Alien Metals (UFO) said it has executed a conditional Share Sale Agreement (“SSA”) to increase its effective interest in the Hamersley Iron Ore Direct Shipping Ore Project.

Alien plans to increase its interest in the Hamersley Iron Ore Direct Shipping Ore Project, which is located in the Hamersley Province of Western Australia, one of the premier iron ore producing regions of the world, thereby raising its existing 51% holding to over 90%.

The company currently has a 51% direct interest in the Hamersley iron ore project, with the remaining 49% held by Windfield. The Project consists of exploration licence EL47/3953 Brockman and EL47/3954 Hancock licences in the Pilbara region of Western Australia.

Pursuant to the SSA, Alien will acquire an 80% interest in Windfield, thereby bringing its direct and indirect holding in the project to 90.2%. Alien has agreed to acquire Windfield on the basis that its sole asset will be the interest in the project and on a nil net cash basis.

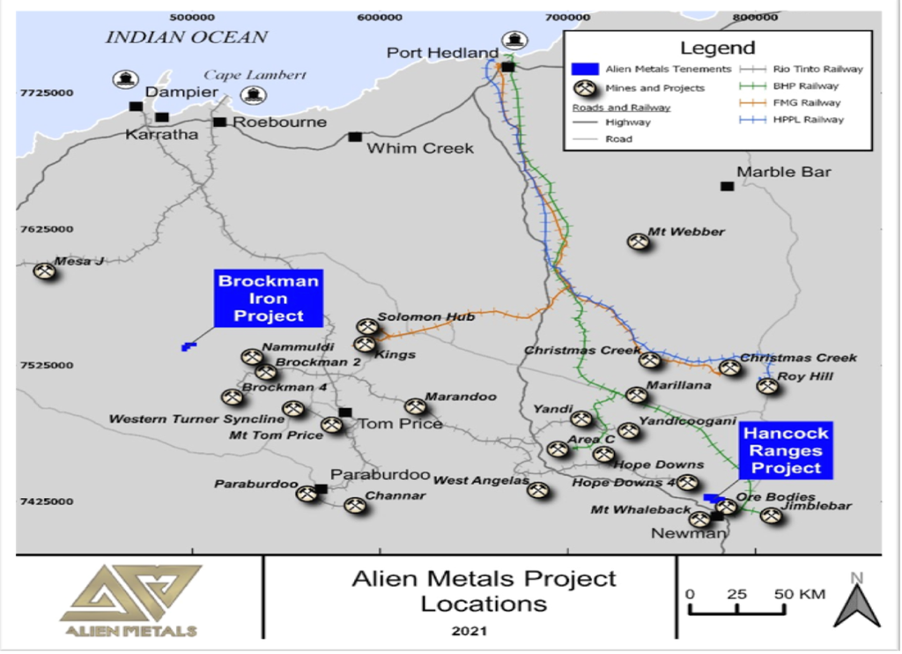

The mineral exploration firm explained that the project consists of two granted exploration licences, the Hancock and Brockman licences, that cover 56.7 km2 and are surrounded by major iron ore companies including Rio Tinto, Fortescue Metals and Hancock Prospecting.

“By obtaining the major controlling interest, we will have greater flexibility to both manage and monetise the Project as our continued exploration moves it up the value curve,” said CEO and Technical Director, Bill Brodie Good. The group said it believes that the acquisition will provide increased flexibility to fund the project via joint venture, partial sale or spin off.

In recent weeks, Alien has received ‘encouraging’ initial results from its drilling program at the Hancock Iron Ore project, widening its understanding of the mineralisation of the area.

The planned holes targeted three initial prospects to enable Alien to continue developing its knowledge of the project (Fig. 1) as a whole and to further prioritise for next stage drilling. The company also highlighted that maiden drilling is still to commence on the Brockman Licence.

Figure 1: Location of the Brockman and Hancock Ranges Iron Ore projects within the prolific iron ore producing region of the Pilbara.

“The excellent initial assay results we’ve seen from our maiden drilling program on the Hancock licence, recent field work carried out on both licences, and along with the continued surge in demand and price for Iron Ore, have underscored the rationale for this acquisition and we are delighted to be increasing our stake in the Hamersley Project to over 90%.

“Iron ore has recently broken through the US$200 per tonne barrier, driven largely by global infrastructure demand and stimulus spending as economies look to shake off the COVID-19 economic slump. These factors are showing no sign of slowing as global demand for Iron Ore continues to rise and we see continued resilience in the price,” added Bill Brodie Good.

Against this backdrop, the company highlighted to investors that it feels the acquisition is “highly value accretive for the Company and will deliver significant value for shareholders.”

Alien is now in the process of initiating a follow-up drill program on the Hancock licence with a view to generating a maiden JORC compliant resource. It said that once permits have been received, it will also commence its maiden drill program at the Brockman licence, “which contains historic BHP iron prospects and remains an exciting licence in its own right.”

What the analysts are saying:

First Equity analysts have highlighted the timing of Alien's move to pursue and expand its interest at a time when iron-ore prices are continuing to surge and Chinese steel output is reaching an all-time record high on the back of global Covid-19 economic recovery and US infrastructure stimulus plans.

Analysts say the value of this 39% stake is worth more than the £2.1m being paid and that when a maiden JORC resource statement is published on the project, which it anticipates will be in July/August, investors and analysts may be able to estimate how much its stake could be worth.

‘By holding around 90%, Alien will also be better placed, as the management explained in the RNS, to advance the project via a Joint Venture, partial sale or listing spin off,’ the firm wrote this morning.

As a result of Alien acquiring ‘a more meaningful stake’ and given what could prove to be a company-making project for an in-demand commodity, along with other Group interests in silver and copper, First Equity continues to rate the stock as ‘Buy’ with a target price of 1.20p.

Meanwhile, analysts at Turner Pope Investments have stated that the rationale for the company's move is clear. ‘In obtaining the major controlling interest, the Board will secure much greater flexibility to both manage and monetise the Project as continuing exploration takes it further up the value curve at a time when governments worldwide are committing significant new funding to major, longer-term infrastructure projects in an effort to kick-starting their post-Pandemic economies, it noted.

TPI said it sees potential for an upward reassessment of its current valuation range for Alien which is now 'reasonably well capitalised, which should provide a working runway beyond the end of 2021.'

As a result, the research institution said it is is re-considering a reduction of the ‘aggressive’ 60% discount that was previously applied (to account for remaining execution, financing and dilution risks) in expectation of being able to declare compliant resources, but also to revisit the prudent valuations apportioned elsewhere amongst its exciting, albeit earlier stage, prospects.

‘In expectation of continuing heavy news flow, Alien’s share price might continue to anticipate potential for further high-impact results,’ analysts at Turner Pope Investment concluded.

View from Vox

Recently, Iron ore prices have risen to record highs with expectations building that benchmark prices could get to $200 a tonne which would beat the $194 hit more than a decade ago. As a result of the surging prices, Alien believes its iron ore projects will deliver significant value.

Shares in Alien Metals have increased by nearly 25% in value since the start of April 2021.

Reasons to  UFO

UFO

UFO’s portfolio of exploration stage assets includes volcanogenic massive sulphide style mineralisation (copper, zinc and lead), high-grade silver projects in Mexico and a 51% interest in two highly prospective iron ore projects in the Pilbara region in Australia.

The company said its portfolio may be expanded to include other minerals such as iron ore and lithium, and jurisdictions within Africa and Asia where its management has demonstrable expertise advancing assets in line with international reporting standards.

Expanding Licence Areas

In recent weeks, the company was granted a 208 km2 exploration licence by Ironbark Zinc surrounding the Citronen zinc-lead project, a high-grade metal project located in northern Greenland which is believed to be one of the world's largest undeveloped zinc-lead projects.

The minerals exploration and development company said the project holds a JORC resource of 131.1m tonnes @ 4.5% zinc and lead for 13bn pounds of contained zinc and lead metal.

The licence is valid until 31 December 2023 and continues UFO’s strategy of identifying counter-cyclical opportunities in first class mining jurisdictions with ‘excellent upside potential.’

"The Company and its advisers continue to assess new projects and identified an opportunity to secure an exploration footprint in northern Greenland on strike and adjacent to the world class undeveloped Citronen zinc-lead project,” said CEO, Bill Brodie Good.

IBK believes the projects offer an attractive entry into one of the world's premier silver belts and will soon start marketing them to a range of potential investors and project partners.

UFO said it will continue its efforts in exploring and developing the projects and simultaneously consider third party funding options to develop and mine the projects.

In other recent news, the company has also recently completed a detailed geological mapping and sampling programme at the Hamersley iron ore projects in Australia with field observations indicating that two of its prospects may be part of the same larger system.

The two projects, which have demonstrated “great potential” are located in the Hamersley Province which is known as one of the premier iron ore producing regions of the world.

Preliminary handheld XRF results are consistent with those observed in the 2019 field programme, with reported ranges of between 40% and 70% iron.

Alien Metals has now commenced preparing a Program of Works ("POW") for submission ahead of drilling.

Meanwhile, North American advisor firm IBK Capital has commenced the marketing process for the Company's San Celso and Los Campos silver projects which are located in Mexico.

The process for the silver projects follows the successful earn-in transaction with Capstone Mining announced earlier in October 2020 regarding UFO’s Donovan 2 copper-gold project.

Complementary Acquisitions

Alien Metals has executed an acquisition-led strategy headed by a high-quality geological team to build a strong portfolio of diversified assets including two recent acquisitions in 2019

These include the Brockman and Hancock Ranges high-grade iron ore projects and the Elizabeth Hill Silver projects both located in the Pilbara region, Western Australia.

In addition to progressing its portfolio of assets and following its strategic review of its portfolio of silver and precious metals projects in Mexico, Alien Metals has identified priority exploration targets within its 9 mining concessions which it is working to advance systematically.

The Company’s silver projects are located in the Zacatecas State, Mexico’s largest silver producing state which produced over 190m oz of silver in 2018 alone accounting for 45% of the total silver production of Mexico for that year.

Follow News & Updates from Alien Metals here: