Atlantic Lithium (ALL) , an Africa-focused lithium explorer, released a quarterly activities and cash flow report for the period ended September 30 2023.

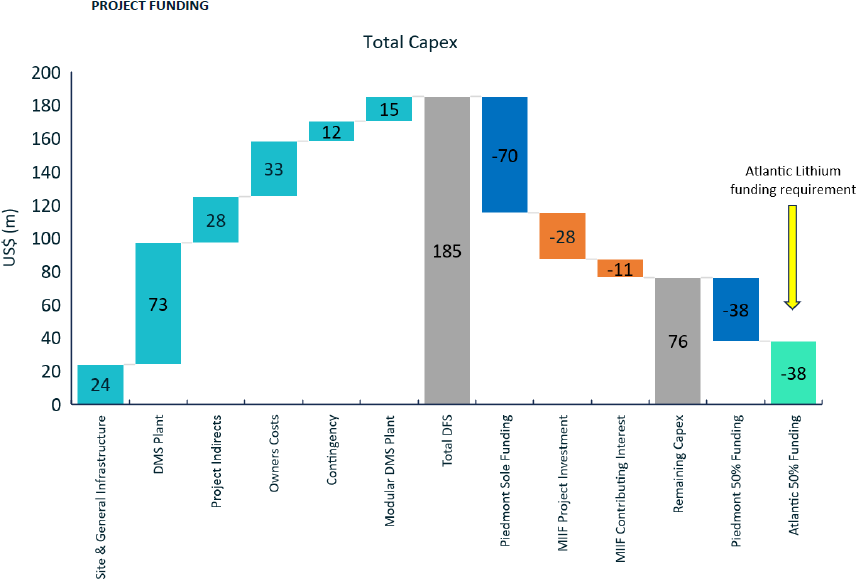

During the quarter, Atlantic received a commitment from partner Piedmont Lithium to sole fund the first US$70m, and 50% of any additional costs thereafter, of the total US$185m development cost for Atlantic's flagship Ewoyaa lithium project in Ghana. For a portion of the remaining 50%, Atlantic has commenced a competitive offtake partnering process to secure funding.

Additionally, the Minerals Income Investment Fund of Ghana plans to invest a total of US$32.9m in Atlantic and its Ghanaian subsidiaries to expedite the development of Ewoyaa. An MoU was also signed with the University of Mines and Technology, Tarkwa (UMaT) to assess the viability of producing feldspar, quartz, and muscovite as by-products of spodumene production at Ewoyaa.

Post-period, Atlantic was granted a long-anticipated Mining Lease for Ewoyaa, representing a major de-risking milestone for the project.

Cash on hand at period-end was A$10.6m.

View from Vox

Atlantic Lithium achieved significant operational progress at its flagship Ewoyaa lithium project in Ghana during the quarter, culminating in the granting of a Mining Lease by the Ghanaian government, representing a crucial endorsement and derisking milestone for the project. Atlantic is the first company to be granted a mining lease for lithium in Ghana as the country aims to establish itself as a leading hub in Africa's EV supply chain, with Atlantic Lithium as an initial key partner.

The mining lease terms, agreed through close cooperation with the government, are in line with Ghana's new Green Minerals Policy, and reaffirm Ewoyaa's strong economics as one of the lowest capex and opex hard lithium projects globally - with strong commercial metrics and profitability potential for a 2.7Mtpa operation, producing a total of 3.6Mt of spodumene concentrate (approx. 350,000tpa) over a 12-year mine life (LOM).

Specifically, per Ewoyaa's updated definitive feasibility study (DFS), the project boasts a post-tax NPV8 of US$1.3bn, with free cash flow of US$2.1bn from LOM revenues of US$6.6bn and average LOM EBITDA of US$280m per year. C1 cash operating costs are estimated at US$377/t of concentrate Free-On-Board Ghana Port, after by-product credits, with an AISC of US$675/t.

The DFS used the new 35.3Mt at 1.25% Li2O Mineral Resource Estimate for the project, increased from 30.1Mt at 1.26% Li2O earlier in the year. Early results from Atlantic's 2023 drilling programme at Ewoyaa have enhanced the project's value, recently indicating significant mineralisation outside the current resource estimate. The DFS also included modular DMS units and an increased throughput of 2.7Mtpa. Early revenue generated by the modular DMS units will reduce the peak funding requirement for the mine build, which is Atlantic's justification for choosing the technology.

Overall, Ewoyaa's development cost estimate is US$185m. The project continues to gain funding, as existing US-based partner Piedmont recently committed US$70m and 50% thereafter of the total capex, and Ghana's Mineral Income Investment Fund provisionally agreed to invest US$32.9m. The latter aligned Ewoyaa further with the government's vision for Ghana's mining industry. Atlantic has also commenced an offtake partnering process with a "major investment bank", aiming to attract offers to further expediate and derisk the project. As it stands, once in production Atlantic will own 40.5% of Ewoyaa, Piedmont will own an equal 40.5%, Ghana's Mineral Income Investment Fund will own 6%, and the government of Ghana will own 13%.

As part of the mining lease grant, Atlantic has agreed to undertake a feasibility study to assess the viability of producing feldspar at Ewoyaa. Feldspar is a by-product of the DMS process that Atlantic aims to supply to the Ghanaian ceramics market. An MOU recently signed with the University of Mines and Technology (UMaT) aims to evaluate the potential for producing feldspar, quartz, and muscovite as by-products of spodumene production at Ewoyaa.

Overall, the granting of a mining lease represents a considerable derisking milestone in the development of Ewoyaa and puts the project firmly on track to become one of the world’s next major producers of spodumene concentrate. Atlantic finished the quarter ended September 30 with A$10.6m.

Follow News & Updates from Atlantic Lithium: