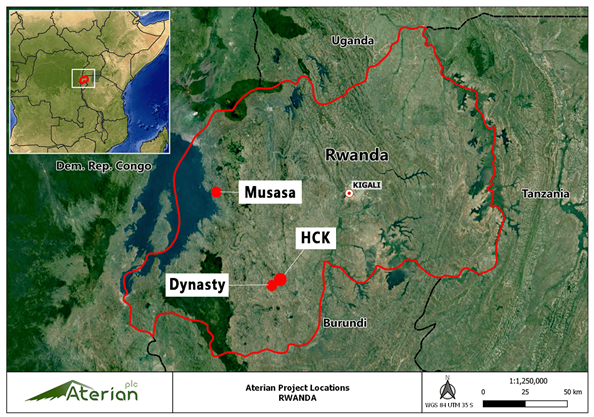

Aterian (ATN ), an Africa-focused metal explorer, has updated markets on its work projects in Rwanda. It reported 22 zones of "potentially mineralised pegmatite" identified over its southern projects, confirming rare-metal hosting targets for future exploration. Fieldwork has indicated a strike length of 2,500m with widths up to 100m, particularly in the HCK-1 zone.

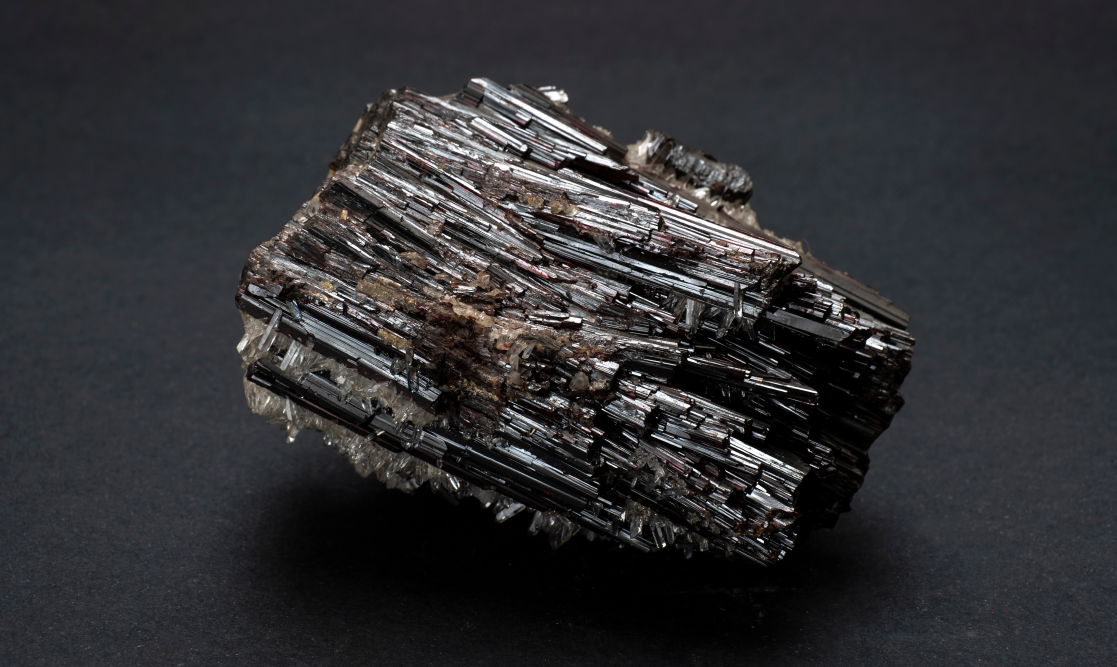

The miner is currently conducting a multi-method geophysical survey in HCK-1 in preparation for a preliminary drilling programme expected to commence in Q2 2023. Prospective HCK-1 targets include tantalum, niobium, tin, tungsten, and lithium.

Aterian said it has entered discussions with several artisanal mining parties to improve artisanal mining productivity through mechanisation. Additionally, 1Villager.com, an online stakeholder management tool, has been engaged by the company to support whistleblower management, social license reporting, and stakeholder engagement, as part of Aterian's ongoing commitment to ethical supply chain management.

View from Vox

After confirmation of 22 pegmatite zones across the southern projects, metallurgical test work and a preliminary drilling programme are next, with the latter expected to commence in 2Q23. A detailed ground-based geophysical survey over HCK-1 is currently in progress.

The company also issued a brief update on its activities in Musasa. Recent work on the project has been limited to geological recon and the completion of the Kassava prospect exploration pitting programme - Kassava being one of five identified targets on the project. Aterian said it has filed an application with the Rwandan government to extend and secure the long-term tenure at Musasa over an area of c. 400 hectares.

Aterian's wholly owned Eastinco is currently engaged in 3 partnerships within Rwanda to explore and develop tantalum, niobium, tin, and lithium opportunities. Eastinco holds a Rwandan metal Trading Licence, which should facilitate trading of metal concentrates within the region.

The company and its JV partners in Rwanda believe in building a critical metals business with exploration options funded internally, which is broadly aligned with ESG values and Rwanda's long-term mining sector objectives, and should further contribute to increased mining and metal recovery efficiencies.

ESG-minded investors should also be happy to know that Aterian has expanded its commitment to EGS values. Per its ITSCI membership, the company complies with international standards for sustainable supply chains. Aterian has made new hires to ensure traceability compliance. Aforementioned partnerships with artisanal producers should benefit local communities as well, as will the 1Villager management tool.

Follow News & Updates from Aterian :