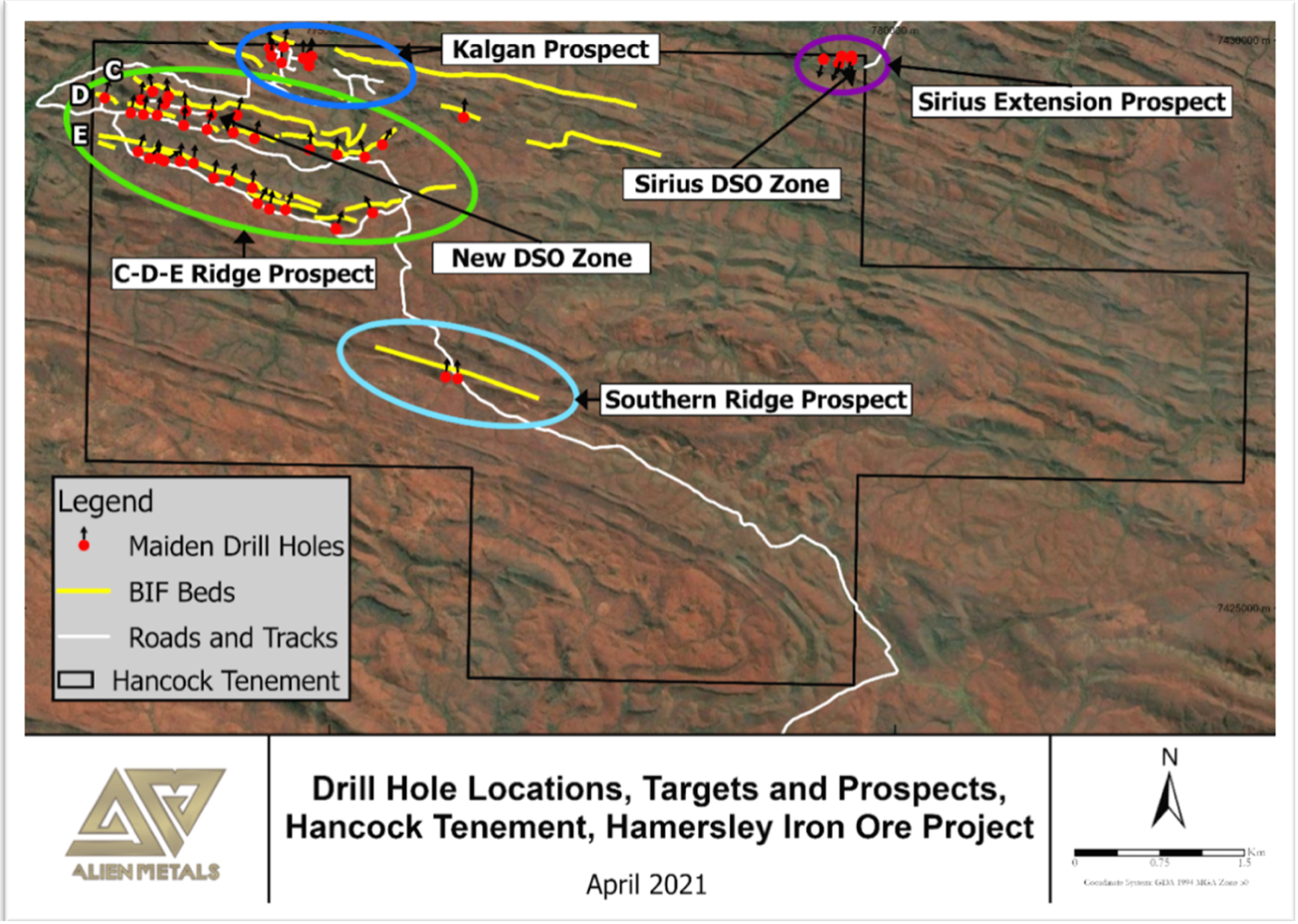

The maiden drilling program at the Hancock Ranges project, was aimed to test four main targets which had been defined from historic and recent work; two high grade east-west ridges of outcropping high-grade iron ore and the Kalgan and Sirius Extension prospects.

The planned holes targeted three initial prospects to enable Alien to continue developing its knowledge of the project (Fig. 1) as a whole and to further prioritise for next stage drilling.

Figure 1: Location of the Brockman and Hancock Ranges Iron Ore projects within the prolific iron ore producing region of the Pilbara.

(Source: Alien Metals)

(Source: Alien Metals)

Alien highlighted to investors that a fourth area was identified in the southern central area and 2 holes were drilled to initially test this at the end of this program (Figure 2).

Figure 2: Drill hole locations, Targets and Prospects, Hancock Tenement, Hamersley Iron Ore Project, May 2021

(Source: Alien Metals)

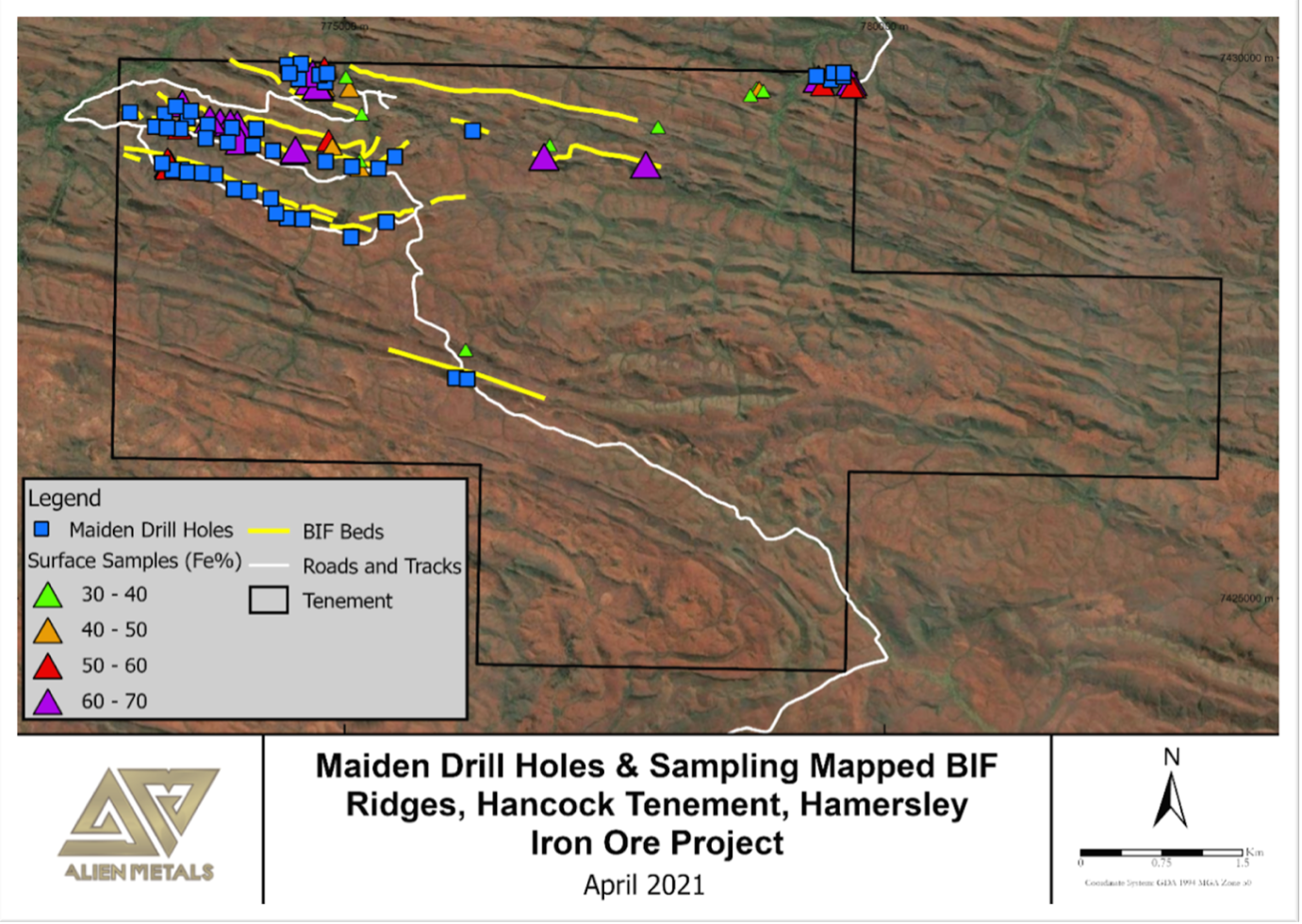

The results received to date from 17 samples (36 holes still awaited) returned a maximum intersection of 1m at 65.88% iron from hole AM21RC001 006 within a significant intersection of 26m @ 54.3% iron from surface, including 13m @ 61.5% Iron from 2m depth.

Other results around this hole returned lower grades which indicate that 2 beds were drilled one below the other, one being the High-Grade Direct Shipping Ore (“DSO”) grade unit and the second being lower but still iron ore bearing. The Group stated that this is significant for future targeting and development as the Company identifies the DSO grade beds as priority.

‘Significantly,’ the Company noted, the majority of assays awaited are from holes which have had significant Banded Iron Formation (“BIF”) with intercepts of up to 55m widths. The Group said these are expected to add significant potential to the project potential.

Figure 3: Drill hole locations under historic surface sampling, Hancock Tenement, Hamersley Iron Ore Project, April 2021.

(Source: Alien Metals)

(Source: Alien Metals)

“In addition to the known DSO grade iron ore at the Sirius Extension prospect, initial assay results confirm the existence of outcropping DSO grade mineralisation in initially identified ridges A to E,” commented Bill Brodie Good, CEO & Technical Director of Alien Metals.

He added, “The program has also opened new highly prospective areas of the tenement previously not explored and identified prospective further DSO grade potential. To date, we have received assay results from 17 out of the 53 holes drilled. Initial results are encouraging and already add to the understanding of the mineralisation of the project.”

The Company said it expects to receive the remaining results in the coming weeks and that this will provide it with a greater understanding of the potential of the project and support planning for a follow-up drilling program which will be commencing “shortly after.”

“Overall, we are extremely encouraged by the BIF intersections on certain ridges and the information we have today gives us great confidence in the potential for the project. With current iron ore prices at multi-year highs, we believe that our iron ore projects will deliver significant value to shareholders as we continue to advance them with further exploration.”

View from Vox

Recently, Iron ore prices have risen to record highs with expectations building that benchmark prices could get to $200 a tonne which would beat the $194 hit more than a decade ago. As a result of the surging prices, Alien believes its iron ore projects will deliver significant value.

Shares in Alien Metals have increased by over 7% in value since the beginning of the year. The stock was trading 4.50% higher this morning at 1.15p following the announcement.

Reasons to UFO

UFO’s portfolio of exploration stage assets includes volcanogenic massive sulphide style mineralisation (copper, zinc and lead), high-grade silver projects in Mexico and a 51% interest in two highly prospective iron ore projects in the Pilbara region in Australia.

The company said its portfolio may be expanded to include other minerals such as iron ore and lithium, and jurisdictions within Africa and Asia where its management has demonstrable expertise advancing assets in line with international reporting standards.

Expanding Licence Areas

In recent weeks, the company was granted a 208 km2 exploration licence by Ironbark Zinc surrounding the Citronen zinc-lead project, a high-grade metal project located in northern Greenland which is believed to be one of the world's largest undeveloped zinc-lead projects.

The minerals exploration and development company said the project holds a JORC resource of 131.1m tonnes @ 4.5% zinc and lead for 13bn pounds of contained zinc and lead metal.

The licence is valid until 31 December 2023 and continues UFO’s strategy of identifying counter-cyclical opportunities in first class mining jurisdictions with ‘excellent upside potential.’

"The Company and its advisers continue to assess new projects and identified an opportunity to secure an exploration footprint in northern Greenland on strike and adjacent to the world class undeveloped Citronen zinc-lead project,” said CEO, Bill Brodie Good.

IBK believes the projects offer an attractive entry into one of the world's premier silver belts and will soon start marketing them to a range of potential investors and project partners.

UFO said it will continue its efforts in exploring and developing the projects and simultaneously consider third party funding options to develop and mine the projects.

In other recent news, the company has also recently completed a detailed geological mapping and sampling programme at the Hamersley iron ore projects in Australia with field observations indicating that two of its prospects may be part of the same larger system.

The two projects, which have demonstrated “great potential” are located in the Hamersley Province which is known as one of the premier iron ore producing regions of the world.

Preliminary handheld XRF results are consistent with those observed in the 2019 field programme, with reported ranges of between 40% and 70% iron.

Alien Metals has now commenced preparing a Program of Works ("POW") for submission ahead of drilling.

Meanwhile, North American advisor firm IBK Capital has commenced the marketing process for the Company's San Celso and Los Campos silver projects which are located in Mexico.

The process for the silver projects follows the successful earn-in transaction with Capstone Mining announced earlier in October 2020 regarding UFO’s Donovan 2 copper-gold project.

Complementary Acquisitions

Alien Metals has executed an acquisition-led strategy headed by a high-quality geological team to build a strong portfolio of diversified assets including two recent acquisitions in 2019

These include the Brockman and Hancock Ranges high-grade iron ore projects and the Elizabeth Hill Silver projects both located in the Pilbara region, Western Australia.

In addition to progressing its portfolio of assets and following its strategic review of its portfolio of silver and precious metals projects in Mexico, Alien Metals has identified priority exploration targets within its 9 mining concessions which it is working to advance systematically.

The Company’s silver projects are located in the Zacatecas State, Mexico’s largest silver producing state which produced over 190m oz of silver in 2018 alone accounting for 45% of the total silver production of Mexico for that year.

Follow News & Updates from Alien Metals here: