"Don't fight the Fed", has been one of the most successful investment adages since 'Kool Aid' was launched back in 1927

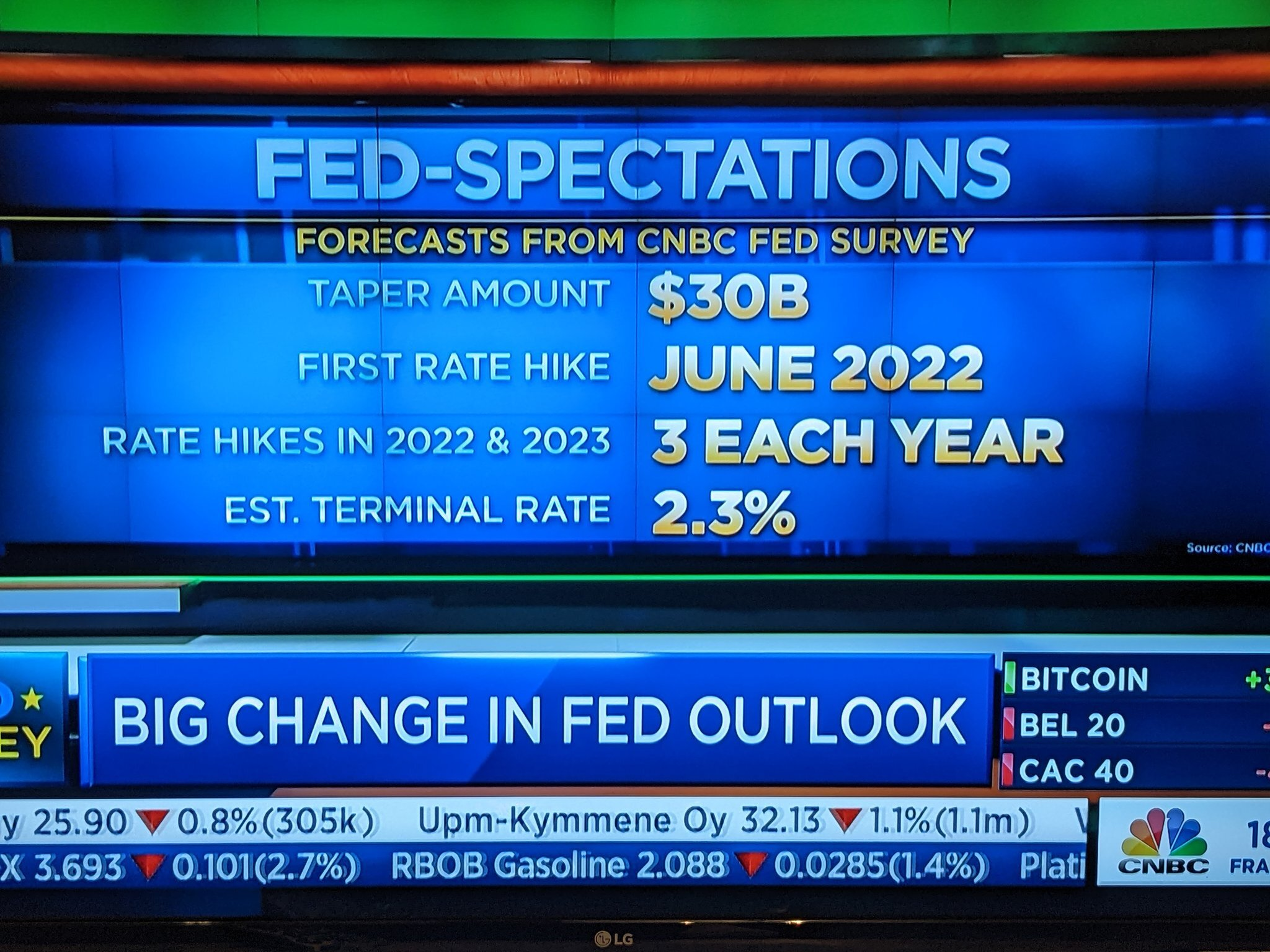

That said after nearly a century of helping guide the markets. It appears from the latest CNBC survey (see below) - that many of Wall Street's top economists believe the

Federal Reserve Board will ultimately be forced to lift US interest (terminal) rates to 2.3%.

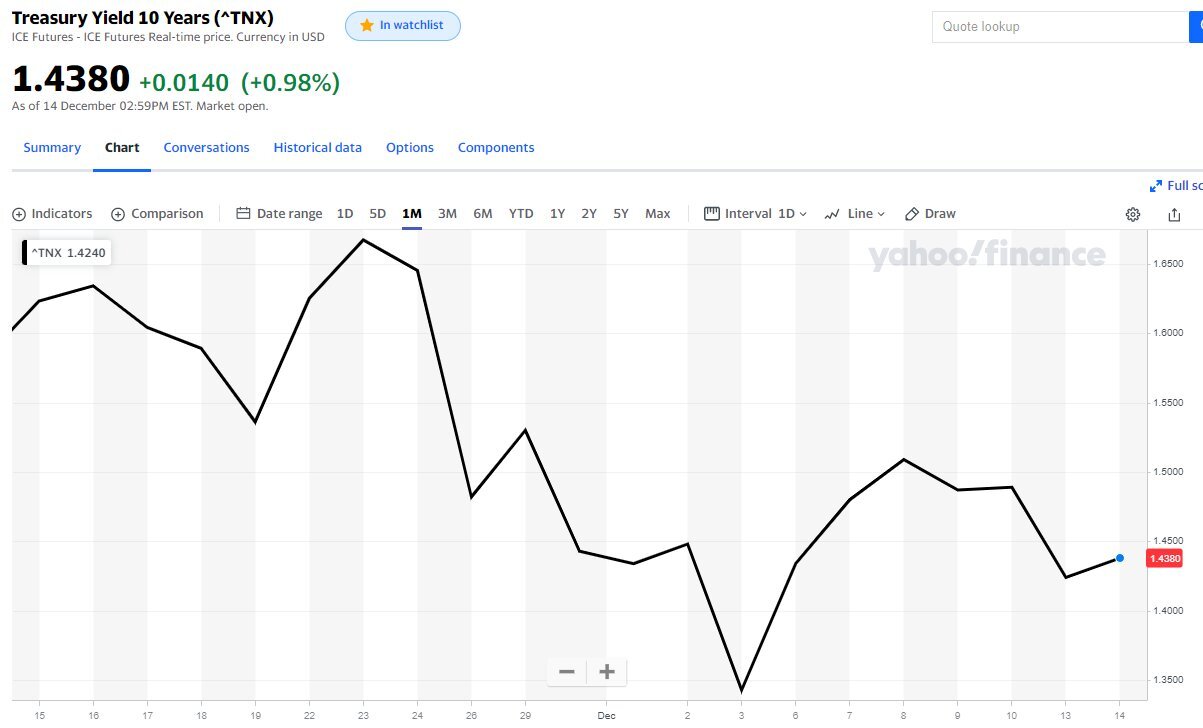

Which on first impressions seems a little crazy, since the yield on the 10 year Treasury continues to decline to 1.44%.

Implying (to me at least) that the super-smart bond guys reckon the FOMC is about to make a major policy error. In turn, inverting the yield curve & triggering a possible recession. A scenario (however unlikely) which wouldn't be ideal for the banks (re NIMs, credit cycle) or equity/bond investors in general.

So who will be correct this time? The Fed or Wall Street? Hope not both!