Alien Metals (UFO ) shares jumped 22% this morning after the company announced an agreement with Anglo American (AAL ) for the exclusive right to negotiate up to US$15m in project funding and 100% of offtake from the Hancock iron ore project in Pilbara, Western Australia. Alien Metals acted through its wholly-owned subsidiary Iron Ore Company of Australia (IOCA).

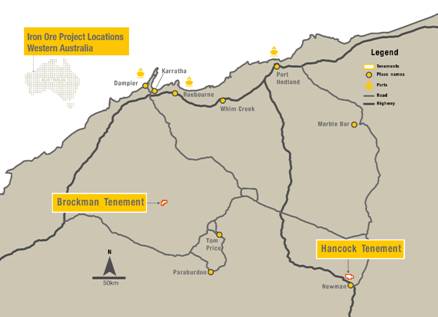

Location of Hancock Iron Ore Project, Western Australia

The agreement includes a US$10m advance payment facility and 100% offtake for sinter fines and lump from the Hancock Project. Offtake terms will include vessel prepayments for up to US$5m for the 12 months.

Anglo American will enjoy an exclusivity period of 60 days and will receive an agreed royalty for 24 months.

View from Vox

Alien Metals shares jumped 22% on today's news as investors cheered the mandate letter with mining giant Anglo American. The agreement will enable the negotiation of alternative debt funding and 100% offtake solution. CEO Bill Brodie explained: "This Mandate Letter supports our near-term production aspirations and, unlike conventional debt finance, the potential bespoke funding with offtake provides alignment between the parties for the pursuit of scale across multiple assets with a world class counterparty."

Alien recently executed an option to acquire an additional 39% interest in the Hancock and Brockman iron projects in the Pilbara region, increasing its stake to 90%. The Hancock project is set to be highly profitable, based on preliminary drilling. Initial estimates put projected cost FOB of US$60/t to mine and a total maximum capex of US$30m.

Alien said today that development work was continuing at Hancock, with the potential to reduce that initial capex requirement, outlined in the company's October 2021 scoping study. Alien will issue a further update on this once the process is complete.

Alien also announced recently its full acquisition of the Vivash Gorge iron ore project. With this addition, the company now has three strategically located iron ore projects within the Pilbara region.

Alien Metals has other valuable concessions as well, including the Elizabeth Hill Silver Project and the Munni Munni PGE Project in Western Australia. The company also frequently evaluates projects outside Mexico and Australia. In the last two years, this has included West Africa, Europe and Latin America.

Overall, Alien Metals has had a busy FY22 so far with a steady stream of positive news. As a result, investors have kept Alien shares flat YTD, resisting the broader downturn in equities.

Alien Metals remains well-financed, with a growing number of staff and acquisitions. On 31 December 2021, the company had total assets of US$13m (2020: US$9.4m) of which US$6.4m was cash (2020: US$5.4m).

Follow News & Updates from Alien Metals: