In its final results for the year ended 30 June 2021, the rare earths exploration firm Altona Rare Earths (ANR ) said it expects to start exploration work by the end of September 2021.

The Aquis-listed mining firm highlighted that it is looking to complete its proposed listing on London’s main market by the end of 3Q21 whereby it intends to raise funds upon listing to provide up to 18 months working capital, based on exploration work on two projects.

Altona believes the listing will bring “major advantages” to its acquisition programme and will enable it to benefit from the development of its rare earths mining projects.

The Group hailed its acquisition of up to 70% ownership in the Monte Muambe Rare Earths project over the year which marked its first asset in the rare earth elements mining sector.

For the year to 30 June 2021, the company reported a pretax loss of £0.733m compared to £0.226m in FY20 which the Company said is a reflection of its new strategy of investments into rare earths projects in Africa as well as of the ongoing corporate costs of the Company.

By period-end, cash stood at £0.436m after Altona raised a total of £1.1m in FY21 through the completion of four placings; the first three were completed at a price of 6.5p and the last one, in June 2021, at a price of 12p, a 30% premium to the share price at the time.

Altona said the cash inflow will enable it to pursue its objective to become the owner of multiple rare earths mining projects while driving forward to attain a listing on the main market.

Christian Taylor-Wilkinson, CEO of Altona Rare Earths, commented, "Following our first acquisition of the potentially significant Rare Earths mining project in Mozambique, the board is now focused on commencing maiden exploration work by the end of September.

Altona said it expects to complete more acquisitions by the year end to help mitigate shareholder risk and increase its chances of entering into the production of rare earth elements.

‘At this early stage in the Company's strategy, it is impossible to decide whether successful projects will be taken into production by Altona, or whether the Company will look to find a buyer or partner to take on this hugely costly process of mining production,’ Altona said.

Addressing shareholders, the company told investors that its focus for the foreseeable future is to explore each asset to establish the mineralisation and value of the rare earths.

View from Vox

In June 2021, Altona told investors that it had initiated a new target generation programme across four countries - Mozambique, Angola, Tanzania and Uganda - with the intention of enhancing its strategy of becoming a developer of multiple African rare earths mining projects.

Meanwhile, Altona highlighted to investors that it is in the process of listing on the Official List of the LSE, via a Standard Listing, which it said expected to be achieved by September 2021.

The company describes the listing as a “strategic move” that will enable interested parties to make an investment in Altona as it starts to progress its projects to the next stage.

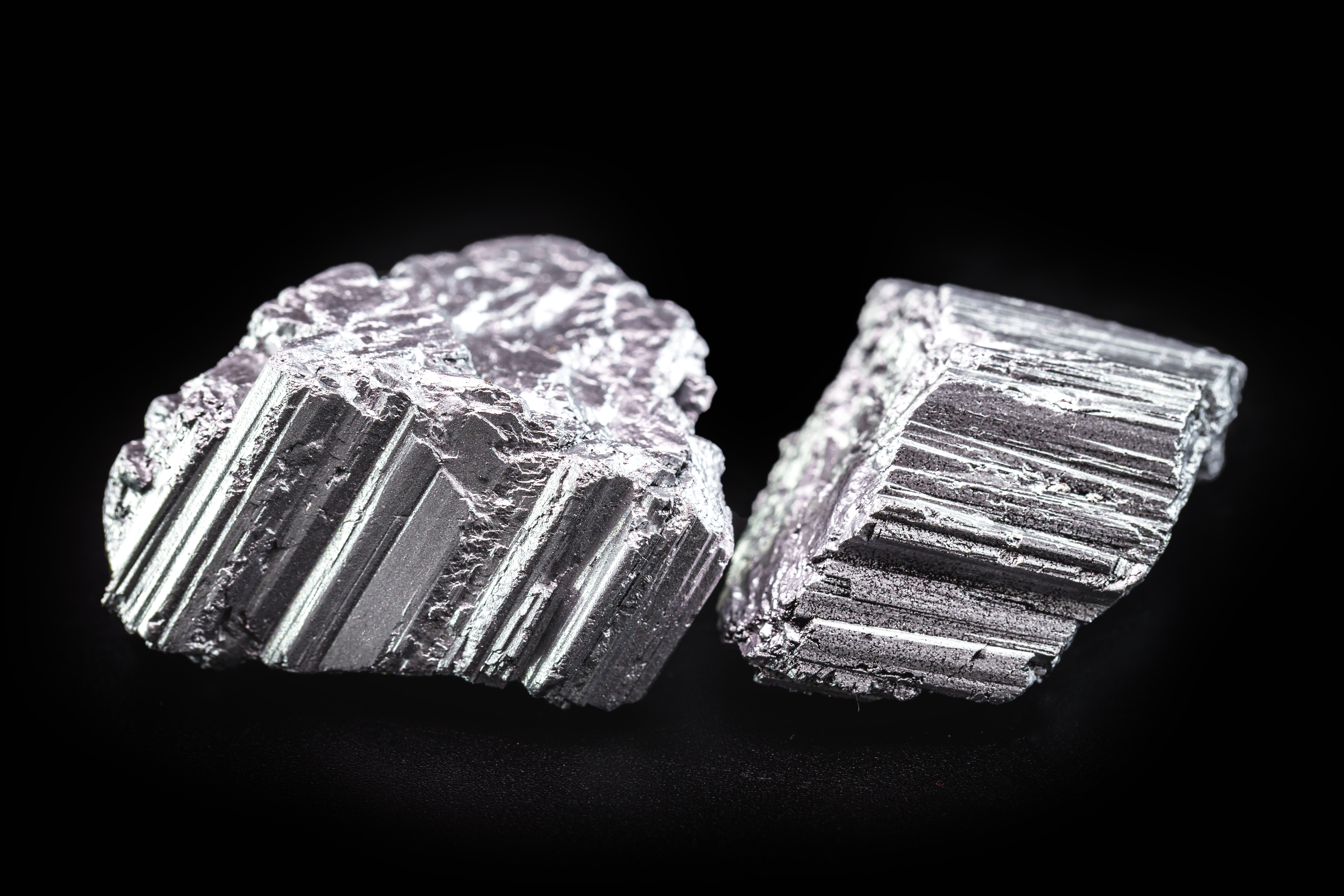

Altona is operating within the rare earth metals sector, which is among the fastest growing mining industries, with technology metals amongst the most in-demand elements globally.

Altona’s focus lies in Africa where it believes the combination of opportunity, its expertise and network provide it with “the ingredients to take full advantage of this growing, global demand.”

Overall, Altona believes that rare earths mining companies in Africa could develop and start supplying technology metals efficiently to the world's green industries in under three years.

Altona said it believes this statistic is only likely to grow as the world moves towards being more environmentally conscious with more players starting to fulfil its "green" potential.

Insert SP chart.

Altona Rare Earths is an Aquis-listed mining exploration company which is focused on the evaluation, rapid development and extraction of Rare Earth Element (REE) metals in Africa.

During the year to 31 June 2020, Altona closed a significant 15-year chapter on its Australian coal exploration activities and opened the door onto its new Rare Earth Metals mining strategy, which it believes “has far greater relevance for the world in the 21st Century.”

The past two years has seen a major global shift in the mind-set of rare earth metals end-users, these being primarily the manufacturers of, inter alia, high-strength permanent magnets for the electric vehicle market, military hardware and green power sectors.

Presently, China controls between 90-95% of the supply chain and crucially, also controls the refining and processing sectors, creating a worldwide bottleneck. It also controls more than 70% of EV battery manufacturing, which means a rise in cost of vehicles due to inflated REE prices could cause a significant delay to one of the world's major "Green Solutions".

Global governments are becoming increasingly aware that to increase the numbers of cars on the road, vehicles must be priced suitably. Since there are no viable alternatives to provide the huge quantities of the technology metals, REE mining firms are turning to Africa.

In theory, the company stated that rare earths mining companies in Africa could develop and start supplying Technology Metals to the world's green industries in under three years.

The Company believes it is now poised at the juncture of a significant opportunity within the rare earth metals sector which the group hopes to capitalise during this year and beyond.

Follow News & Updates from Altona Rare Earths here: