Alien Metals (UFO ) announced this morning interim results for the 6 months to 30 June 2022.

Operational highlights

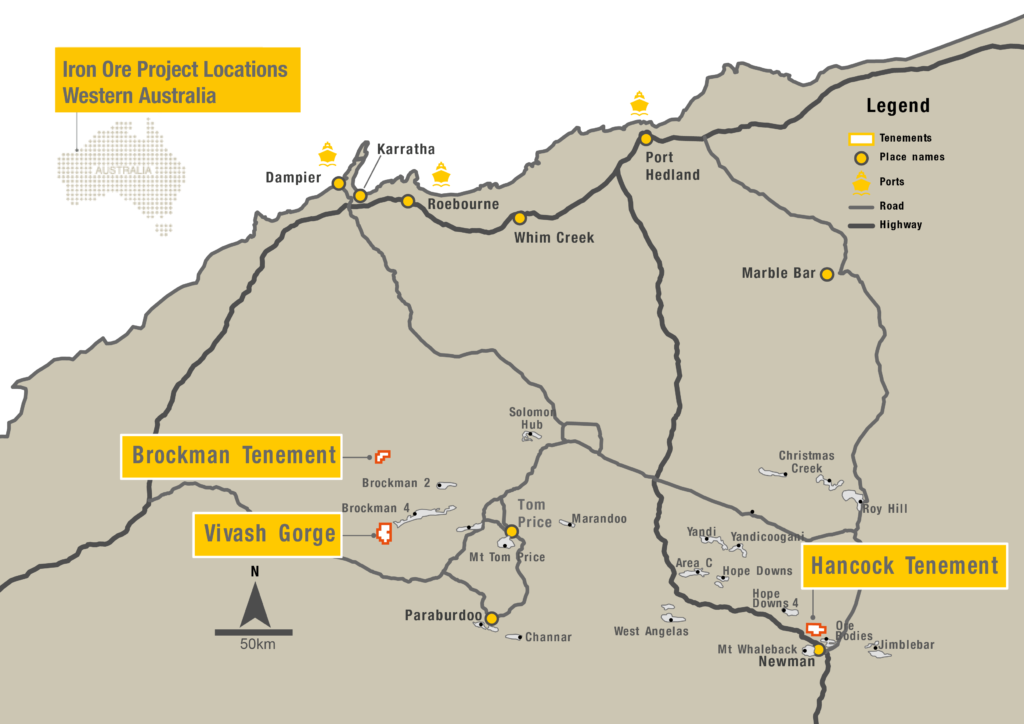

The company continued its expansion and diversification strategy, acquiring the Munni Munni PGE Project, and 100% of the Vivash Gorge Iron Ore Project, both in the Pilbara region of Western Australia.

At its Hancock Iron Ore Project, to the East of Vivash, the company received highly positive results, confirming high-grade direct shipping ore (DSO) at a grade of 62.7% Fe with very low impurities, further derisking the asset. Furthermore, test work has indicated a potential for a Lump yield which could command a premium price over the fines above 62% Fe.

The initial JORC resource for Hancock remains at 10.4Mt @ 60.4% Fe with a further highly anomalous 3 km of new ridge targets yet to be drill tested. Production is targeted for 2023. Alien said its subsidiary Iron Ore Company of Australia (IOCA) has entered into advanced discussions with a number of potential offtake partners.

The nearby Elizabeth Hill Silver Project has similarly returned very high-grade assays for silver as well as base metals. In January 2022, Alien revealed initial results from full-scale operation at Elizabeth Hill, showing 9m @ 8,326g/t silver from 15m, and 24.8m @ 829g/t silver from 2m.

Alien continued development of its Mexican assets in 1H22. Drilling at Dononvan 2 identified a 34m anomalous zinc in hole DONDD-A04. Alien said it would continue to advance Donovan 2 as enough indicators were present to suggest a potentially larger zone of mineralisation. However, Alien announced it would not continue operations at its other Mexican project, San Celso.

Financial highlights

On 30 June, Alien had total assets of US$16.9m of which $3m was cash. Assets nearly doubled from last year's US$8.7m. Current and total liabilities were at $0.9m, and operating losses increased to US$1.4m from US$0.8m last year.

As of 30 June 2022, Alien holds 51% interest (with the option of increasing to 90%) in it Iron Ore projects in Australia, and a 100% interest in the Elizabeth Hill Silver project as well as both the recently acquired Munni Munni PGM deposit and Vivash Gorge Iron Ore project in Australia. The company has 8 fully-owned mining concessions in Mexico. Alien also holds an exploration licence around the Citroen Greenland zinc project.

View from Vox

The first half of FY2022 saw Alien continue to expand and develop its concessions in Australia and Mexico, reflected in a doubling of its total asset worth to US$16.9m.

The recently expanded Hancock Project is shaping up to be a major win for the company, with the potential to offer material upside to investors in the future. An initial bulk sample from the Ridge C Resource confirmed a 67.7% Fe product with very low impurities. A grade of iron this pure will significantly help keep the capex and opex of the project low. Initial estimates put projected cost FOB of US$60/t to mine and a total maximum capex of US$30m.

Moreover, given increasing global demand for sources of green steel, a low-energy high-grade source such as Hancock will be appealing to environmentally conscious buyers.

There is still a "highly anomalous" 3 km of new ridge targets remaining to be drill tested at Hancock, potentially unlocking additional value. Furthermore, test work at the site has indicated a potential for a Lump yield, which could command a premium price over the fines above 62% Fe.

Alien also completed its full acquisition of the nearby Vivash Gorge iron ore project in 1H22. With this addition, the company now has three strategically located iron ore projects within the Pilbara region of Western Australia.

And at Elizabeth Hill, a diamond and reverse drilling programme confirmed further high-grade silver and base metals mineralisation. Silver assays have been particularly impressive, as detailed above. Elizabeth Hill's value is further underpinned by its commodity diversity, also showing assays of copper, nickel, iron, and zinc.

On 5 September, Alien announced an agreement with mining giant Anglo American for the exclusive right to negotiate up to US$15m in project funding and 100% of offtake from Hancock. The agreement includes a US$10m advance payment facility. Alien shares jumped 22% on the day.

Having raised gross proceeds of c. £1.5m in early September, Alien is in a good position to continue advancing its exploration work and driving value higher. The company said reviews are ongoing for adding further projects to its portfolio.

Follow News & Updates from Alien Metals: