Argentex Group PLC AGFX , the international provider of foreign exchange services to institutions, corporates and high net worth private individuals, announces its trading update for the six-month period ended 30 September 2022.

If you have been holidaying abroad this year, you’ll know only too well that the costs have rocketed due to soaring inflation and sterling’s devaluation against the € and $.

UK importers are no different - which coupled with high volatility has meant buoyant demand for Argentex’s specialist forex hedging services from corporates, asset managers and HNW individuals.

Indeed today, the company said H1 revenues (6M ending Sept’22) had soared 75% LFL to £27.4m (£15.7m LY) thanks to both currency movements & market share gains (ie from mainstream banks).

As client numbers jumped 12% to 1,393 (vs 1,241 LY), and #AGFX continued its international expansion & tech platform development.

Plus, given this momentum is unlikely to dramatically slow anytime soon, the Board have similarly guided that FY’22 results (ie for the 12M ending Dec’22) are also likely to be ahead of expectations (Singers: Sales £39m, £9.9m EBITDA & adjusted EPS 4.9p).

CEO Harry Adams adding: “The strong performance during the period is defined by a 75% uptick in revenues, demonstrating our strategy is delivering results as we unlock the long-term growth potential of Argentex."

"The Board is confident in the Group's ability to exceed current market expectations. While current market dynamics, specifically the historic lows in sterling, present exceptional short-term trading conditions, our long-term growth strategy and outlook remain unchanged."

View from Vox

House broker Singers has decided to wait until the interims are released on 8th November before upgrading their numbers and 121p price target.

However, for me (hypothetically), I’m forecasting Q4 turnover will come in at £10m+.

Which assuming a 25% EBITDA drop through rate on a largely fixed cost base, would theoretically deliver FY’22 sales, EBITDA & EPS of around £47m, £12m & 6.3p respectively.

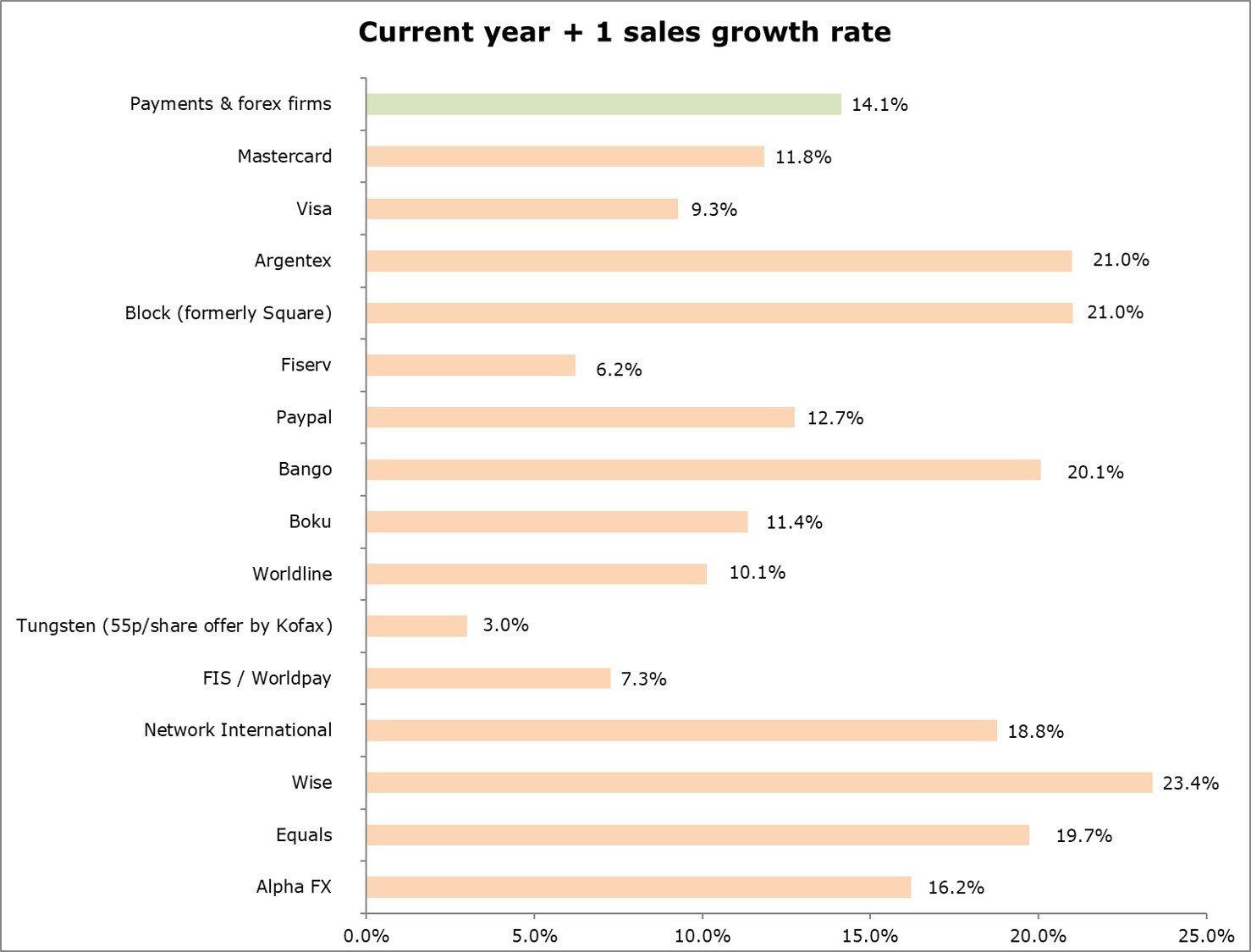

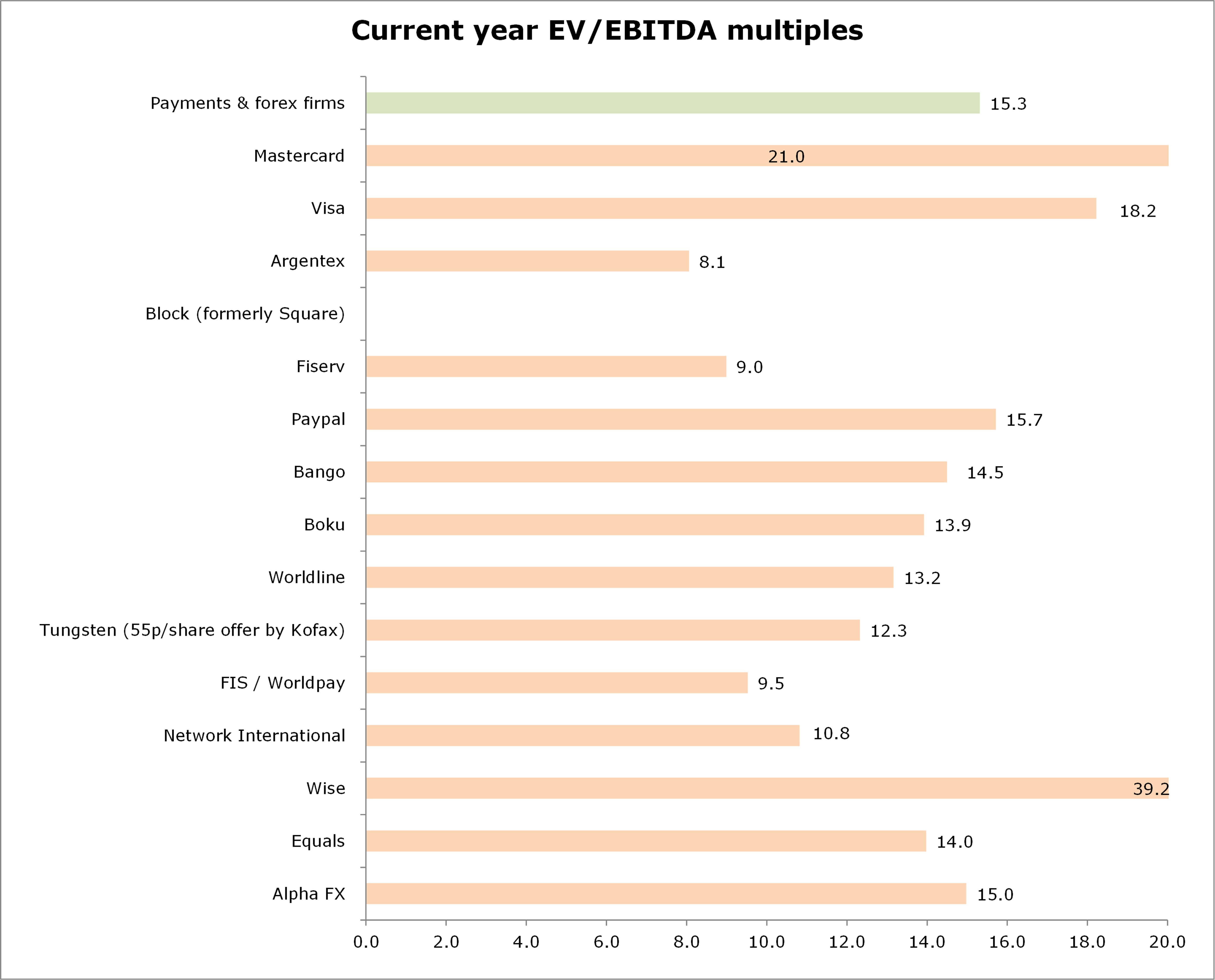

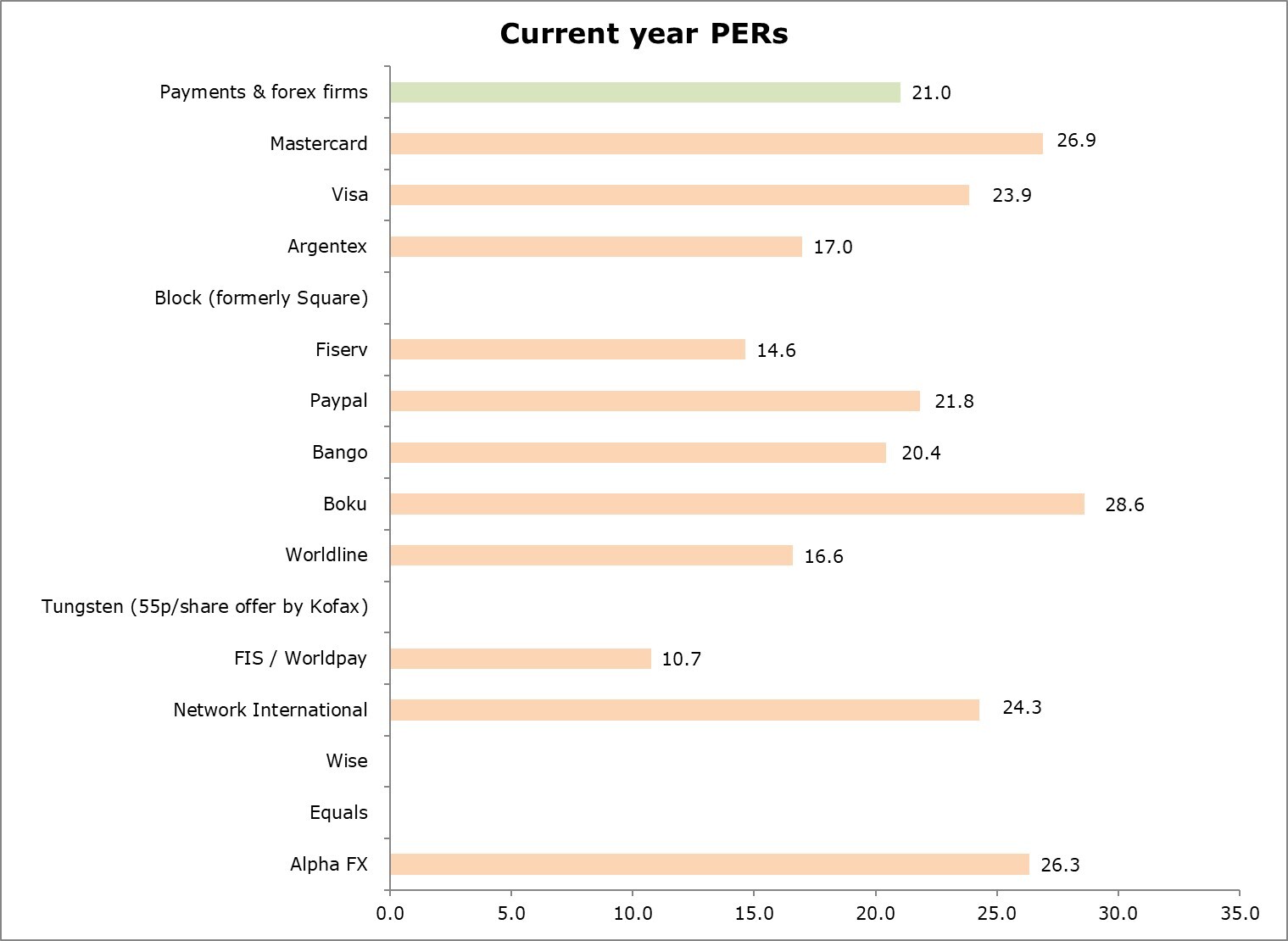

Thus putting the stock at 107p, on EV/sales, EV/EBITDA and PER multiples of 2.1x, 8.1x & 17x vs the broader sector at 5x, 15x & 21x.

If directionally correct, then my conservative valuation would equally rise to 180p/share in 12 month's time, based on a 15x FY'23 EBITDA (est £14m) multiple.