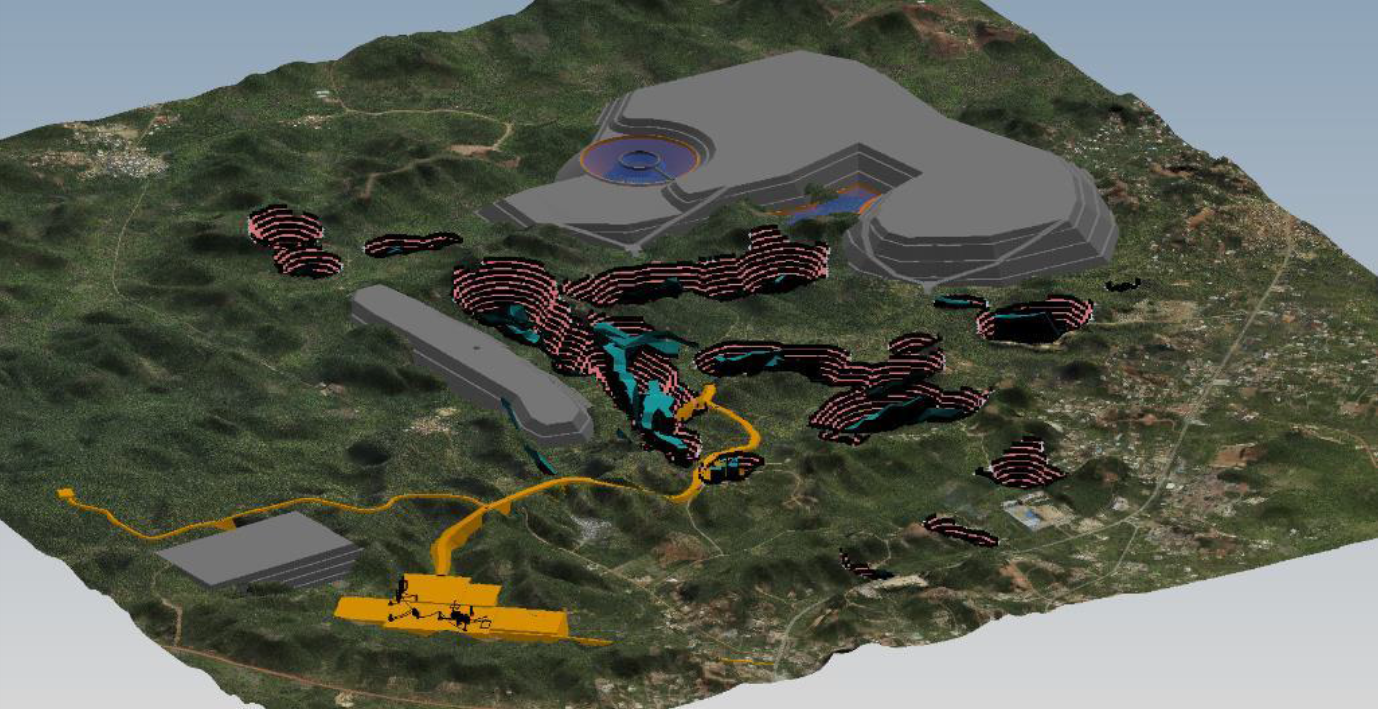

[Ewoyaa lithium project operation overview showing all associated development infrastructure. Image: Atlantic Lithium]

Atlantic Lithium (ALL ), an Africa-focused lithium explorer, announced unaudited interim results for the 6 months ended 31 December 2022.

Ewoyaa Lithium Project, Ghana

During the period, Atlantic accelerated development of its flagship Ewoyaa lithium project in Ghana. A pre-feasibility study (PFS) demonstrated significant profitability potential for Ewoyaa, including life of mine (LOM) revenues exceeding US$4.84bn, a post-tax NPV8 of US$1.33bn, and an IRR of 224% over 12.5 years. The PFS also revealed a US$125m capital cost with a short payback period of <5 months.

Ewoyaa's maiden reserve was declared at 18.9Mt at 1.24% Li2O. This was upgraded significantly post-period to 35.3Mt at 1.25% Li2O. Atlantic filed a Mining Licence application for Ewoyaa, and awarded a processing plant front-end engineering design contract to Primer Group.

Atlantic also completed a 47km drilling programme at Ewoyaa. Results revealed assay results with grades as high as 6.78% Li2O over a 1m interval at the Ewoyaa main "Starter pit", with multiple high-grade intersections within and outside of the initial MRE.

Atlantic was admitted to trading on ASX in September 2022 under the ticker A11. Atlantic finished the year with A$19.1m in cash. Exploration and evaluation expenditure was A$12.7m, which is net of Piedmont Lithium contributions.

View from Vox

Atlantic's flagship Ewoyaa lithium project demonstrates robust economics as Ghana's first lithium-producing mine, having secured a US$103m funding via Atlantic's partnership with Piedmont Lithium. The project, located approximately 100km southwest of the capital Accra, is proven to produce a highly sought-after, premium SC6 product suitable for conversion to battery-grade lithium carbonate and hydroxide. The project is low capex, low opex, with excellent infrastructure connections and short timeline to production.

Last month, Atlantic announced a much improved mineral resource estimate (MRE) for Ewoyaa of 35.3Mt at 1.25% Li2O, including 28Mt or 79% in the high-confidence Measured and Indicated categories.

Ewoyaa's recently announced pre-feasibility study forecasts significant profitability potential for a 2 Mtpa operation, producing an average of 255,000 tpa of 6% Li2O spodumene concentrate (SC6) over a 12.5-year life of mine (LOM), based on the maiden MRE.

Specifically, the pre-feasibility study delivers LOM revenues exceeding US$4.84bn, a post-tax NPV8 of US$1.33bn, and IRR of 224% over 12.5 years. Capital costs were US$125m with a short payback period of under 5 months, and average LOM EBITDA was US$248m/year. The study used average annualised US$1,359/dry metric tonne SC6 pricing and US$1,200/dry metric tonne long-term pricing.

Atlantic summarised its Q4 activities at Ewoyaa in its recently issued trading update. The next step for Ewoyaa is a definitive feasibility study (DFS) targeted for release in Q2 2023, to evaluate an extended mine life and increased throughput, to further enhance the project's economics.

Looking ahead, Atlantic expects to receive the grant of Mining Licence application that was lodged post-period, and then commence environmental impact assessment. With a strong cash position of A$19.1m at the end of 2022, Atlantic is funded to production.

Follow News & Updates from Atlantic Lithium: