It’s often darkest before the dawn. In fact, several global tech stocks have taken a battering of late. Not least PayPal, Spotify, Meta, Uber, Netflix & Zoom. However these are all services that I use & think offer long term value.

Another digital disrupter that has seen its shares plummet >80% from a 12-month peak of 110p is Purplebricks (PURP ). And like its colour implies, risk-tolerant investors require a little ‘bravery’ before climbing on board.

So why do I believe the stock is significantly undervalued? Well at 20p, PURP’s mrkcap is a mere £61m - which given the brand’s consumer recognition & reach looks like a steal on its own.

What’s more, further price falls appear limited too.

You see even after possibly paying out £3.6m in penalties to tenants for allegedly not sending official notification that their rental deposits have been lodged correctly with a ‘ring-fenced’ bank.

The group should still have >£50m of net cash as at Apr’22 (or 16p/share) – with another £10m (3p) of capital tied up in its ‘Homeday GmbH’ JV in Germany with shareholder Axel Springer SE (26.5% stake). But that’s not all.

Far more importantly, CEO Vic Darvey has already implemented the changes required to turn the ship around. Namely greatly enhancing the customer experience by moving to a fully-employed, far more localised, tech-enabled, consistent & service-rich (eg 3D virtual house views) business model. A winning formula IMO.

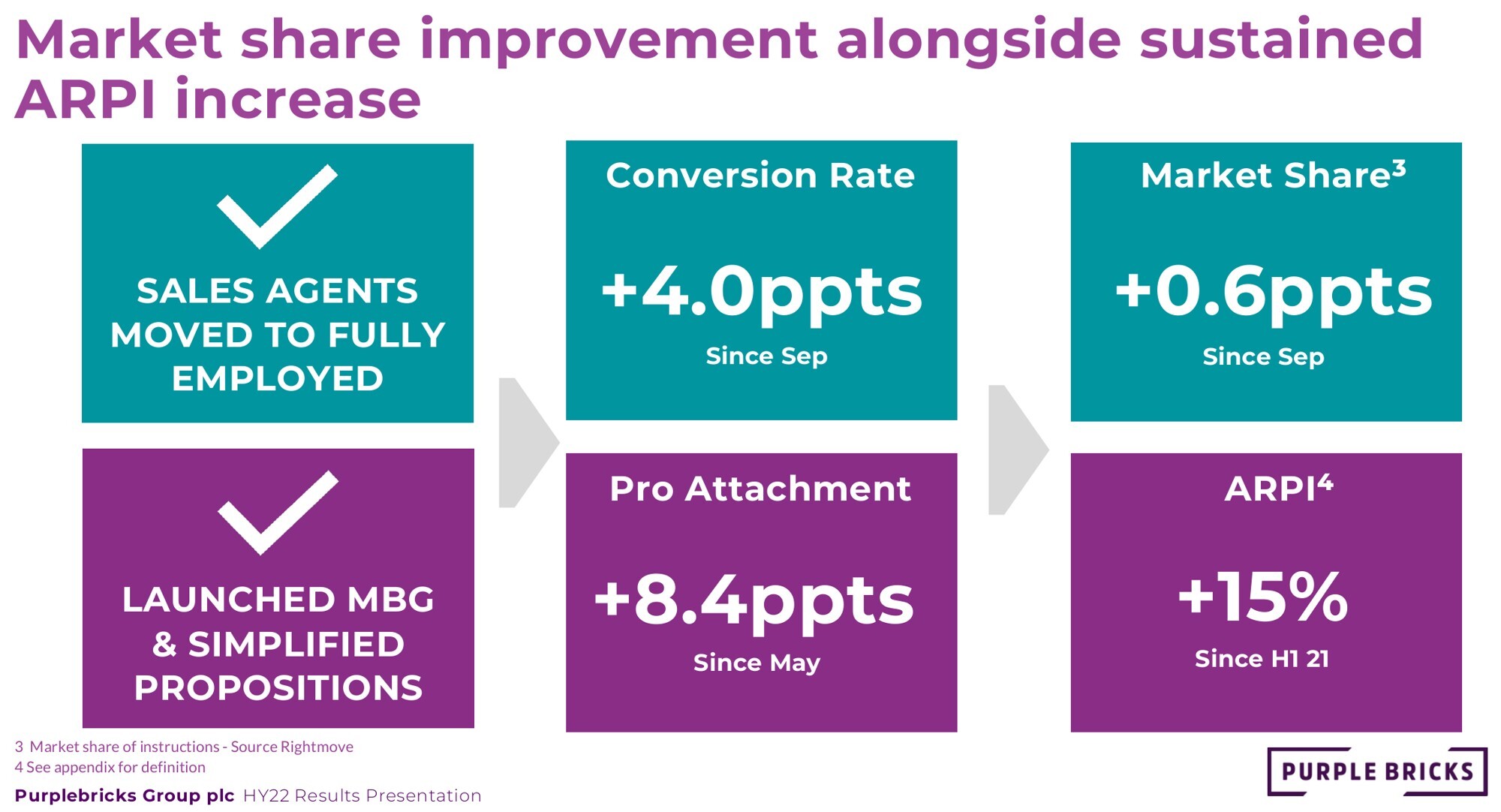

Sure things will take a little time to bed down, & for these improvements to properly filter through the property sector. Yet equally the early signs are promising with recent gains in market share (vs 3.9% Oct’12) &

attachment/conversion rates being registered (see charts).

Ok, so how much might the stock be worth?

Well hypothetically in say 5 years’ time, if PURP can hit its 10% market share target (Est sales £200m) vs 3.9% H1'22 - alongside delivering EBITDA margins of 20%+. Then I would value the company on a

minimum 10x EV/EBITDA multiple, or c. 80p/share (incl the cash). In comparison Citi have a 75p price target.

Plus despite yesterday’s hawkish interest rate hike by the Bank of England, I nevertheless expect the number of UK property sellers to recover later this year, adding to the industry’s momentum.

Watch this space.