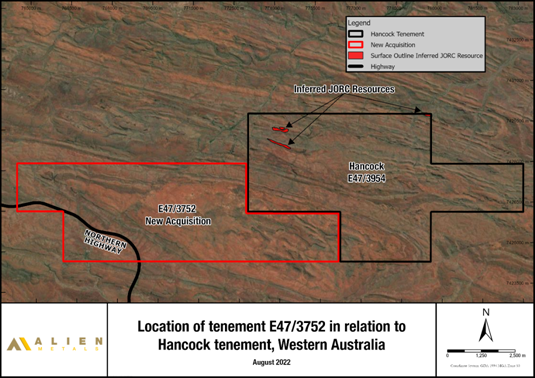

Alien Metals (UFO ) announced this morning its wholly owned subsidiary Iron Ore Company of Australia has signed an agreement with Mallina Exploration Pty Ltd to acquire a valuable tenement next to Alien's existing Hancock iron project in Western Australia. Alien says the tenement is "key to the development of the project".

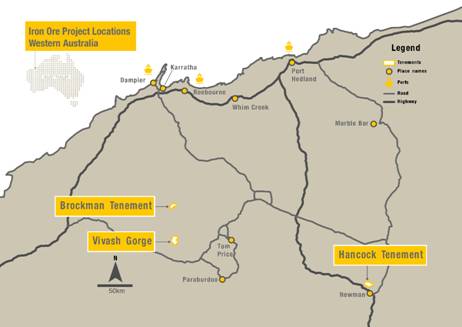

Location of Alien's Iron Ore Projects, Western Australia

The acquisition agreement is currently under application with the Department of Mines, Industry Regulation and Safety DMRIS, Western Australia.

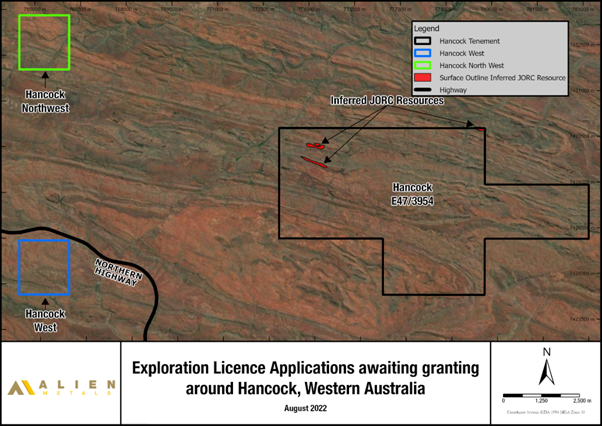

Alien also announced it has applied for two additional exploration licenses within the Hancock area, ELA47/4605 or "Hancock West", and ELA47/4817 or "Hancock Northwest", providing further growth opportunities.

View from Vox

Alien Metals continues to develop its Hancock Project, set to be highly profitable, based on preliminary drilling. Hancock hosts a gross JORC compliant inferred mineral resource of 10.4Mt @ 60.4% Fe, with significant potential to find more DSO-grade material on the tenement across ridges F, G & H.

Based on this promising data, Alien recently exercised an option to increase its stake to 90% in the Hancock and Brockman projects in the Pilbara region of Western Australia.

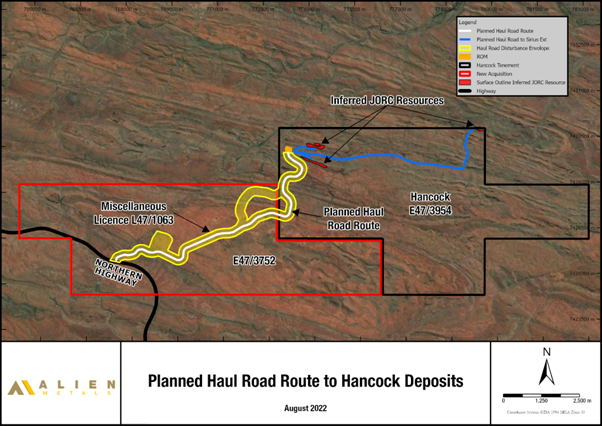

The acquisition announced today, currently under application, is for tenement E47/3752, directly southwest of Hancock. This is a strategically important acquisition as it will enable a planned haul road to take the most optimum route and remain entirely within Alien Metals-owned land, further fast-tracking the Hancock project and offering the shortest distance to market.

Alongside this acquisition, Alien has applied for two other potentially valuable tenements, ELA47/4605 or "Hancock West" and ELA47/4817 or "Hancock Northwest". The tenements are 3.15km2 each, equating to a single block.

Today's news follows last week's major announcement of Alien's agreement with mining giant Anglo American for the exclusive right to negotiate up to US$15m in project funding and 100% of offtake from Hancock. The agreement includes a US$10m advance payment facility. Alien shares jumped 22% on the day of the announcement.

The agreement with Anglo American will enable the negotiation of alternative debt funding and 100% offtake solution. CEO Bill Brodie explained: "This Mandate Letter supports our near-term production aspirations and, unlike conventional debt finance, the potential bespoke funding with offtake provides alignment between the parties for the pursuit of scale across multiple assets with a world class counterparty."

Alien also announced recently its full acquisition of the Vivash Gorge iron ore project. With this addition, the company now has three strategically located iron ore projects within the Pilbara region.

Overall, Alien Metals has had a busy FY22 so far with a steady stream of positive news. As a result, investors have kept Alien shares ahead of the broader downturn in equities.

The Hancock Project is shaping up to be a major win for the company, with the potential to offer material upside to investors in the future. Make sure to Alien Metals, so you do not miss more news about Hancock or the company's other assets.

Alien Metals remains well-financed, with a growing number of staff and acquisitions. On 31 December 2021, the company had total assets of US$13m (2020: US$9.4m) of which US$6.4m was cash (2020: US$5.4m).