Aterian (ATN) , an Africa-focused metal exploration and development company, announced the acquisition of two new exploration projects and several new exploration licences to complement its existing portfolio of projects in Morocco.

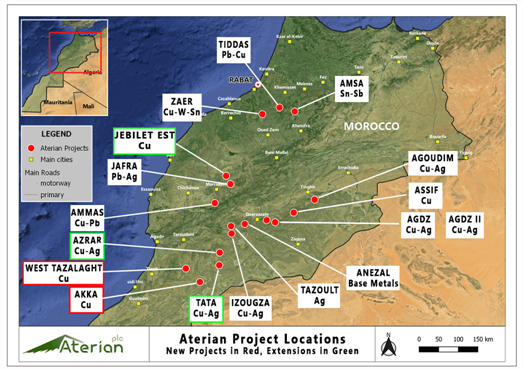

Aterian was granted 10 new licences for an area of 139.6 km2, bringing the company's projects in Morocco to 17, covering a total area of 897 km2. The new licences were awarded to Aterian's 100%-owned subsidiaries as part of a competitive tender process. The main target metals of Aterian's Morocco portfolio include copper, silver, and other base metals.

Separately, Aterian said it raised £1.0m through the issue of 100m shares at a price of 1p, representing an 11% premium to yesterday's closing price. Aterian shares jumped 5.56% on today's announcements.

View from Vox

More good news from Aterian as the company continues its expansion in Africa. Two brand new projects were granted - Akka and West Tazalaght - totalling 74.5 km2. In addition, new licences were granted on the Tata, Azrar, and Jebilet Est projects (see map above) where high copper values have been reported from previous fieldwork. All new projects and licences are located in central Morocco within the western Anti-Atlas - a region considered highly prospective for sedimentary-hosted copper mineralisation.

Exploration programmes on the new projects are expected to commence shortly. All are located close to historical working and active operations, making logistics easier.

With today's announcement, Aterian's Morocco portfolio expands by 17% to 897 km. Morocco is a hotspot for critical metals exploration vital for the energy transition. Aterian is also expanding its presence in Rwanda after announcing last week a joint venture with Rio Tinto for lithium exploration in the Central African country. The JV project spans 2,750 hectars in southern Rwanda and is also conveniently located near well-established infrastructure.

In Rwanda, Aterian now holds the rights to over 3,000 hectares for critical and strategic metals, with projects including the Musasa Project in Western Rwanda, a 70% shareholding in the HCK Joint Venture and a 50% shareholding in the Dynasty JV, both in southern Rwanda. Aterian's existing projects in Rwanda have borne fruit so far, with the company identifying 19 pegmatite zones. The partnership with Rio Tinto should open the door to discovering more critical metal sites in Aterian's southern-based HCK Joint Venture.

Overall, Aterian's expanding presence in Africa in pursuit of critical metals exploration, vital for the energy transition, validates its capital-efficient model, and should deliver continuous value to shareholders and local stakeholders. Following today's fundraise issued at an 11% price premium, the company remains well-funded to meet all existing and planned cash commitments.

Follow News & Updates from Aterian: